Montgomery Maryland Sample Identity Theft Policy for FCRA and FACTA Compliance

Description

How to fill out Montgomery Maryland Sample Identity Theft Policy For FCRA And FACTA Compliance?

Preparing paperwork for the business or personal needs is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the particular area. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to generate Montgomery Sample Identity Theft Policy for FCRA and FACTA Compliance without professional help.

It's easy to avoid spending money on lawyers drafting your paperwork and create a legally valid Montgomery Sample Identity Theft Policy for FCRA and FACTA Compliance on your own, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal templates that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

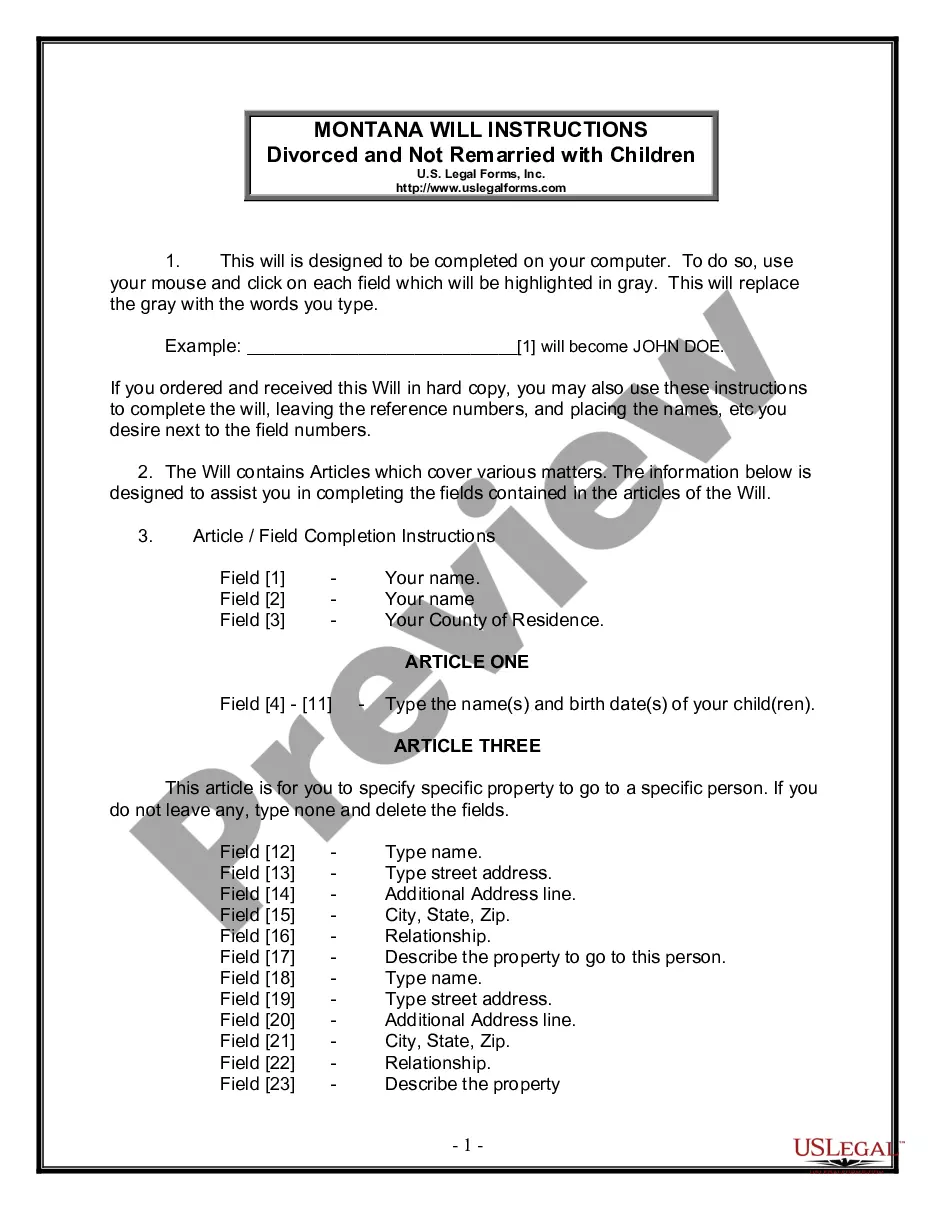

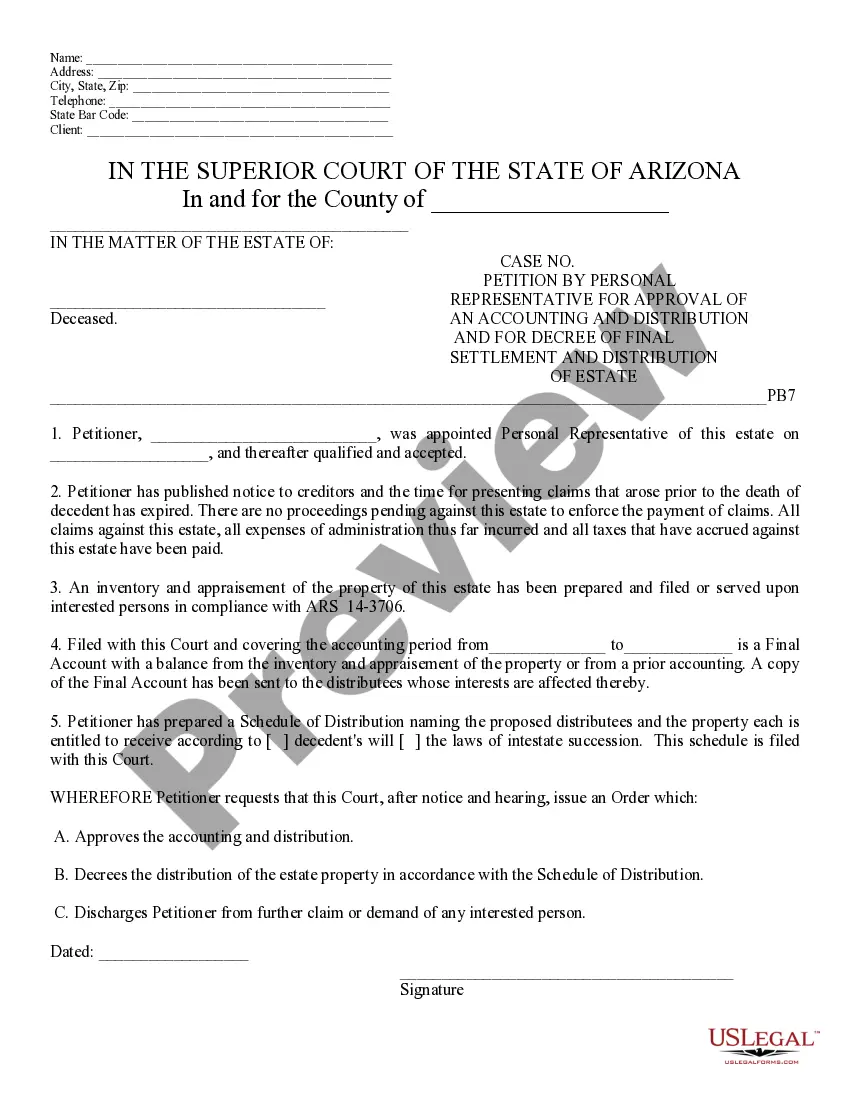

In case you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Montgomery Sample Identity Theft Policy for FCRA and FACTA Compliance:

- Look through the page you've opened and verify if it has the document you require.

- To do so, use the form description and preview if these options are available.

- To find the one that satisfies your requirements, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Select the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any use case with just a few clicks!

Form popularity

FAQ

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act.

FACTA (Fair and Accurate Credit Transactions Act) is an amendment to FCRA (Fair Credit Reporting Act ) that was added, primarily, to protect consumers from identity theft. The Act stipulates requirements for information privacy, accuracy and disposal and limits the ways consumer information can be shared.

The Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB) are the two federal agencies charged with overseeing and enforcing the provisions of the act.

The Fair Credit Reporting Act (FCRA) spells out rights for victims of identity theft, as well as responsibilities for businesses. Identity theft victims are entitled to ask businesses for a copy of transaction records such as applications for credit relating to the theft of their identity.

The Fair and Accurate Credit Transactions Act of 2003 (FACTA) added to the FCRA significant provisions designed to prevent identity theft, control the consequences of identity theft to victims' credit records, and help victims cleanse their credit records of identity-theft related information.

The SEC's identity theft red flags rules require certain SEC-regulated entities to adopt a written identity theft program that includes policies and procedures designed to: Identify relevant types of identity theft red flags; Detect the occurrence of those red flags; Respond appropriately to the detected red flags; and.

Unfortunately, being a victim of identity theft means your credit scores may be negatively impacted. Thieves could open new lines of credit or credit cards in your name -- and fail to pay the bills.

Creditors must develop and implement a written identity theft prevention program (Program); (2) the objectives of the Program; (3) the elements that the Program must contain; and (4) the steps financial institutions and creditors need to take to administer the Program.

On average, it can take 100 to 200 hours over six months to undo identity theft. The recovery process may involve working with the three major credit bureaus to request a fraud alert; reviewing your credit reports to pinpoint fraudulent activity; and reporting the theft.

Deter identity thieves by safeguarding your information Shred financial documents before discarding them. Protect your Social Security number. Don't give out personal information unless you're sure who you're dealing with. Don't use obvious passwords. Keep your information secure.