Philadelphia Pennsylvania Form - Web Site Data Collection Policy

Description

How to fill out Philadelphia Pennsylvania Form - Web Site Data Collection Policy?

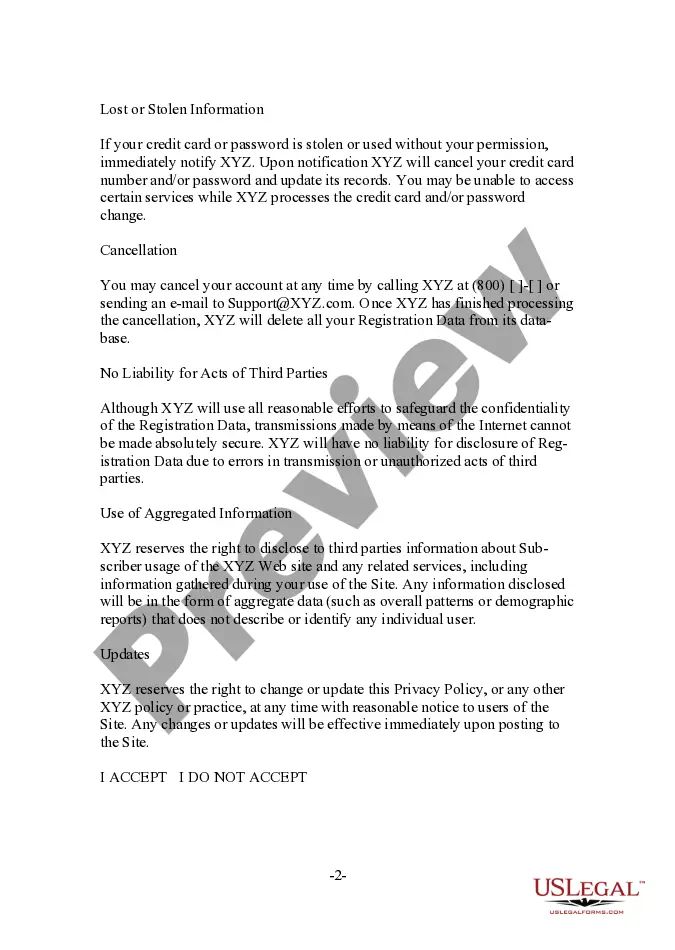

Drafting papers for the business or individual demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to consider all federal and state laws and regulations of the specific area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to create Philadelphia Form - Web Site Data Collection Policy without expert assistance.

It's possible to avoid spending money on lawyers drafting your documentation and create a legally valid Philadelphia Form - Web Site Data Collection Policy on your own, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal templates that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the required form.

If you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Philadelphia Form - Web Site Data Collection Policy:

- Look through the page you've opened and check if it has the sample you need.

- To do so, use the form description and preview if these options are available.

- To find the one that suits your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal forms for any use case with just a few clicks!

Form popularity

FAQ

Every partnership, limited partnership, limited liability company filing with the IRS as a partnership, association, or other group of two or more persons operating a business within Philadelphia, whether residents or non-residents of Philadelphia, is subject to the Net Profits Tax.

All Philadelphia residents owe the City Wage Tax, regardless of where they work. Non-residents who work in Philadelphia must also pay the Wage Tax.

Every individual, partnership, association, limited liability company (LLC), and corporation engaged in a business, profession, or other activity for profit within the City of Philadelphia must ?le a Business Income & Receipts Tax (BIRT) return.

How to file City taxes Filing returns online. All Philadelphia taxes can be filed online.Filing returns through Modernized e-Filing (MeF) You can use the IRS Modernized e-Filing program to file some City of Philadelphia taxes.Filing paper returns.

Unincorporated businesses are required to file and pay both the Net Profits Tax (NPT) and the Business Income & Receipts Tax (BIRT).

Sign the return, enclose W-2 forms, PA Schedule SP (if applicable) and mail to: Philadelphia Department of Revenue, P.O. Box 1648, Philadelphia, PA 19105-1648.

Employees who are nonresidents of Philadelphia and who are required to work at various times outside of Philadelphia within a calendar year may file for a wage tax refund directly with the City of Philadelphia.

How to pay File a return by mail. Mail your return to: Philadelphia Dept. of Revenue. P.O. Box 1660.Pay by mail. Mail all payments with a payment coupon to: Philadelphia Dept. of Revenue. P.O. Box 1393.Request a refund by email. Mail your return and refund request to: Philadelphia Dept. of Revenue. P.O. Box 1137.

Individuals engaged in any for-profit activity within the city of Philadelphia must file a BIRT return. Additionally, individuals who maintain a Commercial Activity License (CAL) must file a BIRT return, even if they didn't actively engage in any business.