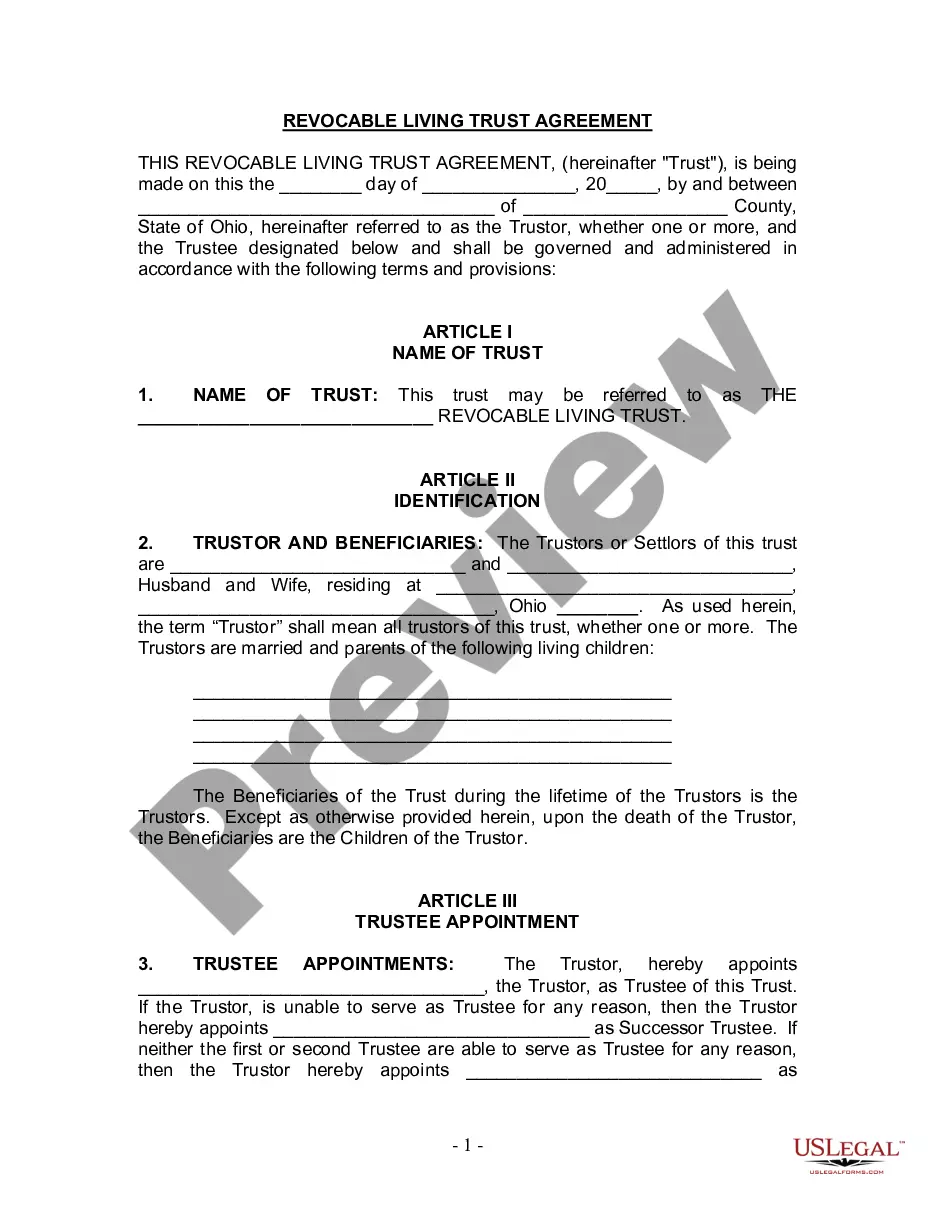

A Clark Nevada Bill of Sale Issued Shares is a legal document that is used to transfer ownership of shares in a corporation or company located in Clark County, Nevada. This document outlines the terms and conditions of the sale between the seller and the buyer, ensuring a smooth and lawful transfer of ownership. The Clark Nevada Bill of Sale Issued Shares contains various essential details, including the names and contact information of both parties involved in the transaction, a detailed description of the shares being sold, and the agreed-upon purchase price. It may also include any additional terms or special conditions agreed upon by both parties. This type of bill of sale is commonly used in Clark County, Nevada, to document the transfer of ownership of various types of issued shares. Some different types of shares that may be included in a Clark Nevada Bill of Sale Issued Shares are: 1. Common Shares: These are the most basic type of shares issued by a corporation. Common shareholders are granted voting rights and are entitled to a portion of the company's profits, usually in the form of dividends. 2. Preferred Shares: Preferred shareholders have certain advantages over common shareholders, such as a fixed dividend rate and priority in receiving company assets in case of liquidation. Preferred shares do not usually grant voting rights. 3. Convertible Shares: Convertible shares have the potential to be converted into a different type of share, commonly common shares. This type of share allows investors to benefit from potential increases in the company's value without immediately taking on the associated risks. 4. Restricted Shares: Restricted shares are subject to certain limitations or conditions imposed by the issuing corporation or regulatory authorities. These restrictions may include holding periods, transfer restrictions, or limitations on sales. 5. Treasury Shares: Treasury shares are shares that were previously issued and have been repurchased by the company. These shares are typically held by the company itself and can be reissued or retired at the company's discretion. When using a Clark Nevada Bill of Sale Issued Shares, it is vital to ensure that all necessary parties have signed the document and that it is properly notarized. This helps to provide legal validity and authenticity to the share transfer, protecting both the buyer and the seller. In summary, a Clark Nevada Bill of Sale Issued Shares is a crucial legal document used to transfer ownership of shares in a corporation or company in Clark County, Nevada. It covers various types of shares, including common shares, preferred shares, convertible shares, restricted shares, and treasury shares. By carefully documenting the terms and conditions of the share transfer, this document ensures a smooth and lawful transaction for both parties involved.

Clark Nevada Bill of Sale Issued Shares

Description

How to fill out Clark Nevada Bill Of Sale Issued Shares?

Drafting paperwork for the business or individual needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to create Clark Bill of Sale Issued Shares without expert assistance.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Clark Bill of Sale Issued Shares by yourself, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required form.

In case you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Clark Bill of Sale Issued Shares:

- Examine the page you've opened and verify if it has the sample you need.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that meets your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Select the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any scenario with just a few clicks!

Form popularity

FAQ

Washington General Bill of Sale Date of sale. Purchase price. Item description. Buyer and seller names and contact information.

How do you write a bill of sale? When you write a bill of sale, you include both the seller and buyer's name and address, a complete description of the sold item, the vehicle's identification number, conditions, date, amount paid, previous owner, method of payment and any other agreements between the buyer and seller.

Yes, completing a bill of sale is legally required in Washington. In order to apply for a new title, the buyer must present a bill of sale that has been signed by the seller.

You can report the sale: In person at any vehicle licensing office 2022 Online (vehicle only) at dol.wa.gov 2022 Mail a Vehicle Report of Sale or Vessel Report of Sale to any vehicle licensing office.

In most cases approval of the transfer by the company is a formality, confirmed via a board resolution unless an officer of the company has previously been authorised to accept share transfers.

To register and title your vessel, you must go to your local BMV and provide proof of ownership, such as the original certificate of title or a bill of sale, proof of residency and Social Security number, and proof that sales tax was paid such as a Certificate of Gross Retail or Use Tax Paid on the Purchase of a Motor

A Share Sale and Purchase Agreement is an agreement for the sale and purchase of a stated number of shares at an agreed price. The shareholder selling their shares is the seller and the party buying the shares is the buyer. This agreement details the terms and conditions of the sale and purchase of the shares.

How Do I Write a Washington Bill of Sale? The full legal name (printed) The date the bill of sale was created. Certain information about the item being sold. The amount of money the item was sold for. The signatures of the buyer and seller.

A share sale agreement is a document that outlines the terms of the sale. It sets out the: rights and obligations of the parties to the transaction; actions that the parties need to perform; and.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.