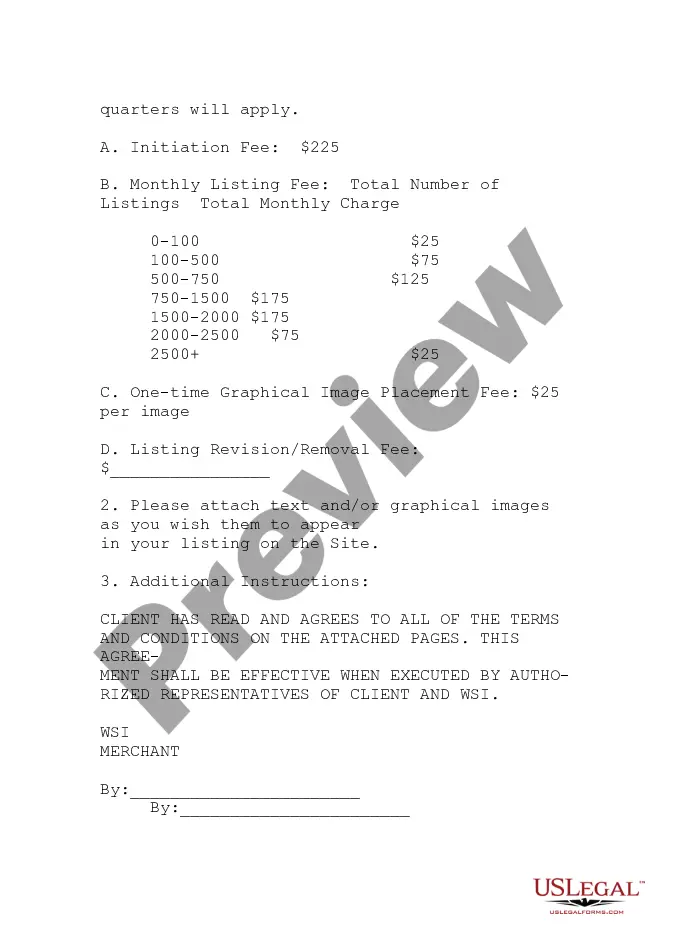

Harris Texas Retail Internet Site Agreement is a legally binding contract that outlines the terms and conditions between a retail company and its customers regarding the use of the company's internet site. This agreement ensures clarity, protection of rights, and establishes a mutually beneficial relationship between the company and its customers. The Retail Internet Site Agreement covers various aspects, including website usage, account creation, privacy policies, terms of sale, intellectual property rights, and dispute resolution. It provides detailed information about the company's online services, product listings, pricing, shipping policies, and return and refund procedures. The agreement emphasizes the need for users to comply with certain rules and guidelines while accessing the retail company's internet site. Customers are expected to use the site responsibly, respecting intellectual property rights, refraining from illegal activities, and adhering to any age restrictions or parental controls implemented by the company. In addition to the general Retail Internet Site Agreement, there might be specific types tailored for different purposes. These may include: 1. Customer Membership Agreement: This type of agreement is applicable if the retail company offers a membership program to its customers, providing exclusive benefits, discounts, or rewards for loyal customers. It outlines the terms and conditions related to membership, including annual fees, benefits, and termination procedures. 2. Vendor Agreement: If the retail company allows third-party vendors to sell products on their website, a Vendor Agreement may be necessary. This agreement sets forth the terms and conditions for vendors, including product listing guidelines, commission rates, payment terms, and dispute resolution procedures. 3. Affiliate Agreement: If the retail company engages in an affiliate marketing program, an Affiliate Agreement may be necessary. This agreement establishes the terms and conditions between the retail company and its affiliates, detailing commission structures, promotional guidelines, and payout procedures. 4. Mobile App Agreement: If the retail company provides a mobile application for customers to access their online services, a Mobile App Agreement might be required. This agreement outlines the terms of use, privacy policies, notifications, data collection, and any additional features specific to the mobile app. In summary, the Harris Texas Retail Internet Site Agreement is a comprehensive contract that governs the relationship between a retail company and its customers regarding the use of the company's website. Depending on specific circumstances, additional agreements such as Customer Membership Agreement, Vendor Agreement, Affiliate Agreement, or Mobile App Agreement may be required to address specific aspects of the retail company's online services.

Harris Texas Retail Internet Site Agreement

Description

How to fill out Harris Texas Retail Internet Site Agreement?

Whether you plan to start your company, enter into an agreement, apply for your ID update, or resolve family-related legal concerns, you need to prepare certain documentation meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any individual or business case. All files are grouped by state and area of use, so opting for a copy like Harris Retail Internet Site Agreement is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of more steps to obtain the Harris Retail Internet Site Agreement. Follow the guide below:

- Make certain the sample meets your personal needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to obtain the sample when you find the correct one.

- Choose the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Harris Retail Internet Site Agreement in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you can access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

If you spot price gouging or experience unfair or unlawful business practices, please file a complaint online or call our Consumer Protection Hotline at 1-800-621-0508.

A nonprofit corporation organized under the Development Corporation Act of 1979 (Article 5190.6, Vernon's Texas Civil Statutes) is exempt from franchise and sales taxes. The sales tax exemption does not apply to the purchase of an item that is a project or part of a project that the corporation leases, sells or lends.

You can get help with your consumer problem from the Citizens Advice consumer service....If a business isn't helping you fix something that went wrong, you could: try making a formal complaint. get help from a dispute resolution scheme. take them to court.

Each taxable entity formed in Texas or doing business in Texas must file and pay franchise tax.

Use franchise tax Webfile or file Form 05-164, Texas Franchise Tax Extension Request, along with the appropriate payment, on or before the original due date of the report. The extension payment must be at least 90 percent of the tax that will be due with the report filed on or before Nov.

Unlike many other states, Texas doesn't require LLCs to file annual reports. Texas imposes a franchise tax on most LLCs, which is payable to the Texas Comptroller of Public Accounts. Franchise tax is based on the LLC's ?net surplus,? which is the net assets minus member contributions.

Penalties and Interest A $50 penalty is assessed on each report filed after the due date. If tax is paid 1-30 days after the due date, a 5 percent penalty is assessed. If tax is paid over 30 days after the due date, a 10 percent penalty is assessed.

The FTC cannot resolve individual complaints, but it can provide information about what steps to take. The FTC says that complaints can help it and its law enforcement partners detect patterns of fraud and abuse, which may lead to investigations and stopping unfair business practices.

Entities Not Subject to Franchise Tax The following entities do not file or pay franchise tax: sole proprietorships (except for single member LLCs);

File a complaint with your local consumer protection office or the state agency that regulates the company. Notify the Better Business Bureau (BBB) in your area about your problem. The BBB tries to resolve your complaints against companies.