This guide has two parts: Part A to help you determine whether your business or organization is at low risk, and Part B to help you design your written Identity Theft Prevention Program if your business is in the low risk category.

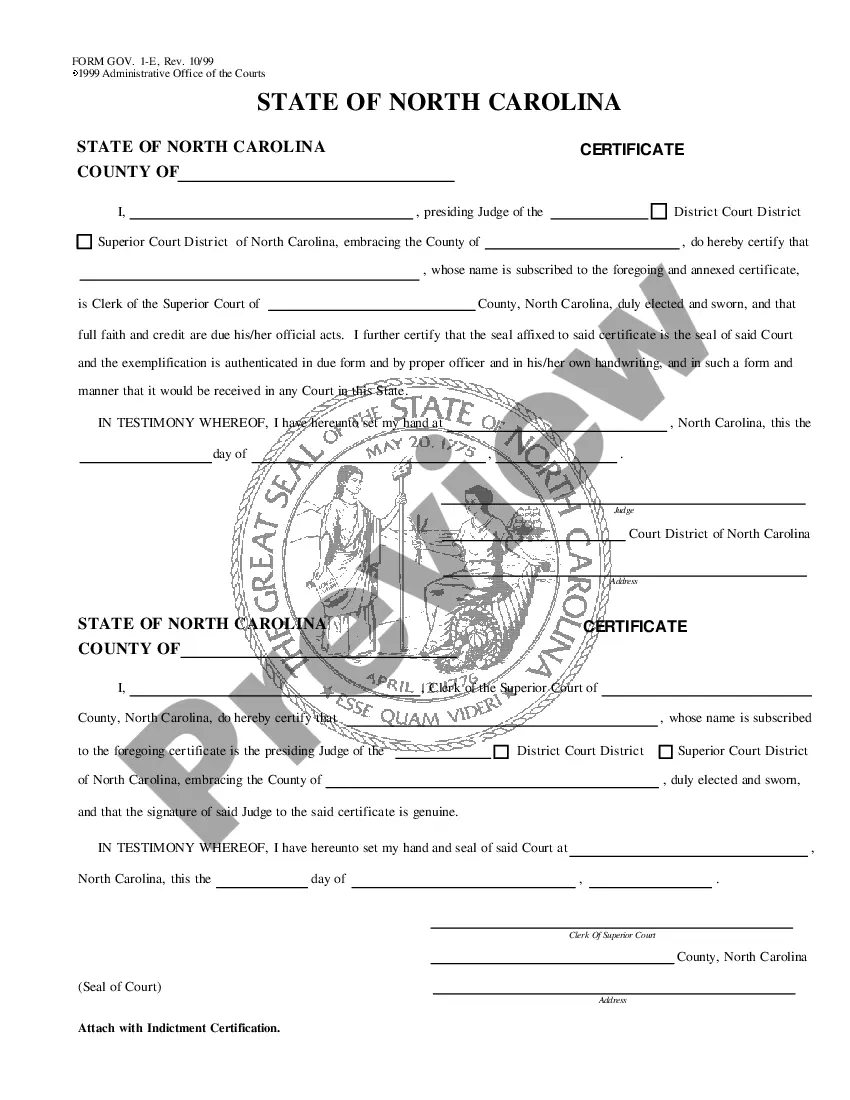

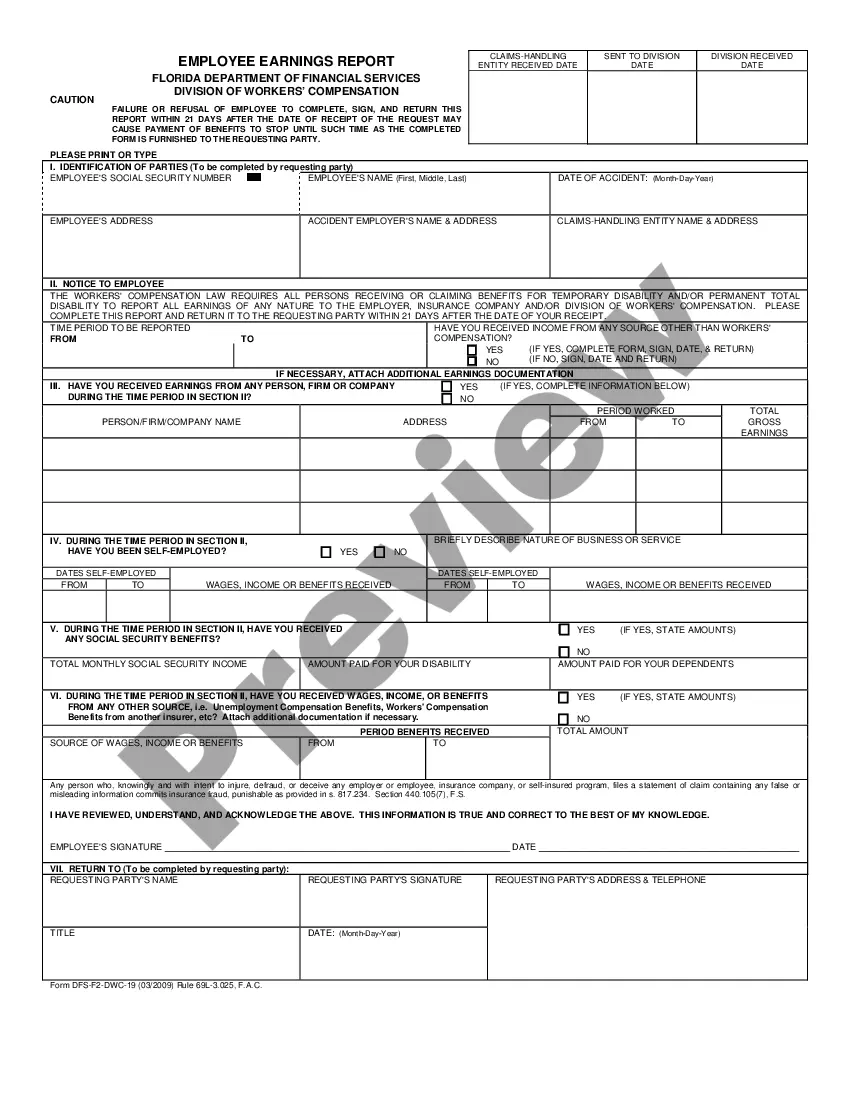

Note: The preview only shows the 1st page of the document.

Queens New York Guide to Complying with the Red Flags Rule under FCRA and FACT The Red Flags Rule, implemented under the Fair Credit Reporting Act (FCRA) and the Fair and Accurate Credit Transactions Act (FACT), requires certain businesses to develop and implement identity theft prevention programs. This guide aims to provide detailed information on complying with the Red Flags Rule specifically for businesses located in Queens, New York. As one of the most populous and diverse boroughs of New York City, Queens is home to a wide range of businesses that may be affected by the Red Flags Rule. Regardless of their size or industry, all covered businesses must be aware of the rule's requirements and take necessary actions to prevent identity theft and safeguard consumers' information. Key Topics Covered in the Queens New York Guide to Complying with the Red Flags Rule: 1. Overview of the Red Flags Rule: This section offers a comprehensive explanation of the Red Flags Rule, its purpose, and who it applies to. It highlights the importance of identity theft prevention and the penalties for non-compliance. 2. Identifying Red Flags: Understanding what constitutes a red flag is crucial for compliance. This guide outlines various potential warning signs of identity theft that businesses in Queens should be attentive to. Examples include suspicious documents or personal information discrepancies. 3. Developing an Identity Theft Prevention Program: Queens businesses must create and maintain a written program that identifies, detects, and responds to red flags. This section provides step-by-step guidance on developing a comprehensive program tailored to the specific requirements of a business in Queens, New York. 4. Training and Staff Awareness: It is essential that employees are educated about the Red Flags Rule and their role in preventing identity theft. This guide explains the importance of training programs, offers best practices for implementation, and provides relevant resources. 5. Assessing and Updating the Program: Regular program assessments and updates are necessary to ensure ongoing compliance. This section outlines the different factors to consider during these reviews and offers guidance on making necessary adjustments to the program. Additional Types of Queens New York Guides to Complying with the Red Flags Rule under FCRA and FACT: 1. Queens New York Guide for Financial Institutions: This guide is tailored specifically for financial institutions operating in Queens, New York. It provides additional industry-specific details and best practices for implementing Red Flags Rule compliance programs in banks, credit unions, and other financial entities. 2. Queens New York Guide for Healthcare Providers: Healthcare providers, including clinics, hospitals, and private practices in Queens, face unique challenges when complying with the Red Flags Rule. This specialized guide addresses the specific considerations and guidelines applicable to the healthcare industry. 3. Queens New York Guide for Retail Businesses: Retail businesses play a vital role in preventing identity theft, as they handle a significant amount of customer information. This guide specifically addresses the red flags and compliance requirements relevant to retail establishments in Queens, New York. By following this comprehensive guide tailored to businesses operating in Queens, New York, covered entities can ensure they are compliant with the Red Flags Rule under FCRA and FACT. Upholding the security of consumers' information will not only protect individuals from identity theft but also safeguard the reputation and success of businesses in Queens.