Phoenix, Arizona: The FACT Red Flags Rule — A Comprehensive Primer In Phoenix, Arizona, the FACT Red Flags Rule serves as a crucial framework for various industries to combat identity theft and fraudulent activities. Understanding the intricacies of this rule is vital not only for businesses but also for individuals residing in the vibrant city of Phoenix. This detailed description will provide a comprehensive overview of what the FACT Red Flags Rule is, its significance, and its impact on different sectors of Phoenix, Arizona. The FACT Red Flags Rule, issued by the Federal Trade Commission (FTC) under the Fair and Accurate Credit Transactions Act (FACT), requires businesses and organizations that fall under its purview to establish and implement a written identity theft prevention program. Its primary aim is to detect, prevent, and mitigate identity theft by identifying "red flags" or suspicious patterns that may indicate potential persona non grata activities. This rule is particularly relevant in Phoenix, known for its thriving economy, diverse sectors, and a population of over 1.7 million residents. Various industries within the city, including finance, healthcare, retail, telecommunications, and education, are required to adopt the FACT Red Flags Rule to safeguard their clients' personal information and protect against identity theft. The FACT Red Flags Rule entails a three-step process that assists businesses in developing a robust prevention program. First, the identification of potential red flags tailored to each industry is critical. This may involve scrutinizing certain activities like suspicious account openings, unauthorized access attempts, address inconsistencies, or the use of unverified identification documents. Secondly, organizations must detect these red flags by implementing appropriate procedures. This may include training employees to recognize and report any suspicious activities, utilizing technology to monitor account activities for unusual patterns, or implementing multi-factor authentication systems to verify the identity of customers or clients. Finally, businesses must respond adequately to any identified red flags to prevent or mitigate potential identity theft. This may involve notifying affected individuals, freezing accounts or transactions, contacting law enforcement agencies, or taking any necessary steps to minimize the risk of fraudulent activities. While the general principles of the FACT Red Flags Rule apply across industries in Phoenix, Arizona, some sectors may have specific variations or requirements. For example, financial institutions in Phoenix must comply with the Red Flags Rule to protect customers' financial information and adhere to industry-specific guidelines set forth by regulatory bodies such as the Office of the Comptroller of the Currency, the Federal Reserve, and the Consumer Financial Protection Bureau. In healthcare, the FACT Red Flags Rule becomes even more vital due to the sensitivity of patient data. Healthcare providers in Phoenix must ensure compliance with the Health Insurance Portability and Accountability Act (HIPAA) and the Red Flags Rule to safeguard patient privacy and prevent medical identity theft. In conclusion, the FACT Red Flags Rule is an essential framework that plays a significant role in Phoenix, Arizona, across various sectors. Its implementation ensures the protection of personal information, minimizes the risk of identity theft, and fosters trust between businesses and their clients. Adhering to this rule not only benefits organizations but also contributes to a more secure and trustworthy environment for the residents of Phoenix.

Phoenix Arizona The FACTA Red Flags Rule: A Primer

Description

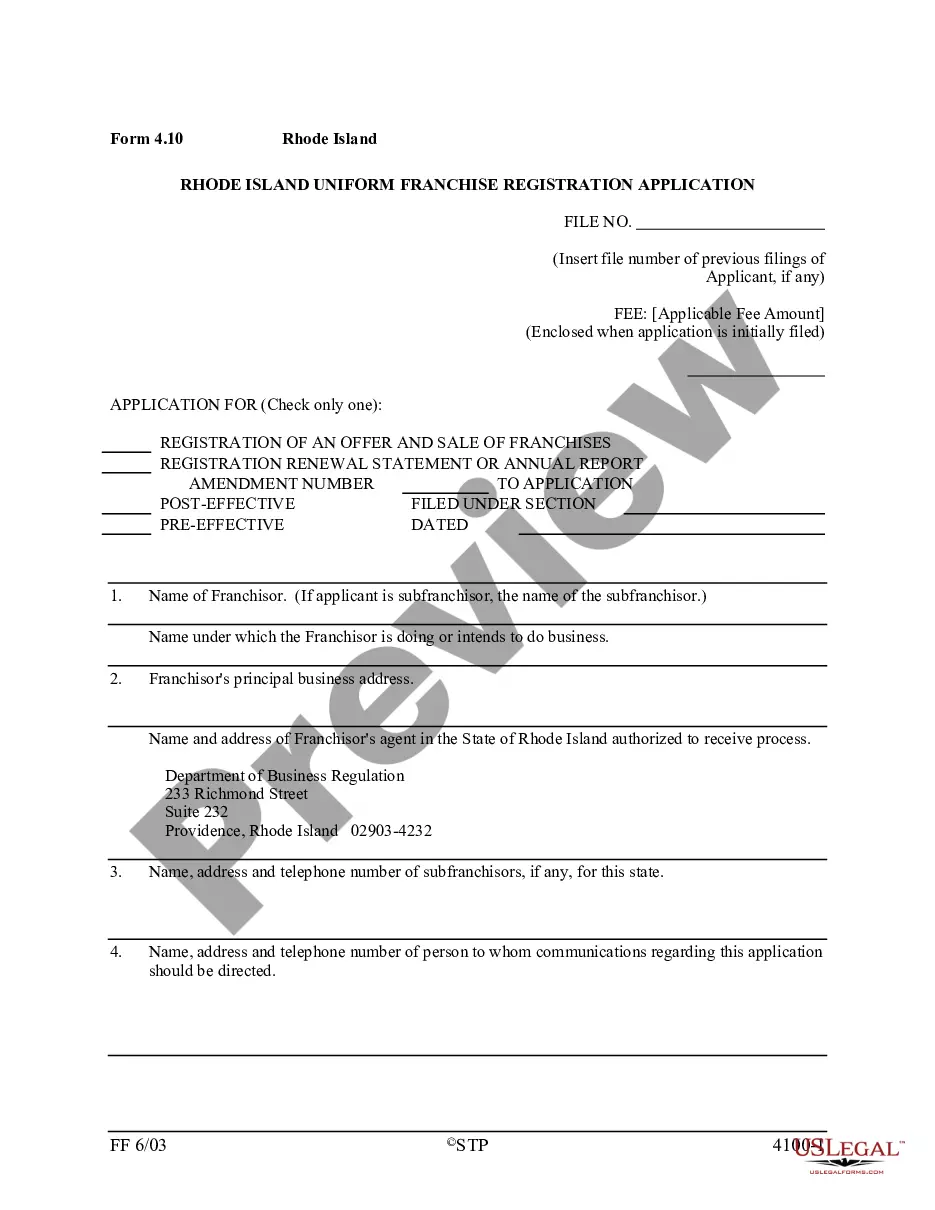

How to fill out Phoenix Arizona The FACTA Red Flags Rule: A Primer?

Whether you plan to open your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific documentation corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business occurrence. All files are collected by state and area of use, so picking a copy like Phoenix The FACTA Red Flags Rule: A Primer is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a few more steps to get the Phoenix The FACTA Red Flags Rule: A Primer. Follow the guide below:

- Make certain the sample fulfills your personal needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to obtain the sample once you find the correct one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Phoenix The FACTA Red Flags Rule: A Primer in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you can access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!