This guide has two parts: Part A to help you determine whether your business or organization is at low risk, and Part B to help you design your written Identity Theft Prevention Program if your business is in the low risk category.

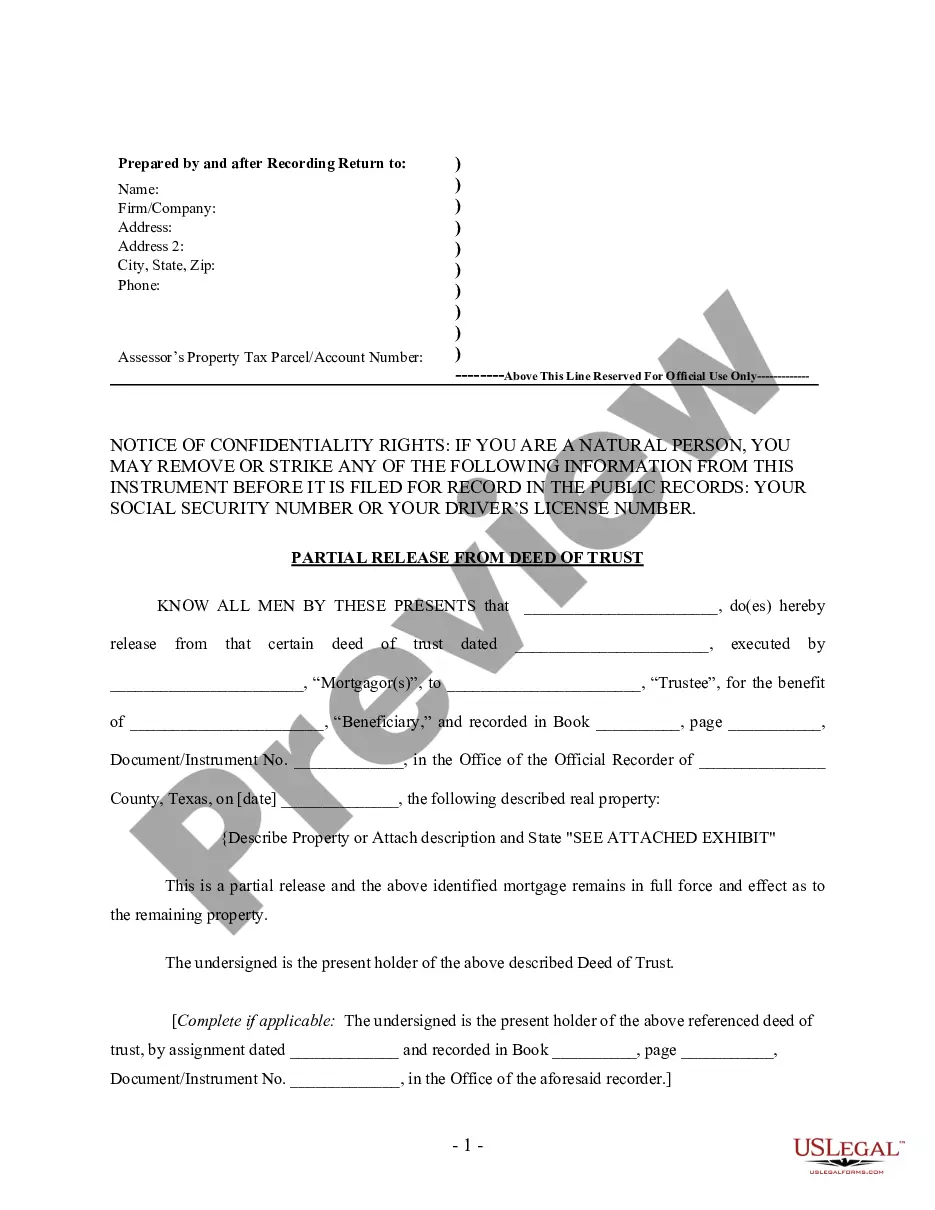

Note: The preview only shows the 1st page of the document.

Montgomery Maryland Guide to Complying with the Red Flags Rule under FCRA and FACT Introduction: The Montgomery Maryland Guide to Complying with the Red Flags Rule under the Fair Credit Reporting Act (FCRA) and the Fair and Accurate Credit Transactions Act (FACT) is a comprehensive resource designed to help businesses operating in Montgomery, Maryland understand and comply with the requirements of these regulations. This guide provides a detailed description of the Red Flags Rule, outlines key provisions of FCRA and FACT, and offers practical guidance on implementing an effective identity theft prevention program. 1. Understanding the Red Flags Rule: The guide begins by explaining the concept of identity theft and the purpose of the Red Flags Rule. It dives into the definition of "red flags" and identifies the various warning signs that businesses should be aware of to detect potential instances of identity theft. This section emphasizes the importance of being vigilant and proactive in safeguarding customer information. 2. Compliance Requirements under FCRA and FACT: The guide then delves into the specific requirements outlined by FCRA and FACT that businesses in Montgomery, Maryland must adhere to. It identifies key components such as risk assessment, staff training, and ongoing monitoring, highlighting the importance of maintaining a robust identity theft prevention program. 3. Creating an Identity Theft Prevention Program: To assist businesses in creating their own tailored identity theft prevention program, the guide provides a step-by-step approach. It outlines the necessary elements, such as policies and procedures, to be incorporated into the program. It also suggests best practices for establishing procedures to detect, prevent, and mitigate identity theft risks. 4. Reporting and Responding to Red Flags: This section discusses the importance of promptly responding to identified suspicious activities or red flags. The guide offers guidance on the appropriate steps to take when encountering potential instances of identity theft, including documenting incidents, notifying customers, and cooperating with law enforcement agencies as required by the regulations. 5. Industry-Specific Compliance: Recognizing the diverse nature of businesses in Montgomery, Maryland, the guide provides industry-specific compliance recommendations. It outlines guidelines for healthcare providers, financial institutions, retailers, and other sectors, addressing their unique red flag indicators and suggesting tailored approaches to compliance with FCRA and FACT. Conclusion: In conclusion, the Montgomery Maryland Guide to Complying with the Red Flags Rule under FCRA and FACT serves as a valuable resource for businesses seeking to navigate the intricate requirements of these regulations. By following the best practices, implementing robust identity theft prevention measures, and staying up-to-date with compliance obligations, businesses in Montgomery, Maryland can effectively protect their customers and safeguard their operations from the risks associated with identity theft.