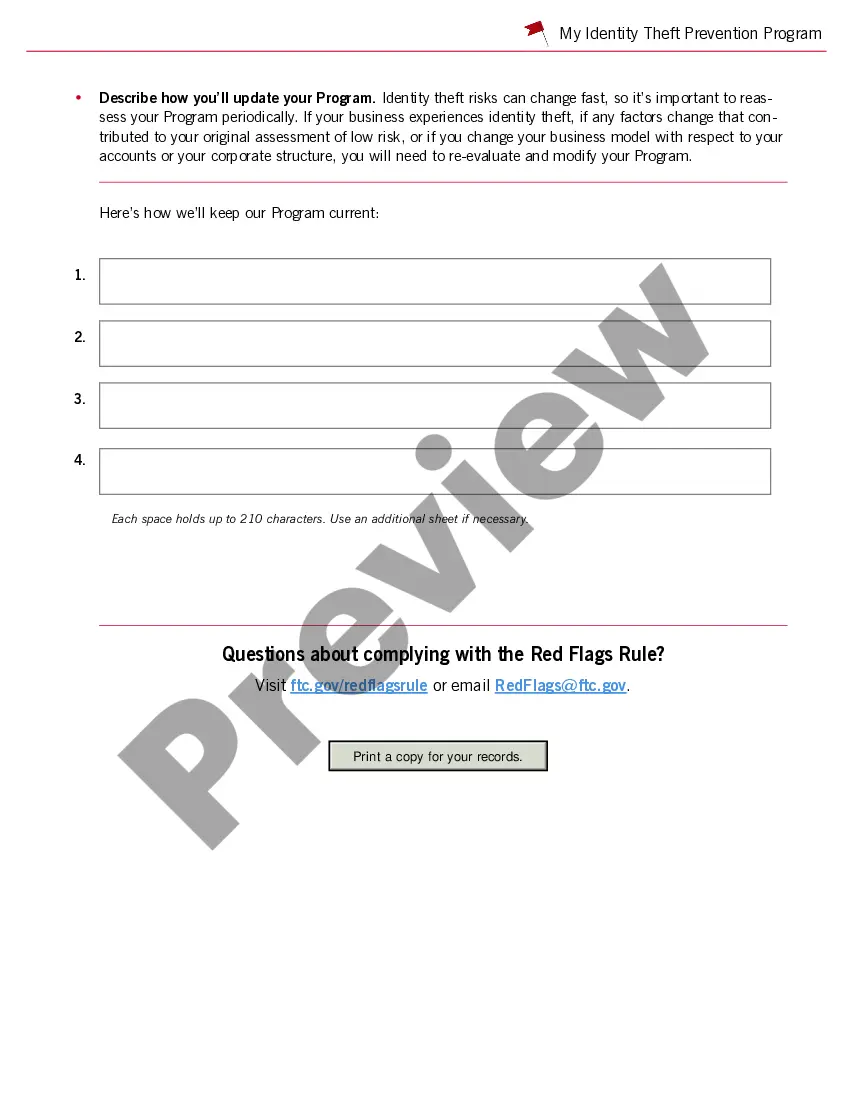

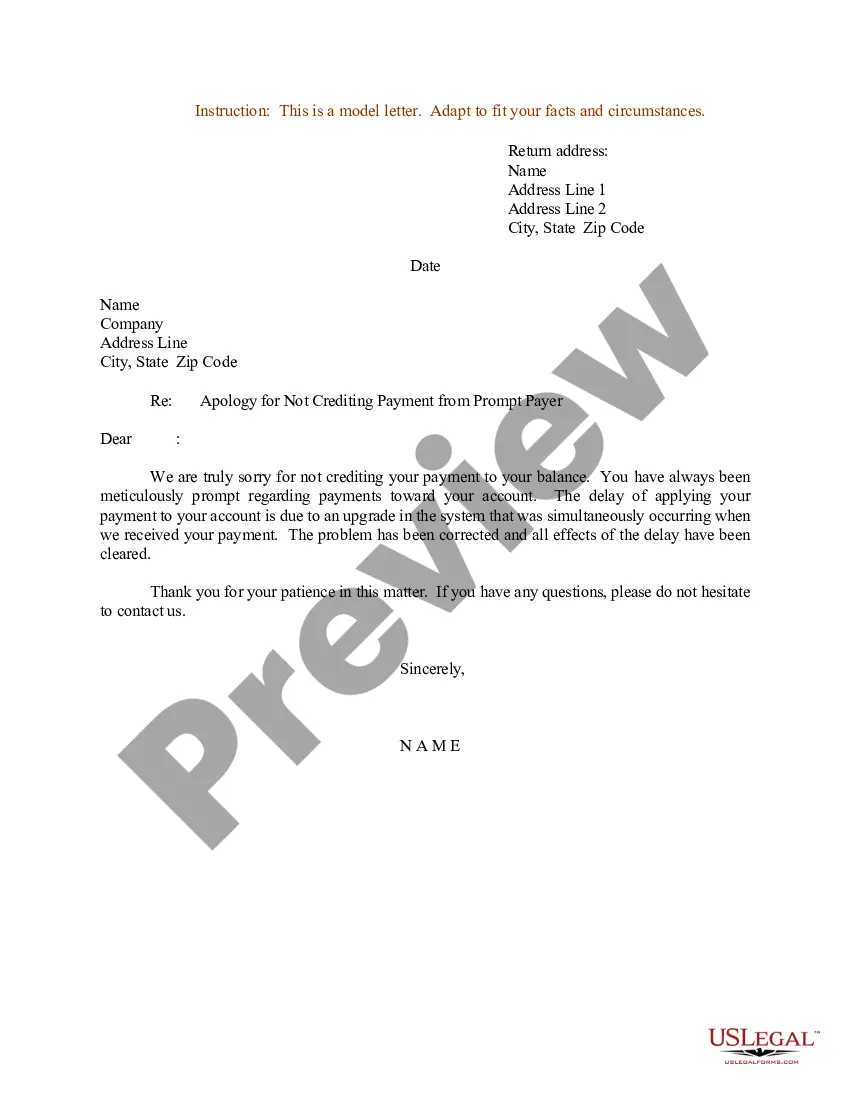

If you are searching for a reliable legal document service to obtain the Mecklenburg Guide to Adhering to the Red Flags Rule under FCRA and FACTA, think about US Legal Forms. Whether you wish to establish your LLC enterprise or manage your asset distribution, we have you covered. You don’t need to be an expert in law to find and download the necessary template.

You can easily type to search or browse the Mecklenburg Guide to Adhering to the Red Flags Rule under FCRA and FACTA, either by a keyword or by the state/county for which the document is designed.

After finding the required template, you can Log In and download it or save it in the My documents section.

Don’t have an account? It’s simple to start! Just find the Mecklenburg Guide to Adhering to the Red Flags Rule under FCRA and FACTA template and review the form’s preview and brief introductory information (if available). If you feel confident about the template’s language, go ahead and click Buy now. Create an account and select a subscription plan. The template will be instantly available for download once the payment is processed. You can now complete the form.

Managing your legal matters doesn’t need to be expensive or time-consuming. US Legal Forms is here to show it. Our extensive assortment of legal forms makes these tasks more economical and accessible. Launch your first business, organize your advance care planning, draft a real estate contract, or execute the Mecklenburg Guide to Adhering to the Red Flags Rule under FCRA and FACTA - all from the comfort of your home. Join US Legal Forms today!

- You can explore over 85,000 forms categorized by state/county and case.

- The user-friendly interface, diverse learning resources, and committed support team make it easy to locate and fill out various documents.

- US Legal Forms has been a dependable service offering legal forms to millions since 1997.