Houston, Texas: The FACT Red Flags Rule: A Primer The FACT Red Flags Rule is a legislation implemented in the United States to combat identity theft and protect consumers' personal information. This article will provide a detailed description of what the FACT Red Flags Rule entails, specifically focusing on its impact in Houston, Texas. Keywords: Houston, Texas, FACT Red Flags Rule, legislation, identity theft, personal information, consumer protection 1. Overview of the FACT Red Flags Rule: The FACT Red Flags Rule was introduced as part of the Fair and Accurate Credit Transactions Act (FACT) in 2003. Its primary purpose is to reduce the risk of identity theft by requiring certain businesses to implement an identity theft prevention program. 2. Identifying Red Flags: Under the rule, businesses in Houston, Texas, need to identify potential red flags or suspicious activities that may indicate identity theft. These include but are not limited to: suspicious documents, unusual account activity, alerts from credit reporting agencies, or mismatched information during the verification process. 3. Developing an Identity Theft Prevention Program (IPP): The FACT Red Flags Rule mandates covered businesses to develop and implement an Identity Theft Prevention Program (IPP) tailored to their specific needs. In Houston, this applies to financial institutions, creditors, and other entities that regularly deal with consumer accounts or personal information. 4. Key Components of an IPP: Houston-based businesses are required to include specific components in their IPP. This typically involves creating policies for identifying, detecting, and responding to red flags, training staff members to implement the program, regularly updating the program, and overseeing its effectiveness through proper administration. 5. Compliance and Penalties: Non-compliance with the FACT Red Flags Rule can lead to serious consequences for businesses operating in Houston, Texas. Violations may result in reputational damage, costly fines, legal actions, and potential loss of consumer trust. 6. Exceptions to the Rule: While the FACT Red Flags Rule generally applies to financial institutions and creditors, it is essential to understand that certain entities and industries may be exempt or subject to modified requirements in Houston, Texas. This can include businesses that have implemented alternative identity theft prevention programs or those offering minimal risk to consumers' personal information. Different Types of Houston Texas The FACT Red Flags Rule: A Primer: 1. Houston Financial Institutions and the FACT Red Flags Rule: Focuses on the specific impact of the FACT Red Flags Rule on banks, credit unions, mortgage lenders, and other financial institutions operating in Houston, Texas. 2. Compliance for Houston Creditors: Explores how the FACT Red Flags Rule affects creditors in Houston, including retailers, healthcare providers, and telecommunications companies, and how they can ensure compliance with the legislation. 3. FACT Red Flags Rule and Consumer Awareness in Houston: Examines the role of consumer awareness and education in Houston, Texas, regarding the FACT Red Flags Rule. Highlights the importance of understanding red flags, reporting suspicious activities, and protecting personal information. 4. Implementing an Effective Identity Theft Prevention Program in Houston: Provides detailed guidance on developing and implementing an Identity Theft Prevention Program (IPP) compliant with the FACT Red Flags Rule for businesses in Houston, Texas.

Houston Texas The FACTA Red Flags Rule: A Primer

Description

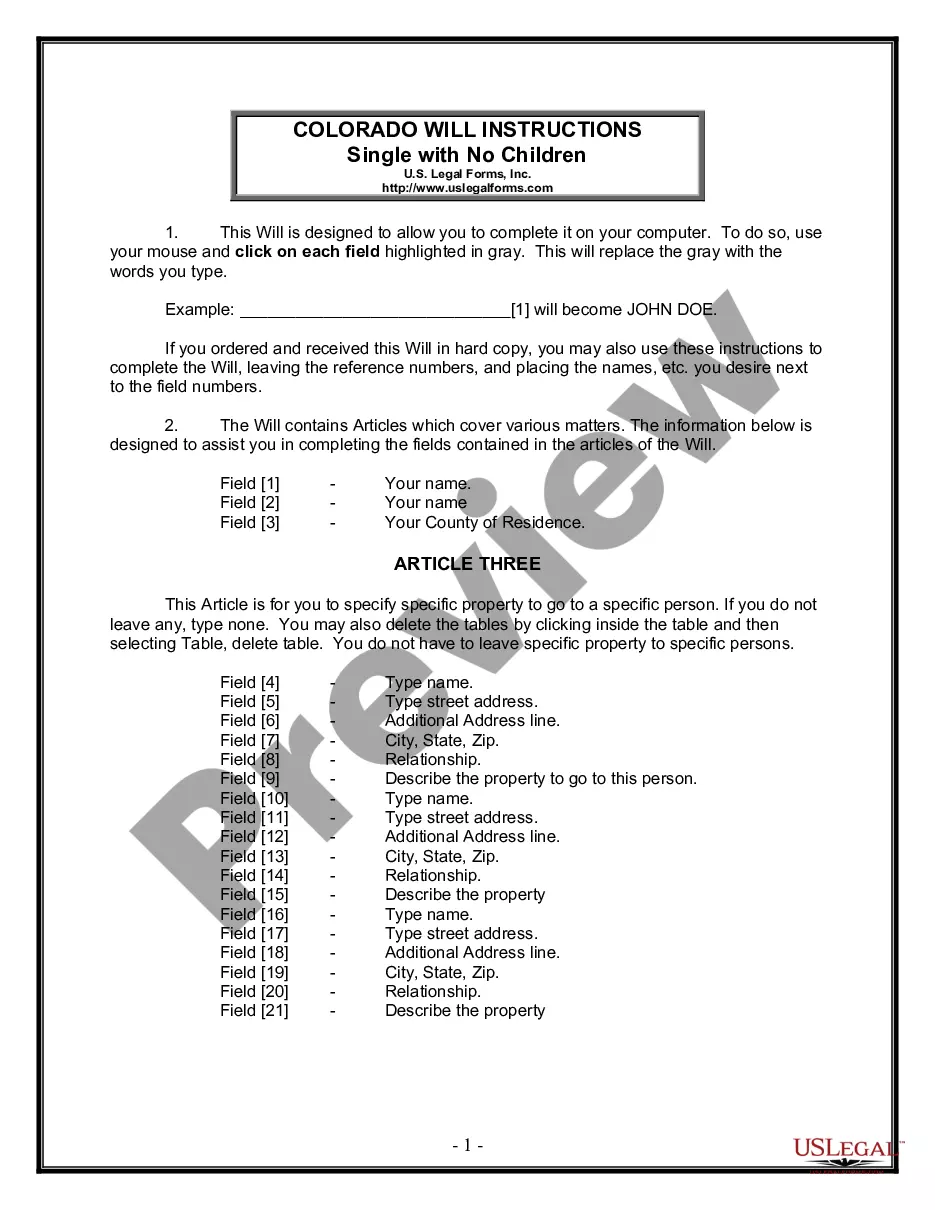

How to fill out Houston Texas The FACTA Red Flags Rule: A Primer?

If you need to get a reliable legal document supplier to obtain the Houston The FACTA Red Flags Rule: A Primer, consider US Legal Forms. Whether you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate form.

- You can search from over 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, variety of learning resources, and dedicated support make it easy to get and complete various documents.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

Simply select to look for or browse Houston The FACTA Red Flags Rule: A Primer, either by a keyword or by the state/county the form is intended for. After finding the necessary form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to start! Simply locate the Houston The FACTA Red Flags Rule: A Primer template and take a look at the form's preview and description (if available). If you're confident about the template’s terminology, go ahead and click Buy now. Create an account and select a subscription plan. The template will be instantly available for download once the payment is processed. Now you can complete the form.

Taking care of your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive collection of legal forms makes these tasks less costly and more reasonably priced. Set up your first company, arrange your advance care planning, draft a real estate contract, or execute the Houston The FACTA Red Flags Rule: A Primer - all from the convenience of your sofa.

Join US Legal Forms now!

Form popularity

FAQ

The program has four elements: 1) Identify Relevant Red Flags. 2) Detect Red Flags. 3) Prevent and Mitigate Identity Theft. 4) Update Program.

The Foreign Account Tax Compliance Act (FATCA), which was passed as part of the HIRE Act, generally requires that foreign financial Institutions and certain other non-financial foreign entities report on the foreign assets held by their U.S. account holders or be subject to withholding on withholdable payments.

Presentation of suspicious documents or identifying information. Unusual or suspicious account activity. Notices from customers, victims or law enforcement agencies.

History. The Red Flags Rule was based on section 114 and 315 of the Fair and Accurate Credit Transactions Act of 2003 (FACTA).

Report of fraud accompanying a credit report; 2. Notice from a credit agency of a credit freeze; 3. Notice from a credit agency of an ?active duty alert?; 4. Receipt of address discrepancy in response to a credit report request; and 5.

Warnings, alerts, alarms or notifications from a consumer reporting agency. Suspicious documents. Unusual use of, or suspicious activity related to, a covered account. Suspicious personally identifying information, such as a suspicious inconsistency with a last name or address.

The Red Flags Rule seeks to prevent identity theft, too, by ensuring that your business or organization is on the lookout for the signs that a crook is using someone else's information, typically to get products or services from you without paying for them.

The Red Flags Rule requires specified firms to create a written Identity Theft Prevention Program (ITPP) designed to identify, detect and respond to ?red flags??patterns, practices or specific activities?that could indicate identity theft.

The Red Flag Rule issued by the Federal Trade Commission (?FTC?) under the Fair and Accurate Credit Transaction (FACT) Act of 2003 requires that all creditors, including utilities and telecommunications companies, develop and implement a written identity theft prevention program.