Fulton County, Georgia: An Overview of the FACT Red Flags Rule Fulton County, Georgia is a vibrant and populous area located in the state of Georgia, with its county seat in the city of Atlanta. Known for its bustling cities, rich history, and diverse culture, Fulton County is a hub of economic activity and serves as a prime location for businesses and residents alike. The FACT Red Flags Rule, also known as the Fair and Accurate Credit Transactions Act, is a federal regulation established by the Federal Trade Commission (FTC) to combat identity theft and protect consumers from fraudulent activities. This vital legislation requires certain businesses and organizations, including financial institutions and creditors, to develop and implement identity theft prevention programs. In Fulton County, like elsewhere across the United States, businesses and organizations are required to comply with the FACT Red Flags Rule. This rule obligates them to identify, detect, and respond appropriately to any red flags that may indicate identity theft or fraudulent activity. By doing so, businesses can help safeguard their customers' personal information and prevent potential financial losses. There are different types of businesses and organizations in Fulton County that must adhere to the FACT Red Flags Rule. Some examples include: 1. Financial Institutions: Banks, credit unions, and other financial institutions operating in Fulton County must develop comprehensive identity theft prevention programs to comply with the FACT Red Flags Rule. These programs typically involve the identification of potential red flags, employee training, detection and response procedures, and regular program updates. 2. Creditors: Mortgage lenders, auto finance companies, credit card issuers, and other types of creditors in Fulton County are also required to comply with the FACT Red Flags Rule. These businesses must develop programs that specifically address the red flags related to their industry, such as suspicious activity involving loan applications, credit card transactions, or account access. 3. Healthcare Providers: Medical facilities, hospitals, and healthcare providers in Fulton County often handle sensitive patient information, making them potential targets for identity theft. Therefore, these entities must also develop identity theft prevention programs to comply with the FACT Red Flags Rule. Their programs should focus on protecting patient records and detecting any signs of unauthorized access or fraudulent activity. Overall, the FACT Red Flags Rule has been instrumental in improving identity theft prevention efforts in Fulton County and beyond. By requiring businesses and organizations to be vigilant in identifying red flags and taking appropriate measures, consumers can have greater peace of mind when engaging with financial services, obtaining credit, or seeking healthcare treatment in Fulton County, Georgia.

Fulton Georgia The FACTA Red Flags Rule: A Primer

Description

How to fill out Fulton Georgia The FACTA Red Flags Rule: A Primer?

Whether you plan to start your business, enter into a contract, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare certain documentation meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business occasion. All files are grouped by state and area of use, so opting for a copy like Fulton The FACTA Red Flags Rule: A Primer is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a few more steps to get the Fulton The FACTA Red Flags Rule: A Primer. Adhere to the guidelines below:

- Make sure the sample fulfills your personal needs and state law regulations.

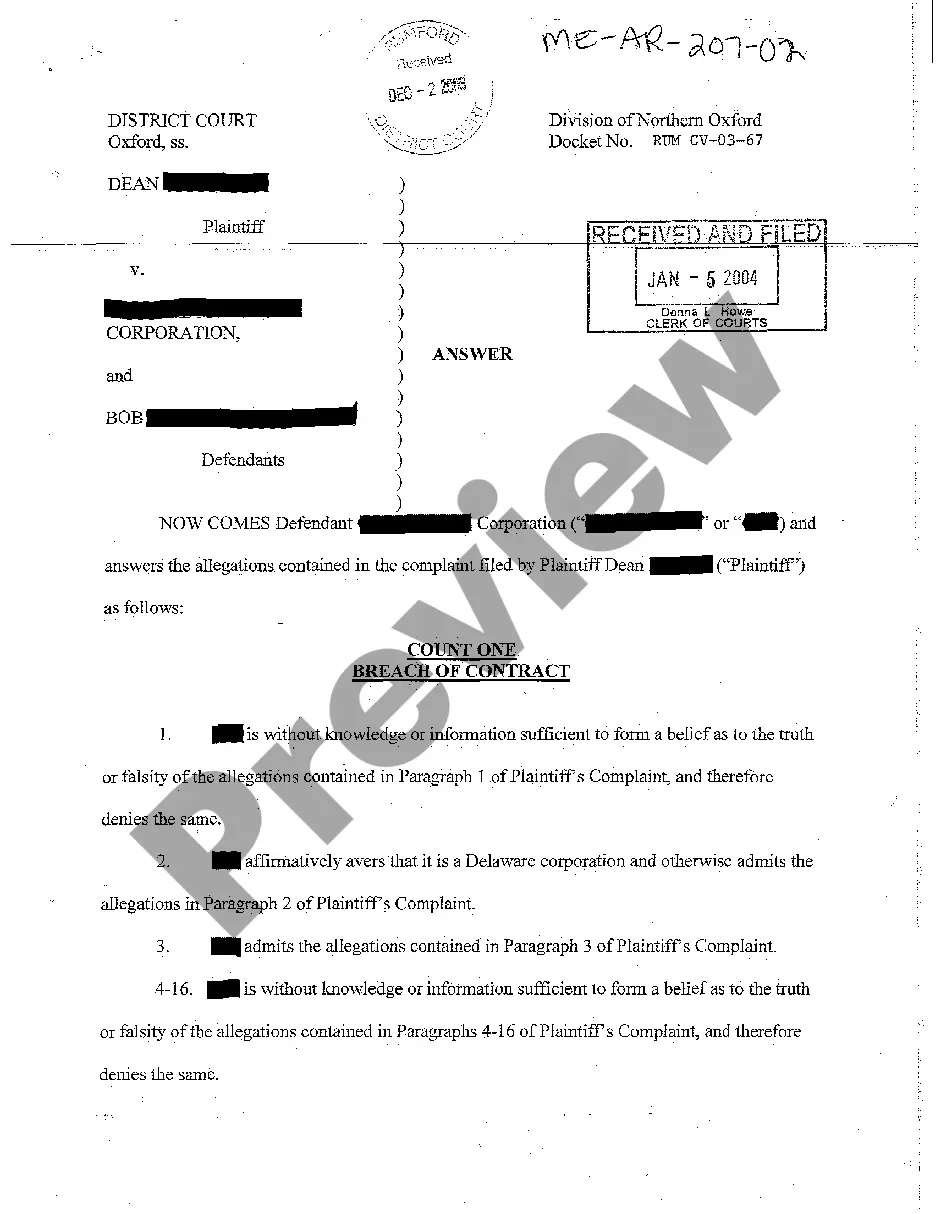

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to obtain the file when you find the correct one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Fulton The FACTA Red Flags Rule: A Primer in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you are able to access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!