Montgomery Maryland Notice To Users Of Consumer Reports - Obligations Of Users Under The FCRA

Description

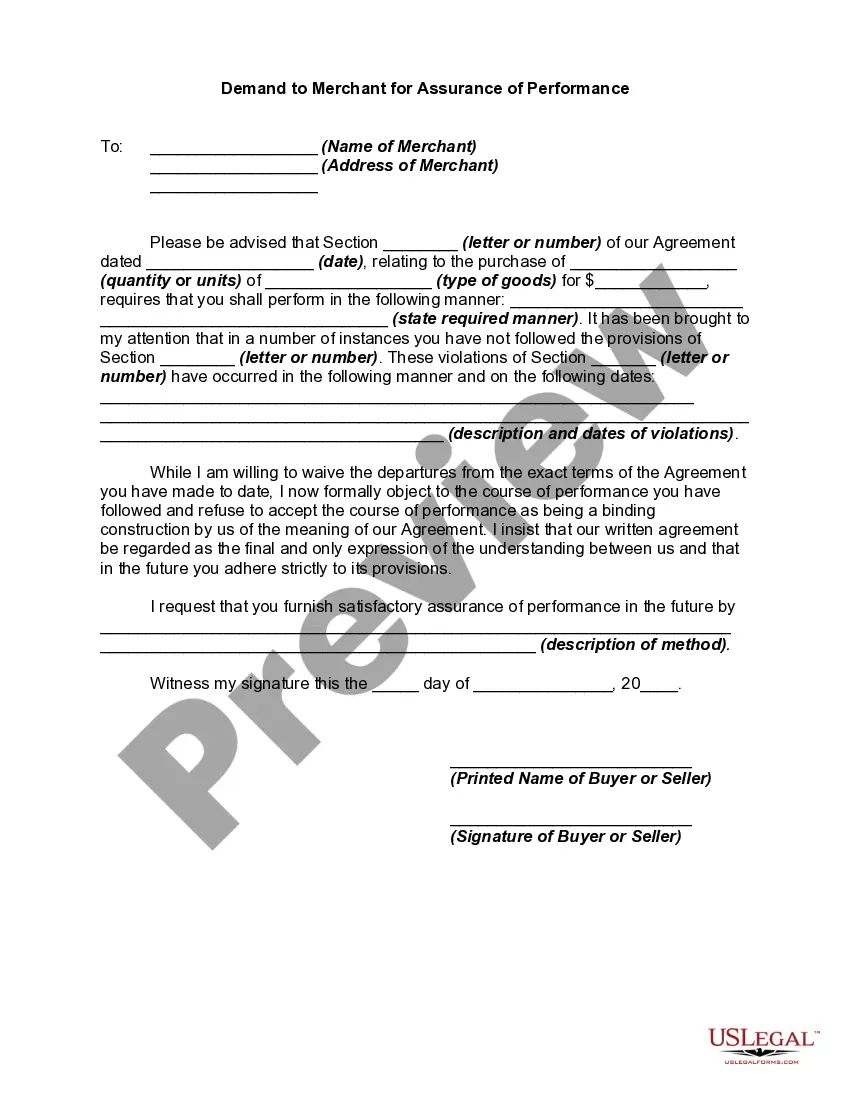

provided to inform users of consumer reports of their legal obligations. The first section of this summary sets forth the responsibilities imposed by the FCRA on all users of consumer reports. The subsequent sections discuss the duties of users of reports that contain specific types of information, or that are used for certain purposes, and the legal consequences of violations.

How to fill out Montgomery Maryland Notice To Users Of Consumer Reports - Obligations Of Users Under The FCRA?

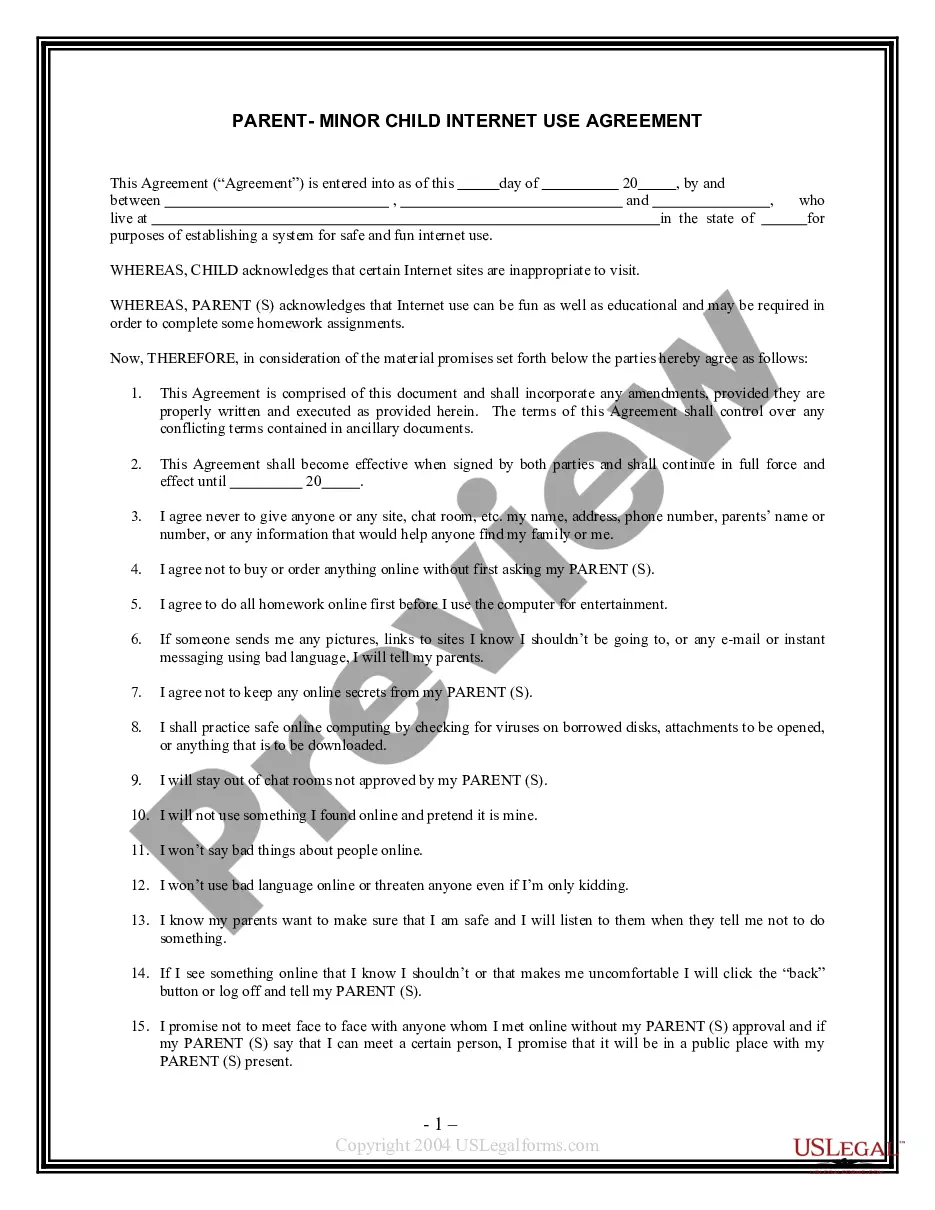

Creating paperwork, like Montgomery Notice To Users Of Consumer Reports - Obligations Of Users Under The FCRA, to manage your legal matters is a challenging and time-consumming process. A lot of circumstances require an attorney’s involvement, which also makes this task not really affordable. However, you can get your legal issues into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal forms created for different cases and life circumstances. We make sure each form is in adherence with the laws of each state, so you don’t have to worry about potential legal issues associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how effortless it is to get the Montgomery Notice To Users Of Consumer Reports - Obligations Of Users Under The FCRA template. Simply log in to your account, download the template, and personalize it to your requirements. Have you lost your form? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is fairly easy! Here’s what you need to do before downloading Montgomery Notice To Users Of Consumer Reports - Obligations Of Users Under The FCRA:

- Make sure that your document is specific to your state/county since the regulations for writing legal papers may differ from one state another.

- Find out more about the form by previewing it or reading a brief intro. If the Montgomery Notice To Users Of Consumer Reports - Obligations Of Users Under The FCRA isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or create an account to start using our website and get the document.

- Everything looks good on your side? Hit the Buy now button and select the subscription plan.

- Select the payment gateway and type in your payment details.

- Your template is ready to go. You can try and download it.

It’s an easy task to find and buy the appropriate document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!

Form popularity

FAQ

The FCRA is chiefly concerned with the way credit reporting agencies use the information they receive regarding your credit history. The law is intended to protect consumers from misinformation being used against them.

The credit score exception notice (model forms H-3, H-4, H-5) is a disclosure that is provided in lieu of the risk-based-pricing notice (RBPN, which are H-1, H-2, H-6 & H-7). The RBPN is required any time a financial institution provides different rates based on the credit score of the applicant.

A creditor must disclose a consumer's credit score and information relating to a credit score on a risk-based pricing notice when the score of the consumer to whom the creditor extends credit or whose extension of credit is under review is used in setting the material terms of credit.

If you report information about consumers to a CRA like a credit bureau, tenant screening company, check verification service, or a medical information service you have legal obligations under the FCRA's Furnisher Rule.

The FCRA is not a strict liability statute. An inaccurate consumer report therefore does not automatically result in liability. Instead, the FCRA imposes civil liability for negligent and willful failures to comply with its requirements (15 U.S.C. §§ 1681n, 1681o).

Under the FCRA, consumer reporting agencies are required to provide consumers with the information in their own file upon request, and consumer reporting agencies are not allowed to share information with third parties unless there is a permissible purpose.

The term negative information means information concerning a customer's delinquencies, late payments, insolvency, or any form of default. Timing of Notice. The financial institution must provide the notice to the customer no later than 30 days after furnishing the negative information to a CRA.

Thus, under the FCRA, certain consumer information will be subject to two opt-out notices, a sharing opt-out notice (Section 603(d)) and a marketing use opt-out notice (Section 624). These two opt-out notices may be consolidated.

The FCRA gives you the right to be told if information in your credit file is used against you to deny your application for credit, employment or insurance. The FCRA also gives you the right to request and access all the information a consumer reporting agency has about you (this is called "file disclosure").

The FCRA requires any prospective user of a consumer report, for example, a lender, insurer, landlord, or employer, among others, to have a legally permissible purpose to obtain a report.