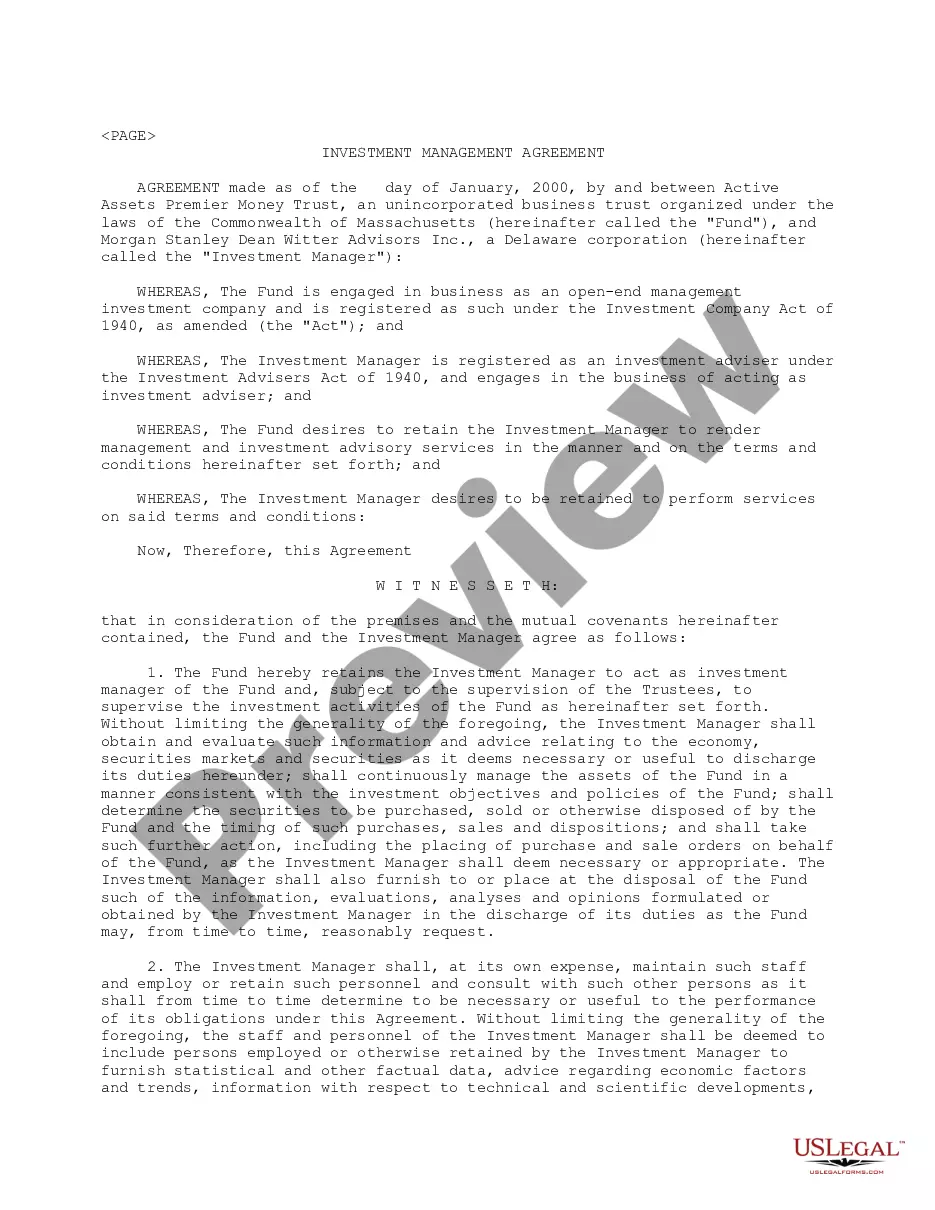

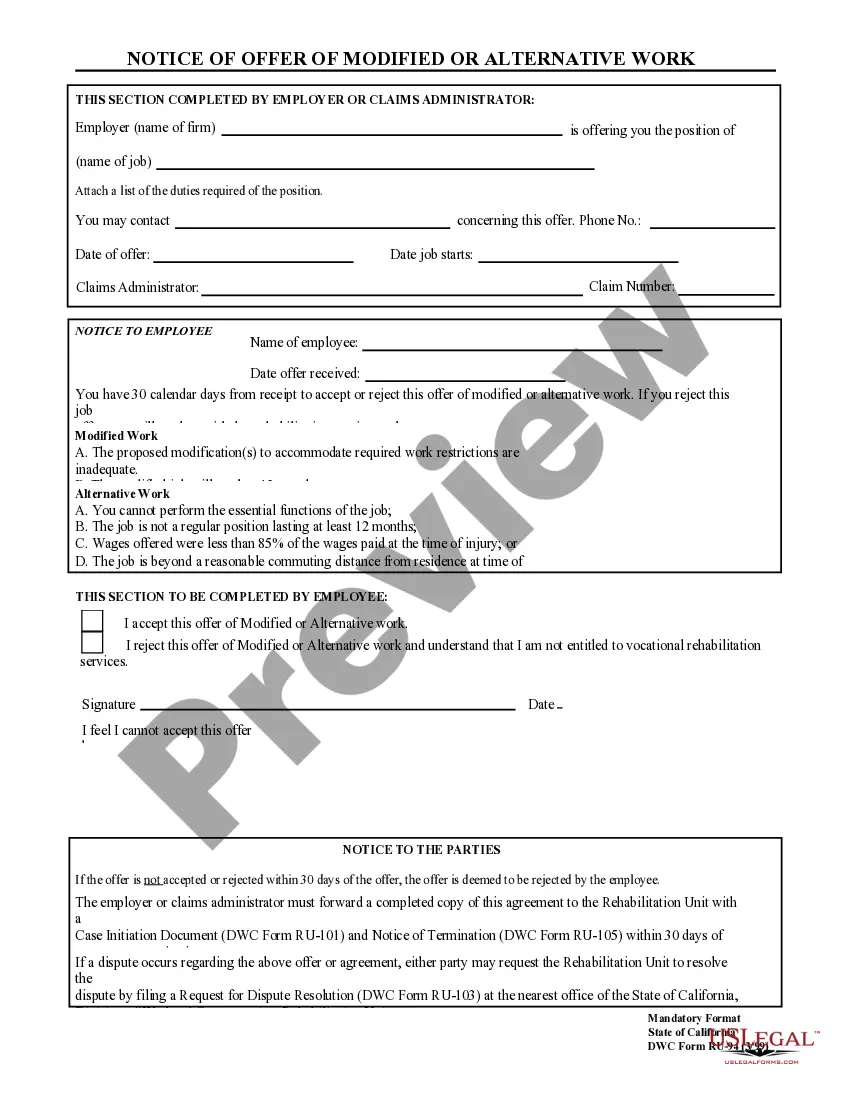

Los Angeles, California — ThFACTTA Red Flags Rule: A Primer Los Angeles, California is a vibrant and diverse city located in the southern part of the state. Known for its sunny weather, beautiful beaches, and thriving entertainment industry, Los Angeles attracts millions of visitors each year. But amidst the glamour and allure, it's important to be aware of certain regulations that businesses and individuals in Los Angeles must adhere to, such as the FACT Red Flags Rule. The FACT Red Flags Rule is a federal regulation implemented by the Federal Trade Commission (FTC) to combat identity theft and protect consumers. It requires businesses and organizations that have "covered accounts" to develop and implement a written Identity Theft Prevention Program (IPP) to detect, prevent, and mitigate identity theft. In Los Angeles, numerous types of entities may fall under the realm of the FACT Red Flags Rule, including: 1. Financial Institutions: Banks, credit unions, and other financial institutions operating in Los Angeles must comply with the FACT Red Flags Rule due to their involvement in providing financial services and holding customer accounts. 2. Health Care Facilities: Hospitals, clinics, and other health care facilities in Los Angeles that maintain patients' medical records and personal information are considered "creditors" under the FACT Red Flags Rule. 3. Utility Companies: Public utilities, such as electric, gas, and water companies, that handle customers' personal and financial information are also subject to the regulations outlined in the FACT Red Flags Rule. 4. Creditors: Any business or organization in Los Angeles that regularly extends or arranges credit or loans (including mortgage lenders, auto dealerships, and retailers) may be classified as a creditor and must comply with the FACT Red Flags Rule. To comply with the FACT Red Flags Rule, businesses in Los Angeles must establish policies and procedures to identify potential identity theft red flags, detect suspicious patterns and activities, respond appropriately to detected red flags, and update their prevention program as necessary. This involves implementing measures such as verifying customer identities, monitoring accounts for suspicious activities, and training employees to be vigilant in detecting and reporting potential identity theft. In conclusion, Los Angeles, California is not only a bustling city known for its glitz and glamour but also a place where businesses must comply with federal regulations like the FACT Red Flags Rule. By understanding and adhering to these rules, businesses and organizations in Los Angeles can contribute to a more secure environment, protecting both themselves and the consumers they serve from the threat of identity theft.

Los Angeles California The FACTA Red Flags Rule: A Primer

Description

How to fill out Los Angeles California The FACTA Red Flags Rule: A Primer?

How much time does it typically take you to create a legal document? Since every state has its laws and regulations for every life scenario, finding a Los Angeles The FACTA Red Flags Rule: A Primer meeting all local requirements can be tiring, and ordering it from a professional attorney is often costly. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online catalog of templates, collected by states and areas of use. In addition to the Los Angeles The FACTA Red Flags Rule: A Primer, here you can get any specific form to run your business or personal affairs, complying with your county requirements. Specialists verify all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can retain the document in your profile at any moment later on. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Los Angeles The FACTA Red Flags Rule: A Primer:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Los Angeles The FACTA Red Flags Rule: A Primer.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

The Red Flags Rule requires financial institutions (and some other organizations) to establish and implement a written Identity Theft Prevention Program (ITPP) designed to detect, prevent and mitigate identity theft in connection with their covered accounts.

The SEC's identity theft red flags rules apply to SEC-regulated entities that qualify as financial institutions or creditors under FCRA and require those financial institutions and creditors that maintain covered accounts to adopt identity theft programs.

Red Flag Requirements Initial Risk Assessment Policies and Procedures Manual Train Staff on Program Implementation New Account Authentication. (All consumer accounts) Validate Change of Address Requests. (All consumer accounts) Anti-Phishing Program Identity Theft Protection. (All consumer accounts)

The Five Categories of Red Flags Warnings, alerts, alarms or notifications from a consumer reporting agency. Suspicious documents. Unusual use of, or suspicious activity related to, a covered account. Suspicious personally identifying information, such as a suspicious inconsistency with a last name or address.

The Red Flags Rule requires that each "financial institution" or "creditor"which includes most securities firmsimplement a written program to detect, prevent and mitigate identity theft in connection with the opening or maintenance of "covered accounts." These include consumer accounts that permit multiple payments

The Red Flags Rule requires specified firms to create a written Identity Theft Prevention Program (ITPP) designed to identify, detect and respond to red flagspatterns, practices or specific activitiesthat could indicate identity theft.

The Red Flags Rule calls for financial institutions and creditors to implement red flags to detect and prevent against identity theft. Institutions are required to have a written identity theft prevention program (ITPP) to govern their organization and protect their consumers.

The Red Flags Rule requires financial institutions (and some other organizations) to establish and implement a written Identity Theft Prevention Program (ITPP) designed to detect, prevent and mitigate identity theft in connection with their covered accounts.

The Five Categories of Red Flags Warnings, alerts, alarms or notifications from a consumer reporting agency. Suspicious documents. Unusual use of, or suspicious activity related to, a covered account. Suspicious personally identifying information, such as a suspicious inconsistency with a last name or address.