Title: Understanding Harris Texas Loan Term Sheet: A Comprehensive Overview Introduction: A Harris Texas Loan Term Sheet is a fundamental document that outlines the key terms and conditions of a loan agreement between a lender and a borrower in Harris County, Texas. This detailed description provides an in-depth understanding of the purpose, contents, and different types of Harris Texas Loan Term Sheets, shedding light on crucial keywords related to this financial agreement. 1. Purpose of Harris Texas Loan Term Sheet: The primary purpose of a Harris Texas Loan Term Sheet is to ensure clarity and transparency between the lender and borrower before drafting the final loan agreement. This document lays out the basic guidelines, terms, and expectations, facilitating negotiations and enabling both parties to assess the viability and feasibility of the proposed loan. 2. Key Components of a Harris Texas Loan Term Sheet: a. Loan Amount: The principal amount the borrower seeks from the lender. b. Interest Rate: The cost of borrowing the loan amount, usually expressed as an annual percentage. c. Loan Repayment Schedule: Specifies the timeline and method for repaying the loan, including installment amounts and due dates. d. Term Length: The duration for which the loan will be extended, usually stated in months or years. e. Collateral: Any assets or properties offered as security against the loan. f. Prepayment Penalties: Conditions and penalties associated with paying off the loan before the agreed-upon term. g. Late Payment Fees: Penalties imposed on the borrower for missed or delayed payments. h. Governing Law: The legal jurisdiction under which the loan agreement is subject. 3. Different Types of Harris Texas Loan Term Sheets: a. Commercial Loan Term Sheet: Pertains to loans sought for business purposes, such as expansion, inventory, or real estate acquisition. b. Personal Loan Term Sheet: Relates to loans obtained for personal use, like financing a vehicle, consolidating debts, or funding education. c. Mortgage Loan Term Sheet: Focuses specifically on loans secured by real estate property, commonly used for purchasing or refinancing a home. Conclusion: A Harris Texas Loan Term Sheet acts as a crucial foundation for forming a detailed loan agreement between a borrower and lender. By highlighting the main elements that comprise this document and introducing different types of Loan Term Sheets, this comprehensive description enables individuals to grasp the essential aspects and significance of these agreements.

Harris Texas Loan Term Sheet

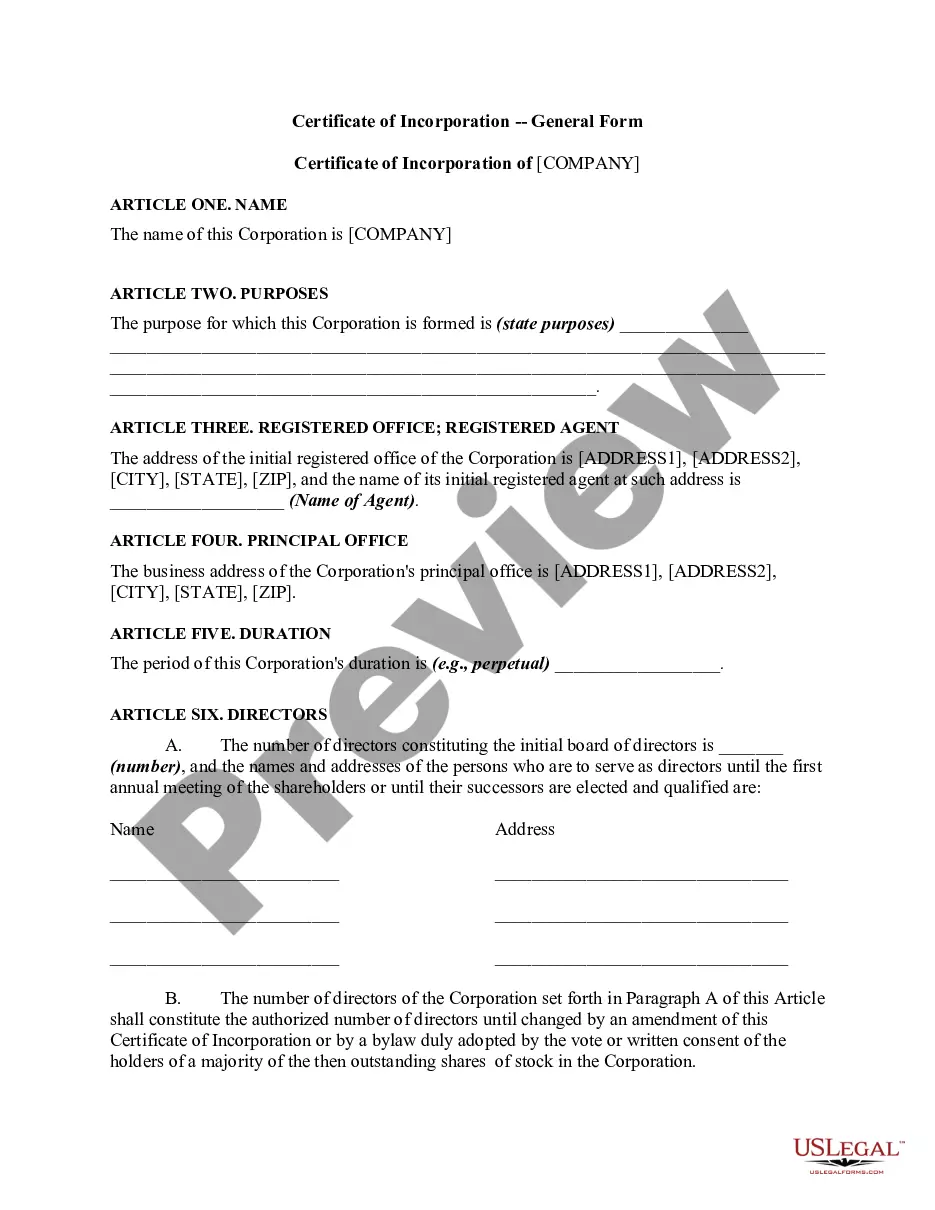

Description

How to fill out Harris Texas Loan Term Sheet?

Drafting documents for the business or personal demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state laws of the particular area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to create Harris Loan Term Sheet without professional assistance.

It's possible to avoid spending money on lawyers drafting your documentation and create a legally valid Harris Loan Term Sheet on your own, using the US Legal Forms web library. It is the largest online collection of state-specific legal documents that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary document.

In case you still don't have a subscription, follow the step-by-step instruction below to obtain the Harris Loan Term Sheet:

- Examine the page you've opened and verify if it has the sample you need.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that meets your needs, use the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Select the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any use case with just a few clicks!

Form popularity

FAQ

Loan terms refers to the terms and conditions involved when borrowing money. This can include the loan's repayment period, the interest rate and fees associated with the loan, penalty fees borrowers might be charged, and any other special conditions that may apply.

10 Essential Loan Agreement Provisions Identity of the Parties. The names of the lender and borrower need to be stated.Date of the Agreement.Interest Rate.Repayment Terms.Default provisions.Signatures.Choice of Law.Severability.

Record the Loan Record the Loan. Record the loan proceeds and loan liability.To record the initial loan transaction, the business enters a debit to the cash account to record the cash receipt and a credit to a related loan liability account for the outstanding loan. Record the Loan Interest. Record the loan interest.

Here are different types of loans available in India....Types of secured loans Home loan.Loan against property (LAP)Loans against insurance policies.Gold loans.Loans against mutual funds and shares.Loans against fixed deposits.

There are three main classification found in Term Loans: short-term term loan, intermediate term loan, and long-term term loan.

Definitions vary from lender to lender, but most commonly, medium-term loans are defined as loans with a repayment period between two and five years. In comparison, short-term loans are repaid within two years, and long-term loans are repaid within 10 to 20 years.

A loan is a sum of money that an individual or company borrows from a lender. It can be classified into three main categories, namely, unsecured and secured, conventional, and open-end and closed-end loans.

Term of the Loan means the time period between the date that the Loan is provided to the Borrower the Maturity Date.

Car loans, home loans and certain personal loans are examples of long-term loans. Long term loans can be availed to meet any business need like buying of machinery or any personal need like owning a house. Long-term loans are the most popular form of credit in the financial industry.