Suffolk New York is a county located on Long Island in the state of New York, United States. It is known for its scenic landscapes, vibrant communities, and rich history. With a population of over 1.5 million residents, Suffolk County offers a diverse mix of suburban and rural areas. One important aspect to consider in the context of Suffolk New York is The FACT Red Flags Rule, known as the Red Flags Rule. This rule was implemented by the Federal Trade Commission (FTC) to protect consumers and businesses from identity theft. The Red Flags Rule requires certain businesses, including financial institutions and creditors, to develop and implement a written program to detect, prevent, and mitigate identity theft. The purpose of the Red Flags Rule is to ensure that businesses are proactive in identifying potential warning signs or red flags of identity theft. These red flags may include suspicious account activities, discrepancies in personal information provided by customers, or notifications from credit reporting agencies. Businesses subject to the Red Flags Rule in Suffolk New York, and elsewhere in the United States, must create a comprehensive identity theft prevention program. This program should outline the steps, procedures, and protocols that the business will follow when identifying, responding to, and mitigating identity theft risks. While the Red Flags Rule applies across industries, certain sectors in Suffolk New York might have additional considerations or specific guidelines to follow. For example, healthcare providers in Suffolk County need to comply with the Health Insurance Portability and Accountability Act (HIPAA) in addition to the Red Flags Rule. In conclusion, Suffolk New York is a county known for its picturesque landscapes and thriving communities. The FACT Red Flags Rule plays a critical role in protecting consumers and businesses from identity theft. Implementing a robust identity theft prevention program is essential for businesses operating in Suffolk County to comply with federal regulations and safeguard their customers' information.

Suffolk New York The FACTA Red Flags Rule: A Primer

Description

How to fill out Suffolk New York The FACTA Red Flags Rule: A Primer?

Preparing documents for the business or personal demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to consider all federal and state laws of the particular region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to draft Suffolk The FACTA Red Flags Rule: A Primer without professional help.

It's possible to avoid spending money on lawyers drafting your paperwork and create a legally valid Suffolk The FACTA Red Flags Rule: A Primer on your own, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

In case you still don't have a subscription, follow the step-by-step guide below to get the Suffolk The FACTA Red Flags Rule: A Primer:

- Examine the page you've opened and verify if it has the document you require.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that satisfies your requirements, utilize the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any use case with just a couple of clicks!

Form popularity

FAQ

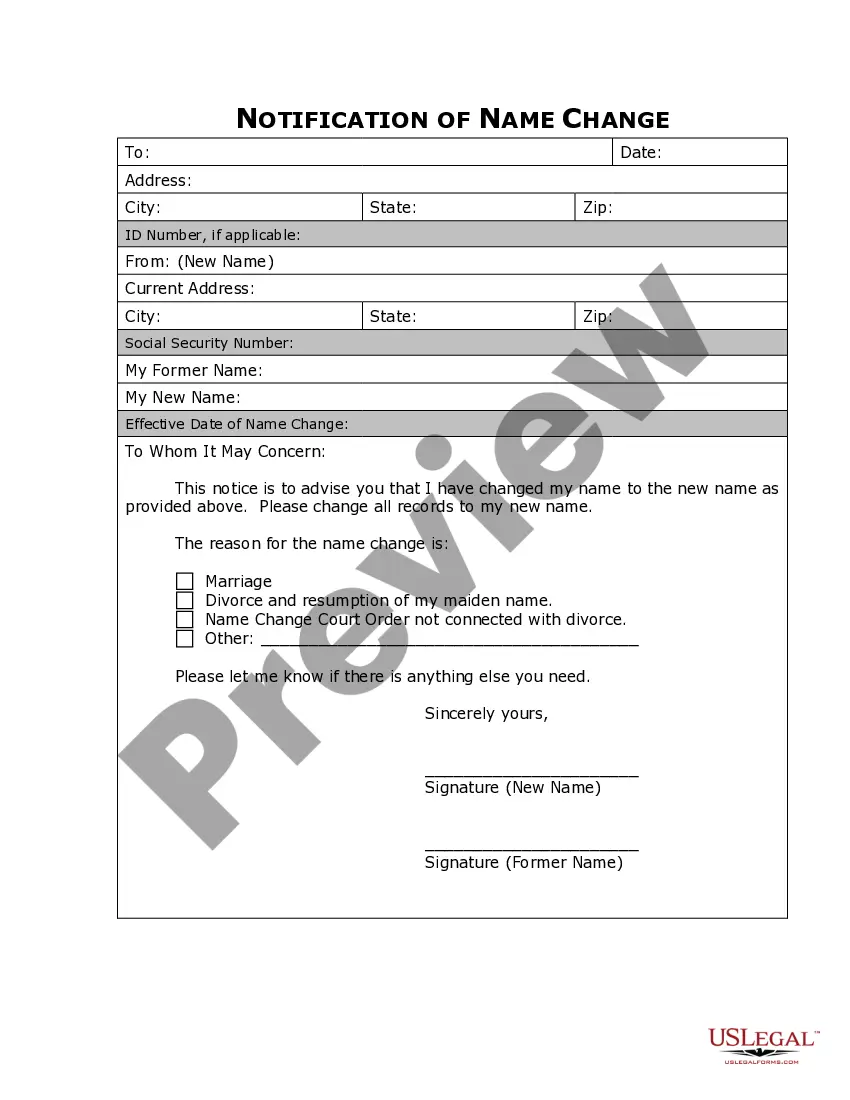

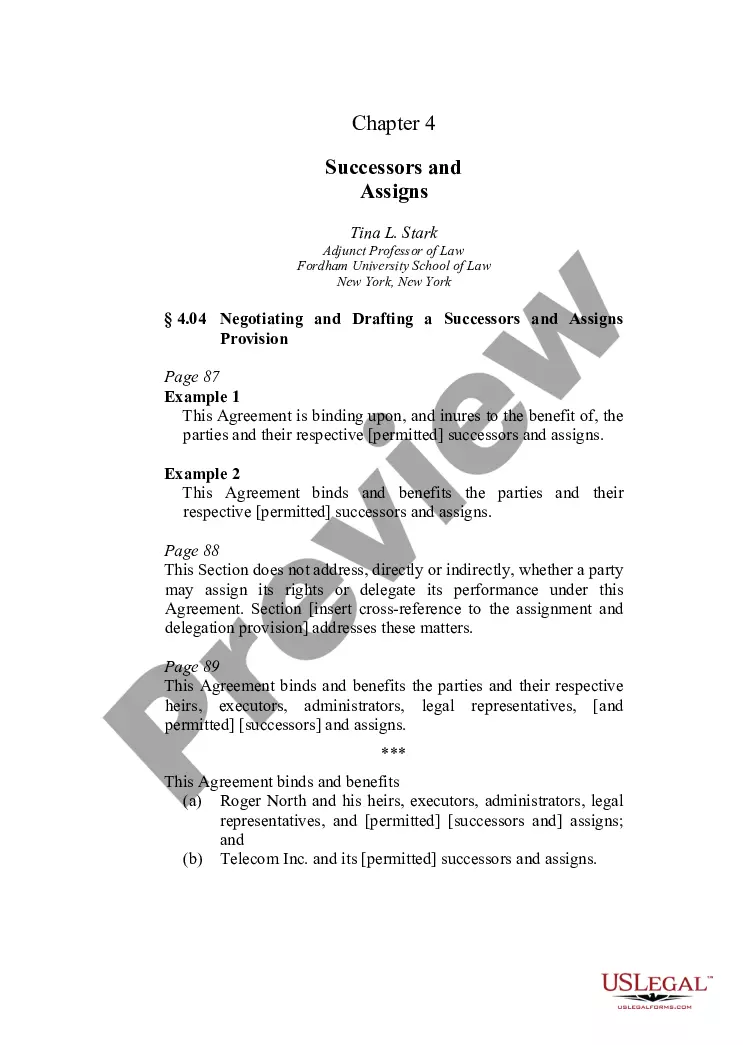

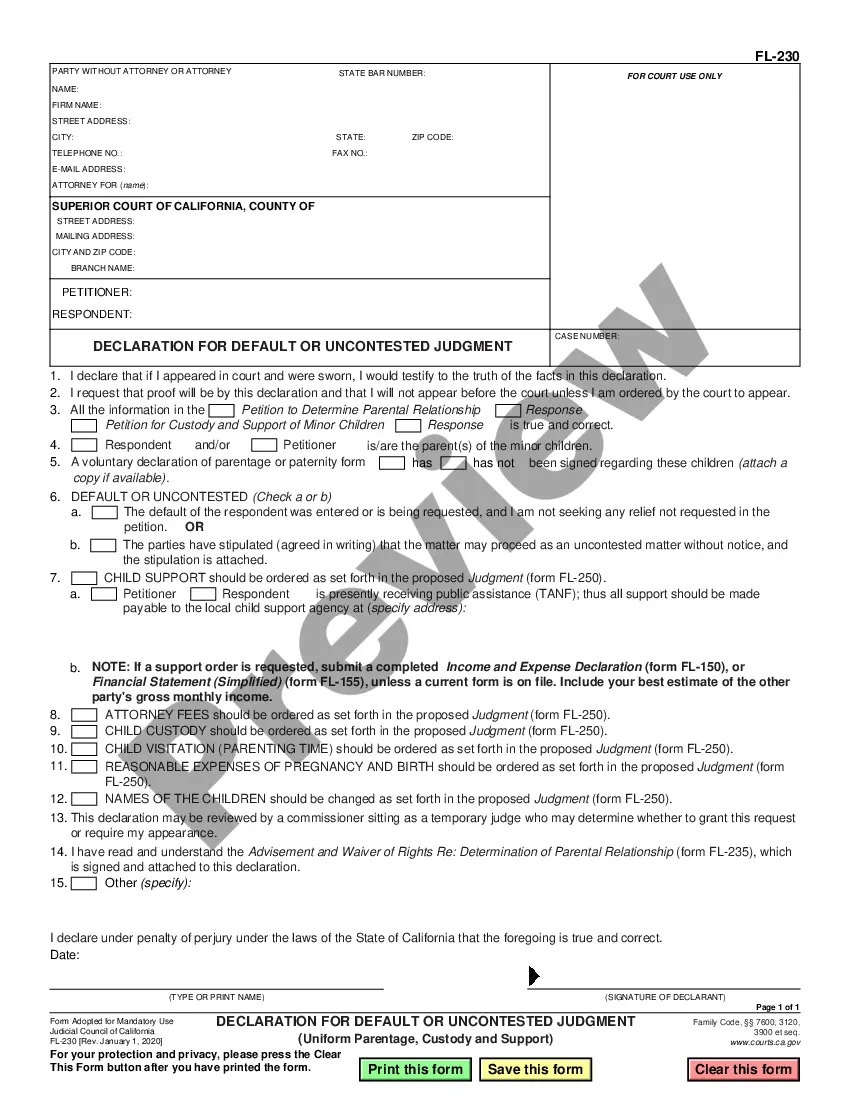

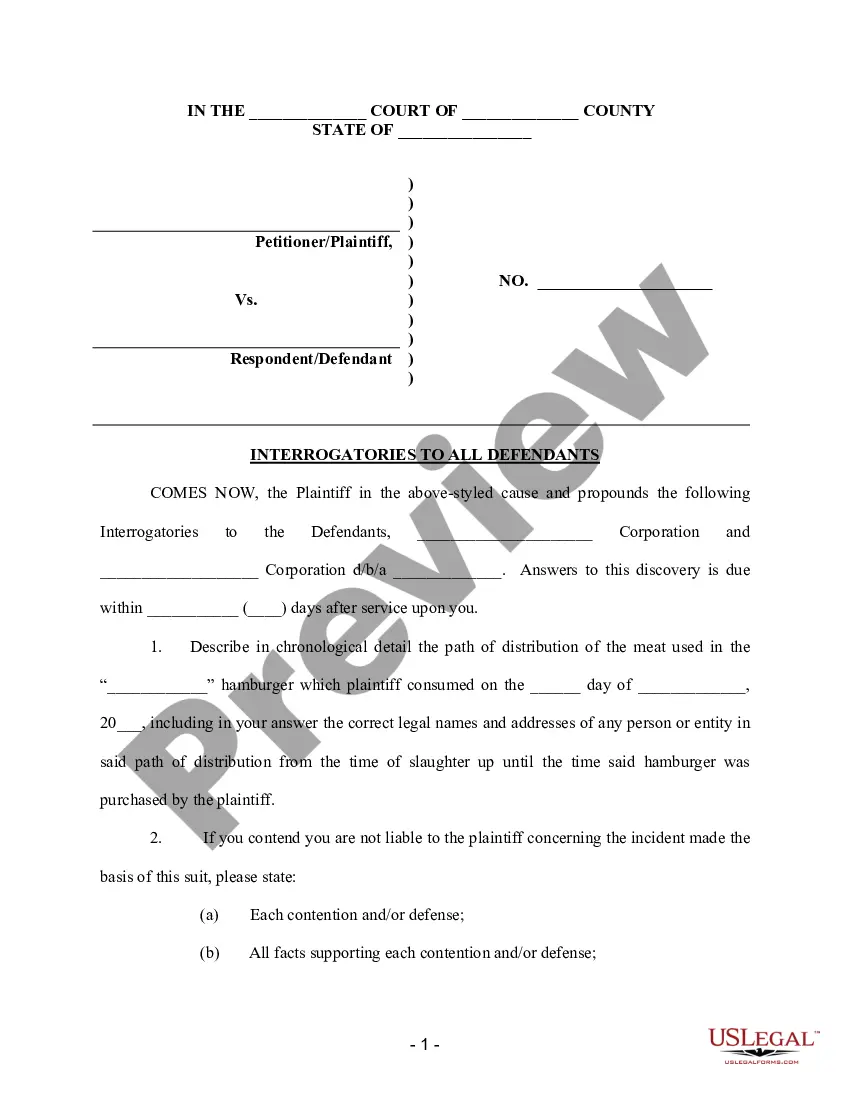

The Red Flags Rule requires specified firms to create a written Identity Theft Prevention Program (ITPP) designed to identify, detect and respond to red flagspatterns, practices or specific activitiesthat could indicate identity theft.

The law indicates that creditors that fall under the Red Flags Rule are only those who regularly and in the ordinary course of business: (1) obtain or use consumer reports, directly or indirectly, in connection with a credit transaction; (2) furnish information to certain consumer reporting agencies in connection with

Essentially, the rule requires businesses to protect themselves and their customers against identity theft by defining red flags (i.e. any suspicious account activity, informational inconsistencies, or other signals that may be indicative of identity theft), putting systems in place to detect and act on those red

The Red Flags Rule requires that each "financial institution" or "creditor"which includes most securities firmsimplement a written program to detect, prevent and mitigate identity theft in connection with the opening or maintenance of "covered accounts." These include consumer accounts that permit multiple payments

The Five Categories of Red Flags Warnings, alerts, alarms or notifications from a consumer reporting agency. Suspicious documents. Unusual use of, or suspicious activity related to, a covered account. Suspicious personally identifying information, such as a suspicious inconsistency with a last name or address.

When the address or phone number is fictitious, a mail drop, or a prison, it is a red flag that indicates suspicious personal identifying information.

The Red Flags Rule calls for financial institutions and creditors to implement red flags to detect and prevent against identity theft. Institutions are required to have a written identity theft prevention program (ITPP) to govern their organization and protect their consumers.

The FACTA disposal rule requires businesses to take reasonable measures to protect against unauthorized access to or use of consumers' information. According to the FTC, burning, pulverizing, and shredding are all considered reasonable measures under the disposal rule.

The Red Flags Rule calls for financial institutions and creditors to implement red flags to detect and prevent against identity theft. Institutions are required to have a written identity theft prevention program (ITPP) to govern their organization and protect their consumers.

The Red Flags Rule requires organizations to implement a written identity theft prevention program to help them identify any of the relevant red flags that indicate identity theft in daily operations.