Kings New York Notice To Users Of Consumer Reports — Obligations Of Users Under The FCRA: A Comprehensive Guide The Kings New York Notice To Users Of Consumer Reports — Obligations Of Users Under The FCRA is a vital document that outlines the responsibilities and obligations of users when obtaining and utilizing consumer reports in compliance with the Fair Credit Reporting Act (FCRA). As a user of consumer reports, it is essential to understand your obligations under the FCRA to ensure fair and accurate reporting practices. Kings New York has provided a detailed description of these obligations, which we will delve into below, along with relevant keywords for easy reference. 1. Purpose of FCRA: The FCRA was enacted to promote accuracy, fairness, and privacy of consumer information collected by consumer reporting agencies (Crash). Users of consumer reports, including entities such as employers, landlords, lenders, and insurance companies, must adhere to specific guidelines to protect consumer rights. 2. Permissible Purpose: Users of consumer reports must have a permissible purpose under the FCRA to access consumer information. Examples of permissible purposes include employment screening, tenant screening, credit decision-making, insurance underwriting, and legal proceedings. 3. Certification: Before obtaining a consumer report, users must certify to the CRA that they have a permissible purpose, will use the report for that purpose only, and will comply with the FCRA provisions. This certification acts as a safeguard against unauthorized access and misuse of consumer information. 4. Notice to Consumers: Users have an obligation to provide prior notice to consumers when negative decisions are based on information obtained from a consumer report. The notice should include the name, address, and phone number of the CRA used, along with information about the consumer's right to dispute inaccuracies and obtain a free copy of their consumer report. 5. Adverse Action Notice: If the information within a consumer report leads to an adverse action, such as denying employment, tenancy, or credit, users must provide an Adverse Action Notice to the consumer. This notice should include details of the adverse action, the CRA's contact information, and information on the consumer's right to obtain a free copy of their consumer report within 60 days. 6. Proper Disposal of Information: Users have an obligation to properly dispose of consumer information obtained from reports. This includes burning, pulverizing, or shredding physical documents and taking appropriate measures to destroy electronic records, ensuring consumer privacy is maintained. Other Types of Kings New York Notice To Users Of Consumer Reports — Obligations Of Users Under The FCRA: 1. Notice to Users of Pre-Employment Screening Reports: This specific notice provides detailed obligations and guidelines for employers who utilize consumer reports for employment screening purposes. It covers topics such as obtaining consent, adverse action procedures, and compliance with the FCRA. 2. Notice to Users of Tenant Screening Reports: This notice focuses on the obligations and responsibilities of landlords and property managers who use consumer reports for tenant screening purposes. It covers areas such as obtaining consent, tenant denial processes, and adherence to the FCRA regulations. In conclusion, the Kings New York Notice To Users Of Consumer Reports — Obligations Of Users Under The FCRA is a crucial document that outlines user obligations, ensuring compliance with the FCRA and protection of consumer rights. Understanding these obligations is vital for every user of consumer reports to maintain fair and accurate reporting practices.

Kings New York Notice To Users Of Consumer Reports - Obligations Of Users Under The FCRA

Description

How to fill out Kings New York Notice To Users Of Consumer Reports - Obligations Of Users Under The FCRA?

Drafting documents for the business or personal needs is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state regulations of the particular area. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to create Kings Notice To Users Of Consumer Reports - Obligations Of Users Under The FCRA without expert help.

It's easy to avoid wasting money on attorneys drafting your paperwork and create a legally valid Kings Notice To Users Of Consumer Reports - Obligations Of Users Under The FCRA by yourself, using the US Legal Forms online library. It is the largest online catalog of state-specific legal templates that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

If you still don't have a subscription, adhere to the step-by-step guide below to get the Kings Notice To Users Of Consumer Reports - Obligations Of Users Under The FCRA:

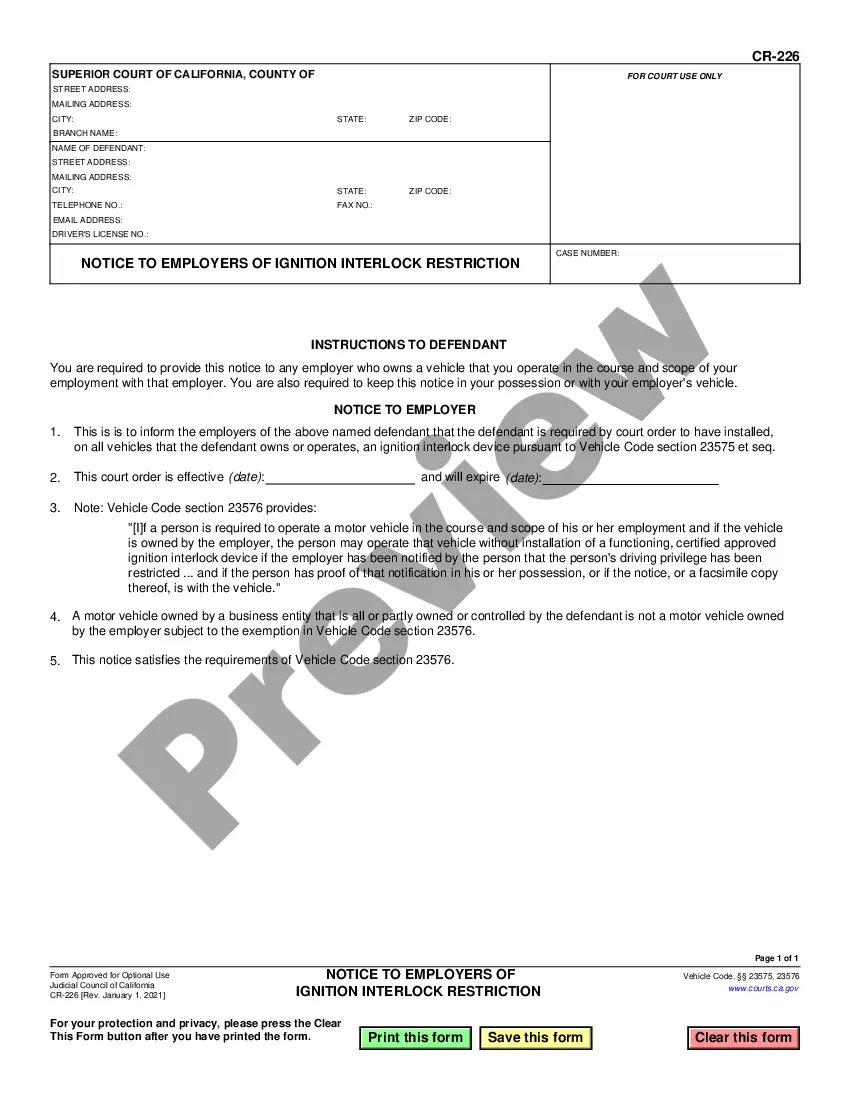

- Look through the page you've opened and verify if it has the document you require.

- To do so, use the form description and preview if these options are presented.

- To find the one that fits your needs, use the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal templates for any situation with just a few clicks!