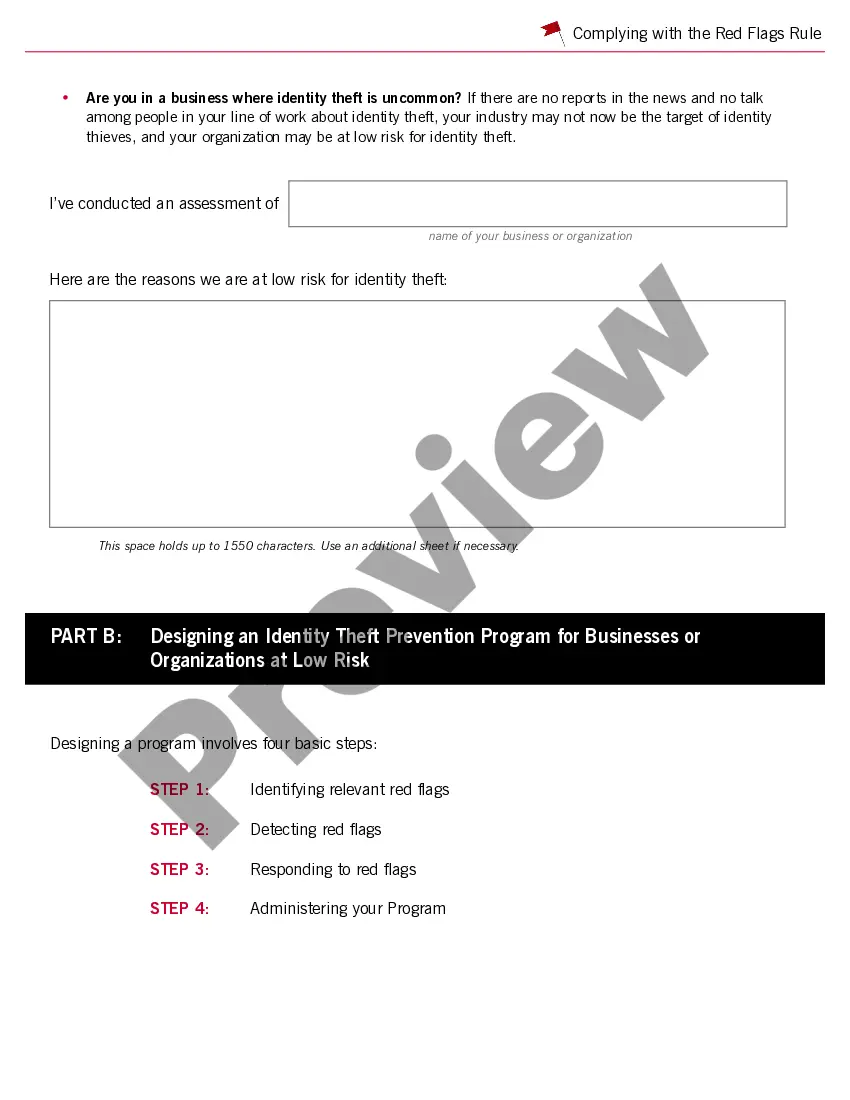

This guide has two parts: Part A to help you determine whether your business or organization is at low risk, and Part B to help you design your written Identity Theft Prevention Program if your business is in the low risk category.

Note: The preview only shows the 1st page of the document.

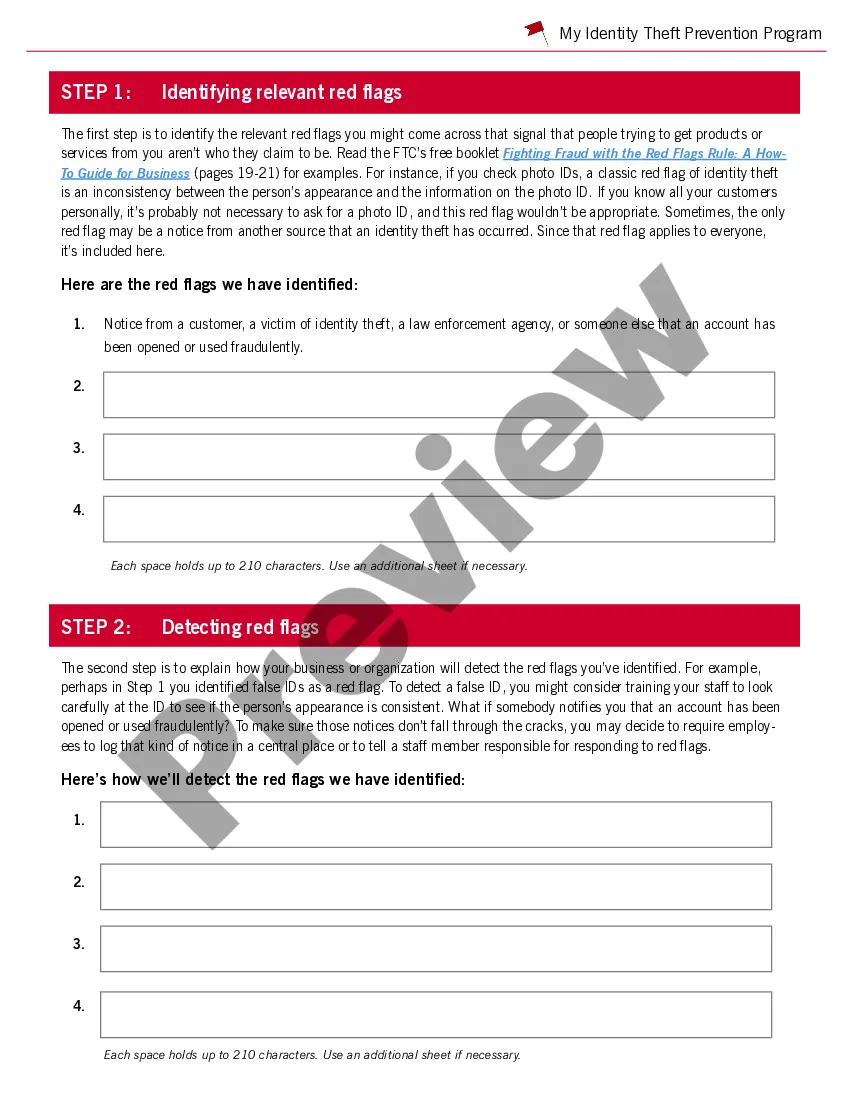

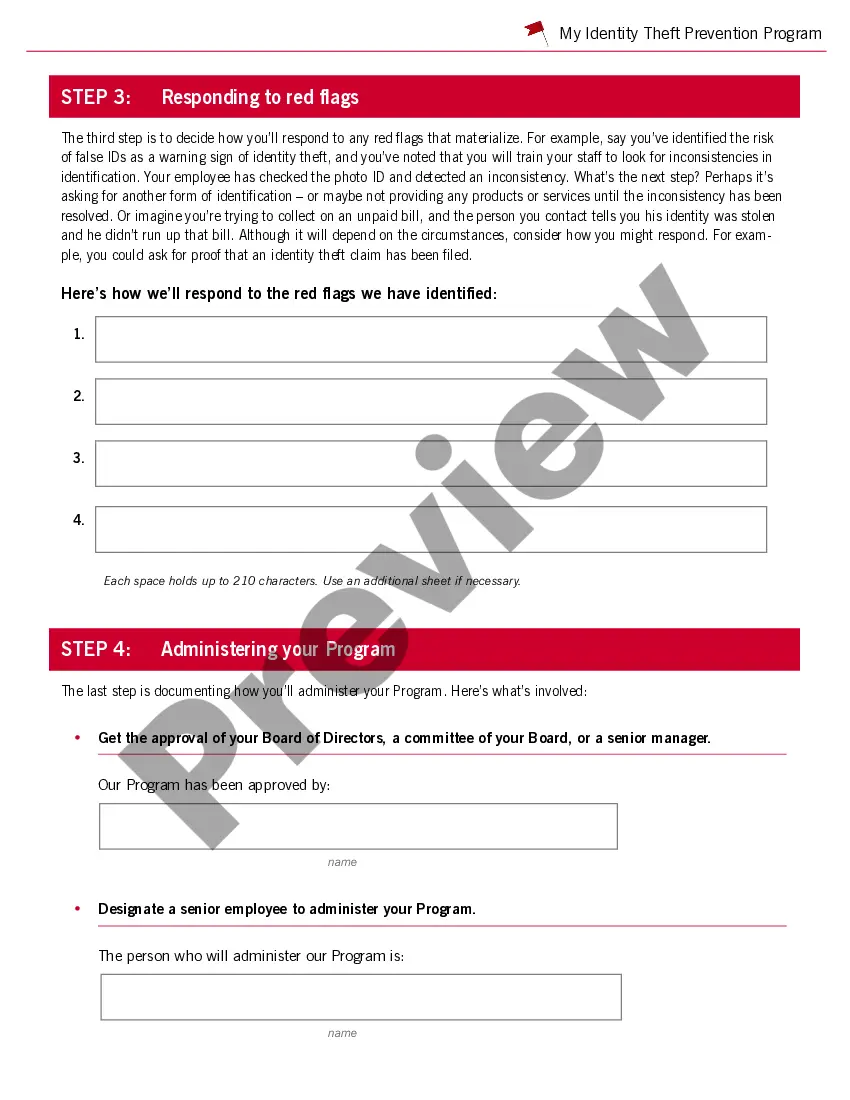

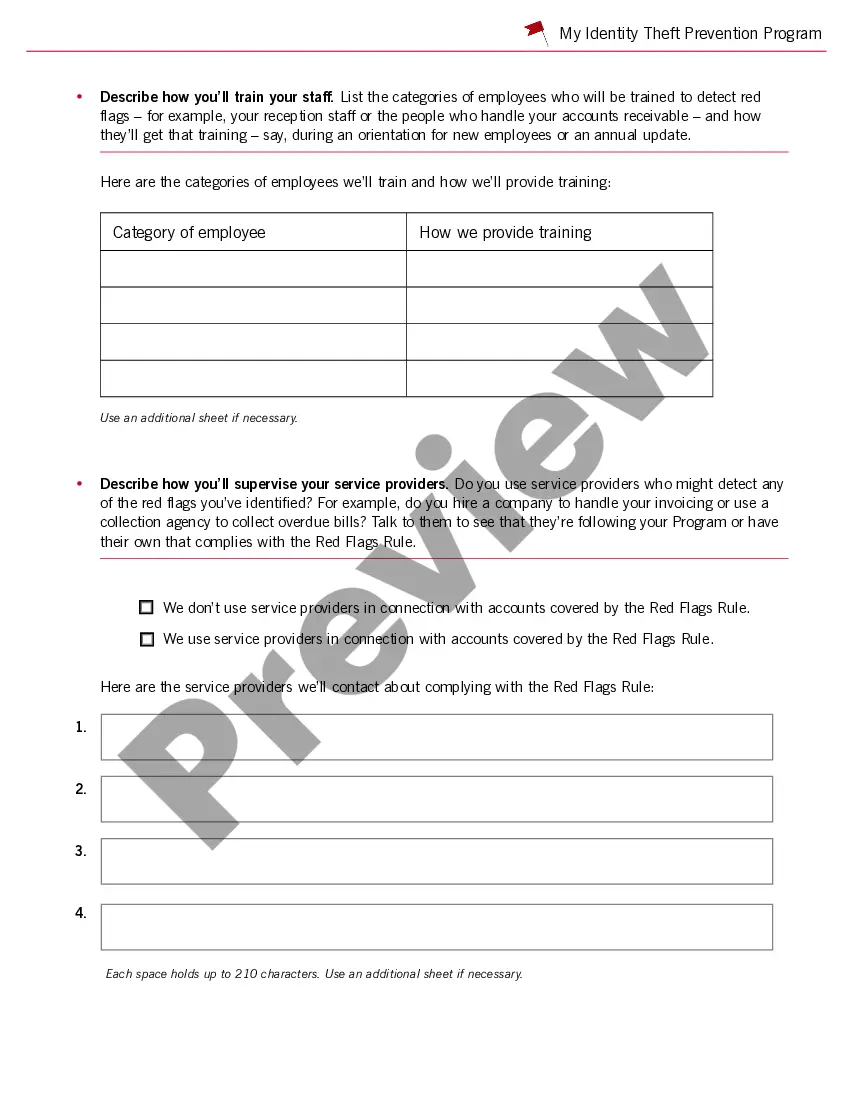

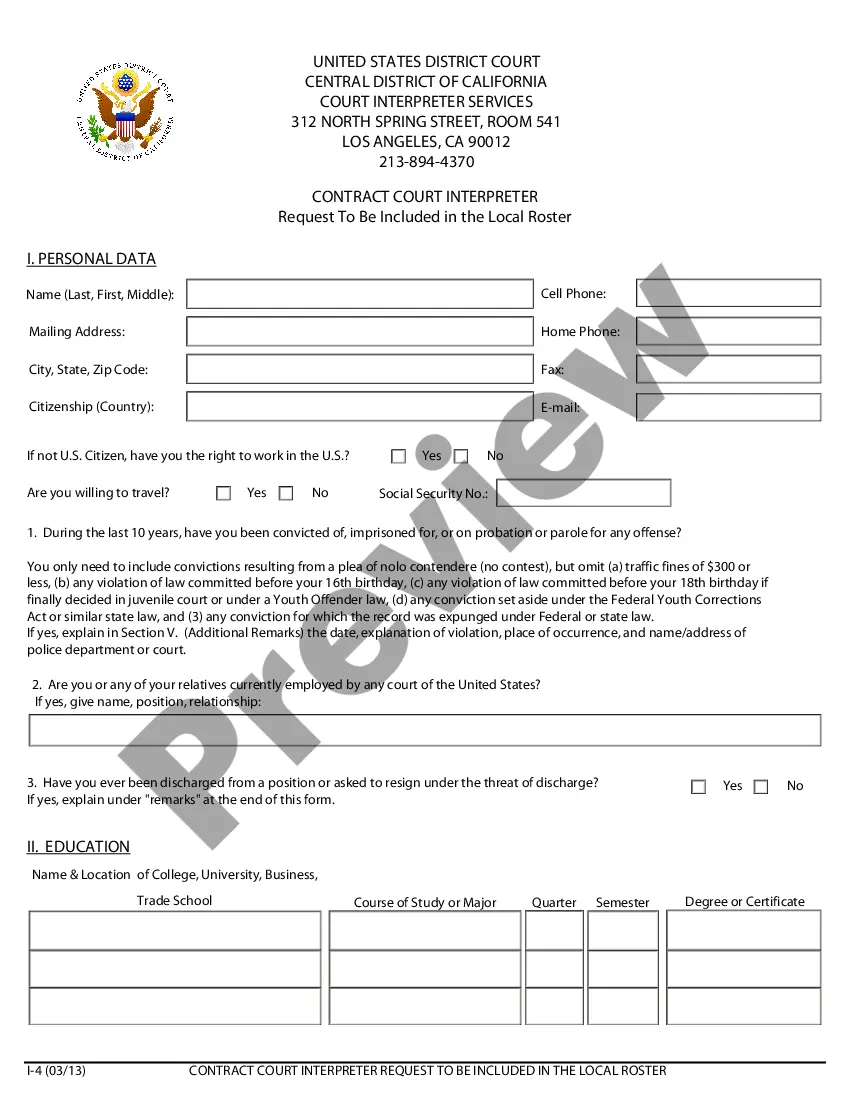

Kings New York Guide to Complying with the Red Flags Rule under FCRA and FACT provides a comprehensive overview of the regulations and requirements outlined by the Federal Trade Commission (FTC) for entities that handle consumer information. This guide aims to assist businesses operating in New York with implementing necessary measures to prevent and mitigate identity theft and fraud. 1. Understanding the Red Flags Rule: This section delves into the importance of the Red Flags Rule and how it relates to the Fair Credit Reporting Act (FCRA) and the Fair and Accurate Credit Transactions Act (FACT). It provides a detailed explanation of what constitutes a "red flag" and highlights the risks associated with identity theft. 2. Identifying Red Flags: This segment focuses on helping businesses recognize possible red flags or indicators of identity theft and fraud. It provides an extensive list of common red flags, including suspicious identification documents, unusual account activities, and alerts from credit bureaus, among others. By identifying these red flags, businesses can proactively detect and respond to potential instances of identity theft. 3. Establishing an Effective Identity Theft Prevention Program: Here, the guide outlines the necessary steps for creating a robust Identity Theft Prevention Program (IPP). It covers key elements such as appointing responsible personnel, conducting risk assessments, designing and implementing policies and procedures, employee training, and ongoing program monitoring and updates. 4. Compliance and Reporting Requirements: This section explores the legal obligations mandated by the FTC for businesses subject to the Red Flags Rule. It emphasizes the submission of an annual report summarizing the effectiveness of the IPP, as well as compliance audits and record-keeping requirements. 5. Additional Considerations: This segment provides supplementary considerations that businesses must be aware of when developing their compliance strategy, including the importance of keeping up with evolving threats and incorporating technological advancements to strengthen their identity theft prevention measures. 6. Industry-Specific Guidelines: Recognizing that different industries may face specific challenges when complying with the Red Flags Rule, this guide also offers industry-specific recommendations tailored to various sectors such as healthcare, finance, e-commerce, and more. It provides insights and best practices that align with the unique needs and regulatory expectations of each industry. Kings New York Guide to Complying with the Red Flags Rule under FCRA and FACT serves as an invaluable resource for businesses in New York looking to establish and maintain effective identity theft prevention programs. By following the guidelines and incorporating the suggested best practices, organizations can significantly reduce the risk of identity theft, safeguard customer information, and ensure compliance with the Red Flags Rule.