Philadelphia, Pennsylvania is a bustling city and the sixth-most populous in the United States. Known for its rich history, vibrant culture, and iconic landmarks, Philadelphia offers residents and visitors a unique experience. From the historic Liberty Bell to the stunning Philadelphia Museum of Art, this city has something for everyone. In terms of identity theft policy, Philadelphia follows strict guidelines set by the Fair Credit Reporting Act (FCRA) and the Fair and Accurate Credit Transactions Act (FACT). These federal laws aim to protect consumers from fraudulent activities and ensure their privacy and financial security. A Philadelphia Pennsylvania Sample Identity Theft Policy for FCRA and FACT Compliance is designed to provide a comprehensive framework for businesses and organizations to protect their customers' personal information. This policy includes guidelines and procedures to prevent, detect, and respond to identity theft incidents, ensuring compliance with the FCRA and FACT regulations. There may be various types of Philadelphia Pennsylvania Sample Identity Theft Policies for FCRA and FACT Compliance, tailored to different industries or sectors. For example: 1. Financial Institutions: Banks, credit unions, and other financial organizations implement specific policies to safeguard their customers' sensitive data. These may include strict verification processes, secure online banking systems, and regular employee training on fraud prevention. 2. Healthcare Providers: The healthcare industry stores a vast amount of personal and medical information, making it a prime target for identity theft. Healthcare providers may have policies that address secure data storage, limited access to patient records, and encryption practices protecting patient privacy. 3. Retailers: Retail businesses that handle customer financial information need to have robust identity theft policies. These policies may focus on secure payment transactions, protecting customer credit card information, and training employees on recognizing and reporting suspicious activities. 4. Educational Institutions: Colleges and universities store extensive personal data of students, faculty, and staff. Identity theft policies in educational institutions may include strict access controls to student records, secure online portals, and regular audits to ensure compliance. In conclusion, Philadelphia, Pennsylvania is a city renowned for its history and culture. As such, it is essential for businesses and organizations within the city to have a Philadelphia Pennsylvania Sample Identity Theft Policy for FCRA and FACT Compliance. These policies ensure the protection of consumers' personal information and maintain compliance with federal regulations, regardless of the industry or sector in which they operate.

Philadelphia Pennsylvania Sample Identity Theft Policy for FCRA and FACTA Compliance

Description

How to fill out Philadelphia Pennsylvania Sample Identity Theft Policy For FCRA And FACTA Compliance?

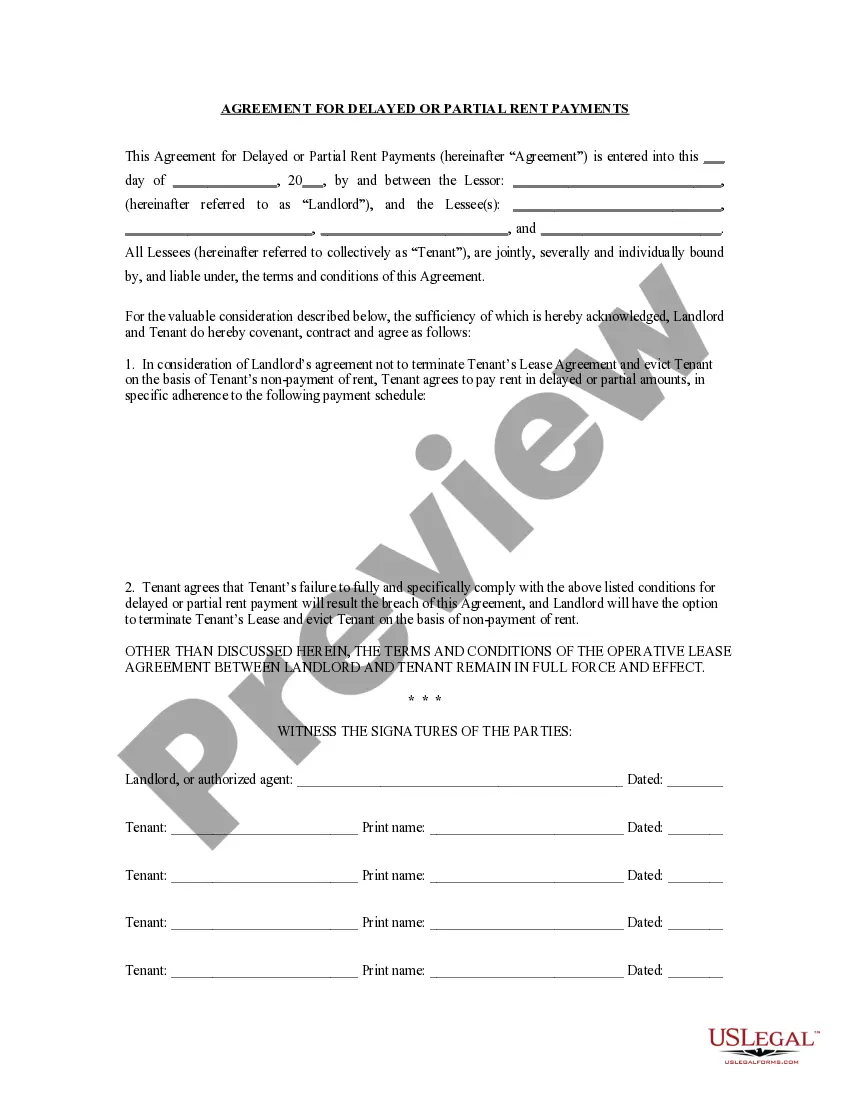

If you need to find a reliable legal form supplier to obtain the Philadelphia Sample Identity Theft Policy for FCRA and FACTA Compliance, consider US Legal Forms. Whether you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed template.

- You can search from over 85,000 forms categorized by state/county and situation.

- The intuitive interface, number of learning materials, and dedicated support team make it easy to get and complete different paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

You can simply type to look for or browse Philadelphia Sample Identity Theft Policy for FCRA and FACTA Compliance, either by a keyword or by the state/county the form is created for. After locating required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the Philadelphia Sample Identity Theft Policy for FCRA and FACTA Compliance template and check the form's preview and description (if available). If you're confident about the template’s language, go ahead and hit Buy now. Create an account and select a subscription plan. The template will be instantly available for download as soon as the payment is completed. Now you can complete the form.

Handling your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our comprehensive variety of legal forms makes this experience less costly and more affordable. Create your first business, arrange your advance care planning, create a real estate contract, or complete the Philadelphia Sample Identity Theft Policy for FCRA and FACTA Compliance - all from the comfort of your home.

Join US Legal Forms now!

Form popularity

FAQ

On average, it can take 100 to 200 hours over six months to undo identity theft. The recovery process may involve working with the three major credit bureaus to request a fraud alert; reviewing your credit reports to pinpoint fraudulent activity; and reporting the theft.

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act.

The Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB) are the two federal agencies charged with overseeing and enforcing the provisions of the act.

The Fair Credit Reporting Act (FCRA) spells out rights for victims of identity theft, as well as responsibilities for businesses. Identity theft victims are entitled to ask businesses for a copy of transaction records such as applications for credit relating to the theft of their identity.

Deter identity thieves by safeguarding your information Shred financial documents before discarding them. Protect your Social Security number. Don't give out personal information unless you're sure who you're dealing with. Don't use obvious passwords. Keep your information secure.

The FCRA and Regulation V generally require a furnisher to conduct a reasonable investigation of a dispute submitted directly to a furnisher by a consumer concerning the accuracy of any information contained in a consumer report and pertaining to an account or other relationship that the furnisher has or had with the

FACTA (Fair and Accurate Credit Transactions Act) is an amendment to FCRA (Fair Credit Reporting Act ) that was added, primarily, to protect consumers from identity theft. The Act stipulates requirements for information privacy, accuracy and disposal and limits the ways consumer information can be shared.

The Fair and Accurate Credit Transactions Act of 2003 (FACTA) added to the FCRA significant provisions designed to prevent identity theft, control the consequences of identity theft to victims' credit records, and help victims cleanse their credit records of identity-theft related information.

Unfortunately, being a victim of identity theft means your credit scores may be negatively impacted. Thieves could open new lines of credit or credit cards in your name -- and fail to pay the bills.

The Red Flags Rule requires that each "financial institution" or "creditor"which includes most securities firmsimplement a written program to detect, prevent and mitigate identity theft in connection with the opening or maintenance of "covered accounts." These include consumer accounts that permit multiple payments