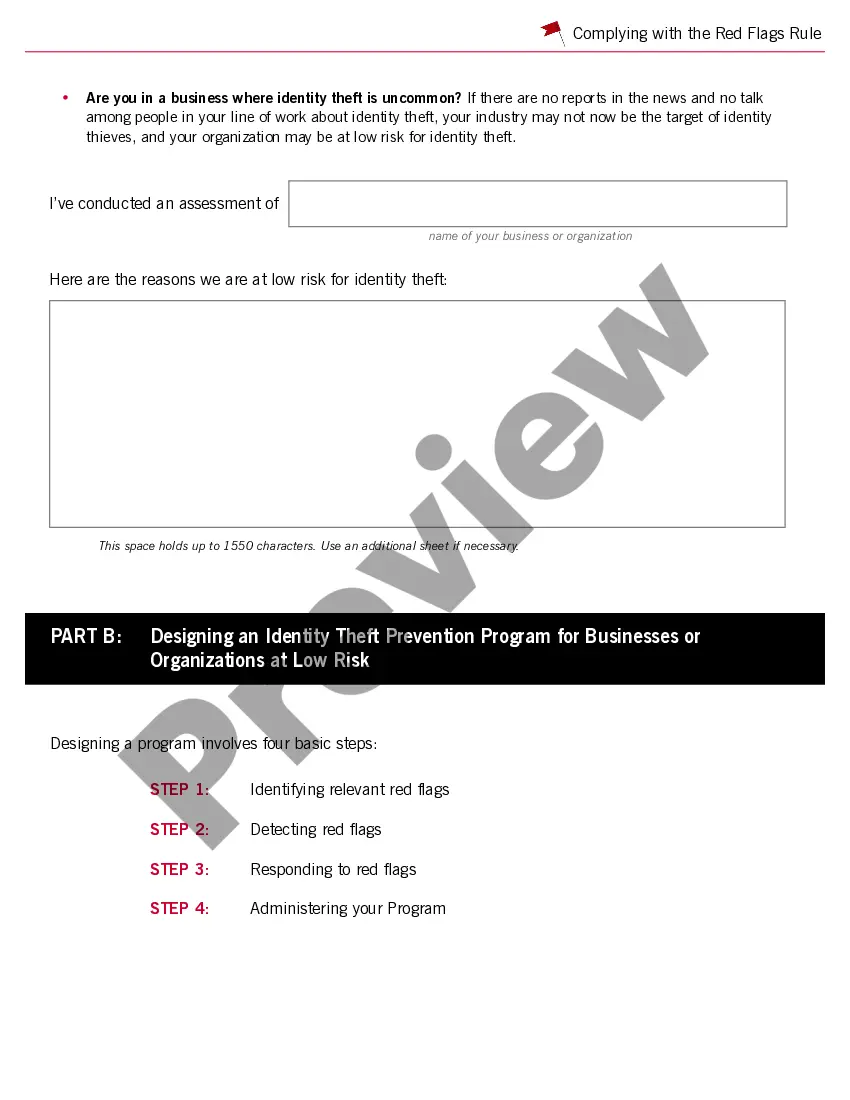

This guide has two parts: Part A to help you determine whether your business or organization is at low risk, and Part B to help you design your written Identity Theft Prevention Program if your business is in the low risk category.

Note: The preview only shows the 1st page of the document.

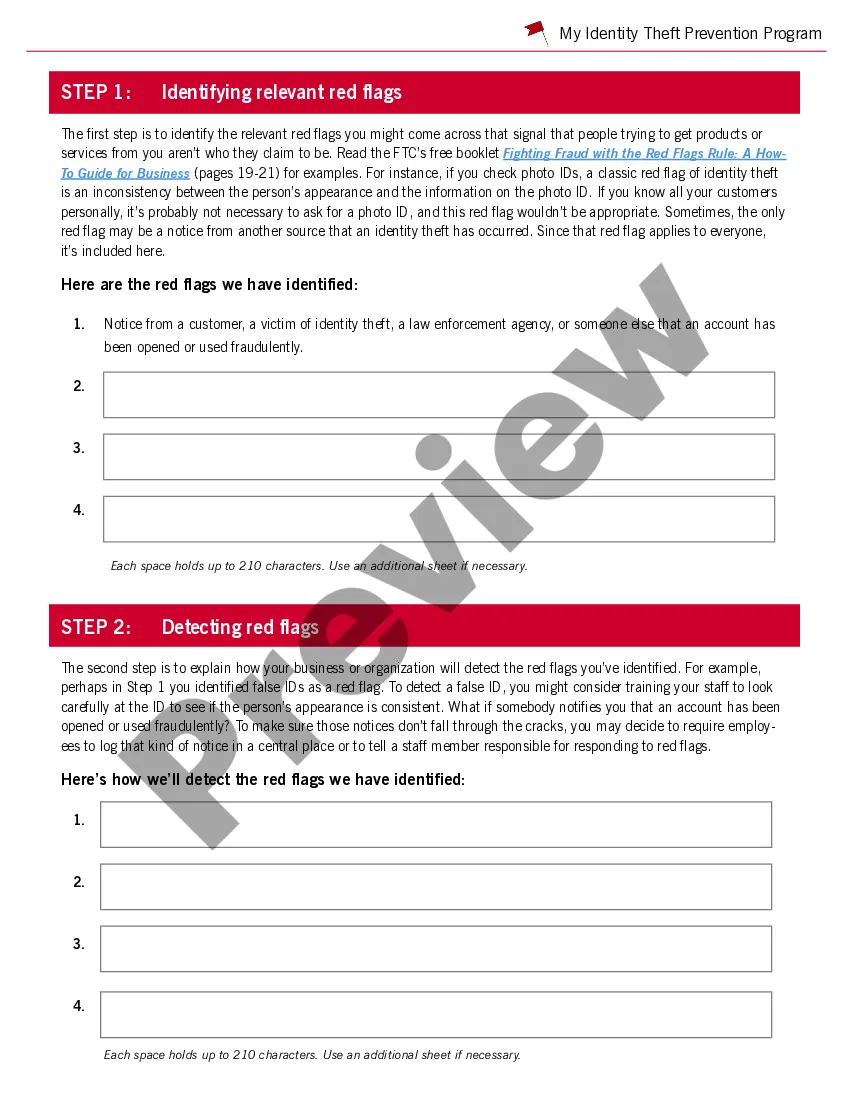

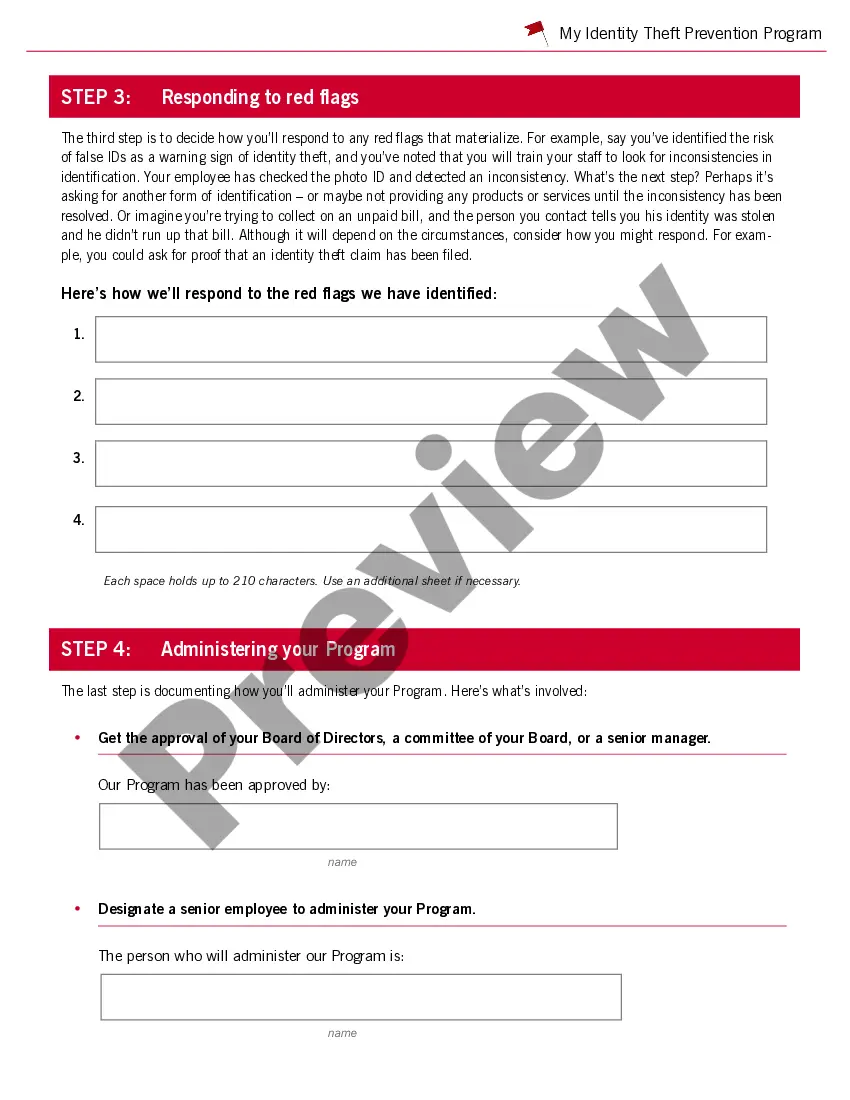

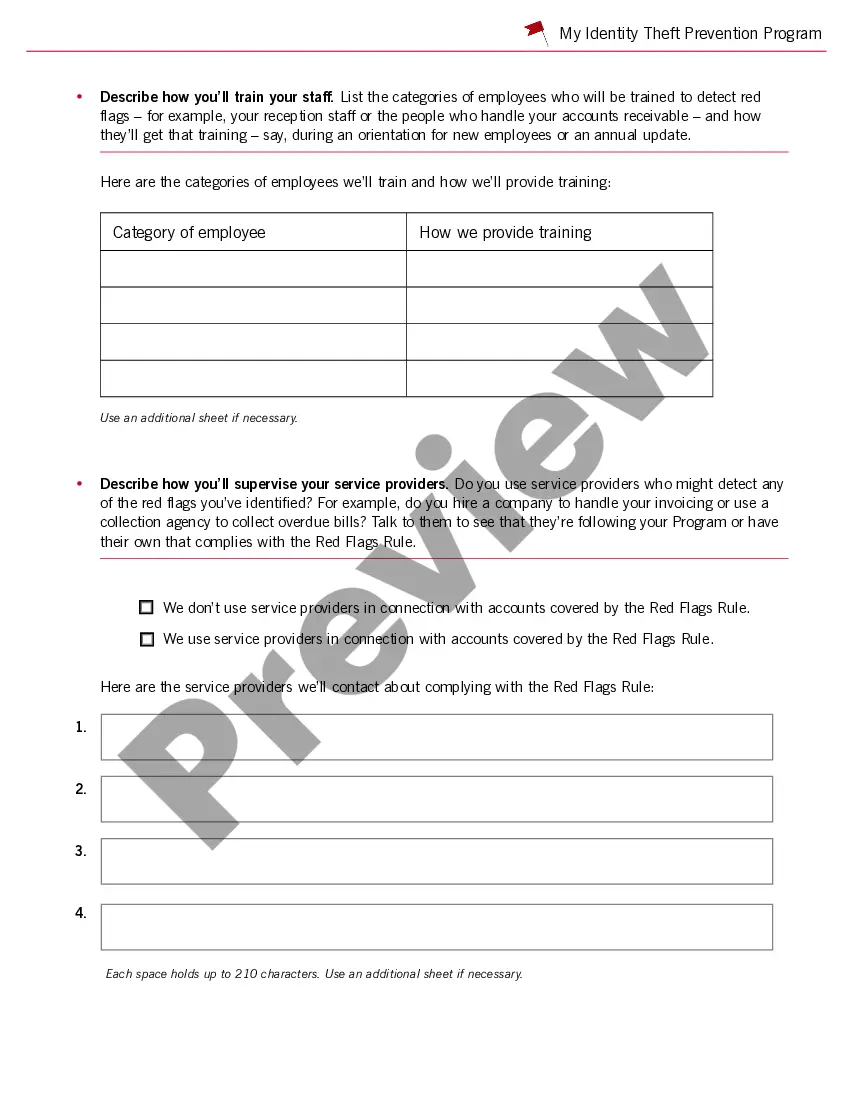

Title: A Comprehensive Guide to Complying with the Red Flags Rule under FCRA and FACT in Houston, Texas Keywords: Houston, Texas, Red Flags Rule, FCRA, FACT, Compliance, Identity Theft, Fraud Prevention, Risk Assessment, Identity Verification Introduction: The Red Flags Rule, enforced by the Federal Trade Commission (FTC), aims to protect consumers and businesses from identity theft and fraud. This guide provides a detailed overview of complying with the Red Flags Rule under the Fair Credit Reporting Act (FCRA) and the Fair and Accurate Credit Transactions Act (FACT) specifically in Houston, Texas. Learn how to safeguard your business, customers, and reputation through effective compliance measures. 1. Understanding the Red Flags Rule: a. Houston, Texas-specific details b. Objective of the rule — protecting businesses and consumers c. Identification and prevention of "red flags" indicating potential fraudulent activities 2. Compliance Requirements: a. FCRA and FACT overview b. Applicability to different businesses in Houston, Texas c. Identifying entities considered "creditors" under the rule d. Creating and implementing a written Identity Theft Prevention Program (IPP) 3. Risk Assessment: a. Conducting a thorough risk assessment tailored to Houston's unique environment b. Identifying potential red flags relevant to the local context c. Determining reasonable and appropriate responses to detected red flags d. Periodic reassessment to ensure an up-to-date prevention program 4. Identity Verification: a. Efficient methods for verifying the identity of customers and clients b. Utilizing technology and third-party verification services c. Establishing clear procedures for verifying documents and information 5. Training and Staff Awareness: a. Educating employees on identifying and responding to red flags b. Designating responsible individuals for program implementation and maintenance c. Ensuring regular training sessions and updates to keep staff informed 6. Incidence Response and Reporting: a. Establishing protocols for addressing detected red flags or potential incidents b. Handling victim complaints promptly and effectively c. Reporting suspicious activities to relevant authorities, such as FTC or credit bureaus Types of Houston Texas Guides to Complying with the Red Flags Rule under FCRA and FACT: 1. Beginner's Guide: A simplified approach to understanding and implementing the Red Flags Rule for businesses new to compliance requirements. 2. Comprehensive Checklist: A step-by-step checklist covering all necessary compliance elements, specifically tailored to Houston-based businesses. 3. Industry-Specific Guide: Detailed guidance catering to the unique compliance needs of industry sectors prevalent in Houston, such as healthcare, financial services, or hospitality. Conclusion: Complying with the Red Flags Rule in Houston, Texas, is crucial to protect your business and customers from identity theft and fraud. By implementing robust compliance procedures, conducting regular risk assessments, and training employees, you can stay ahead of potential red flags and respond swiftly when necessary. Establishing a strong Identity Theft Prevention Program will strengthen your reputation and provide peace of mind to both you and your customers in the ever-growing threat landscape.