Chicago, Illinois Writ of Execution: A Comprehensive Overview The Chicago, Illinois Writ of Execution is a legal document utilized to enforce a judgment and collect a debt owed by a judgment debtor. It is a powerful tool employed by creditors to seize the property and assets of the debtor to satisfy the outstanding judgment. This Writ of Execution is issued by the court upon the request of the judgment creditor, enabling them to pursue the debtor's non-exempt personal or real property, bank accounts, wages, or any other assets considered valuable for repaying the debt. It is crucial to note that only specific types of property can be seized, as exempt assets, such as certain public benefits, necessary household items, and tools of trade, are protected under state and federal laws. In the state of Illinois, there are several types of Writs of Execution available to judgment creditors: 1. General Writ of Execution: This is the most common type of Writ, enabling the seizure and sale of the debtor's non-exempt property to satisfy the judgment. The proceeds from the sale are then distributed among the creditors proportionally. 2. Wage Deduction (Garnishment): Under this Writ, a portion of the debtor's wages can be deducted directly from their paycheck to fulfill the judgment. However, certain exemptions apply, safeguarding some income for the debtor's basic needs. 3. Non-Wage Garnishment: This Writ allows the seizure of a debtor's bank accounts, including savings and checking accounts. The judgment creditor can instruct the bank to withdraw funds and transfer them towards debt repayment. 4. Real Property Execution: In cases where the debtor owns real estate, this Writ permits the sale of the property at a public auction. The proceeds from the sale are used to satisfy the judgment, and any remaining balance is returned to the debtor, if applicable. It is important to understand that the process surrounding the Chicago, Illinois Writ of Execution is governed by specific rules and regulations set forth by the court. Any creditor seeking to utilize this tool must adhere to these guidelines to ensure proper execution and enforcement of the judgment. In summary, the Chicago, Illinois Writ of Execution is an invaluable legal instrument used by creditors to collect outstanding debts from judgment debtors. Through different types of writs such as General Writs of Execution, Wage Deduction, Non-Wage Garnishments, and Real Property Executions, creditors can reclaim their owed dues by seizing the debtor's assets within the boundaries of the law.

Chicago Illinois Writ of Execution

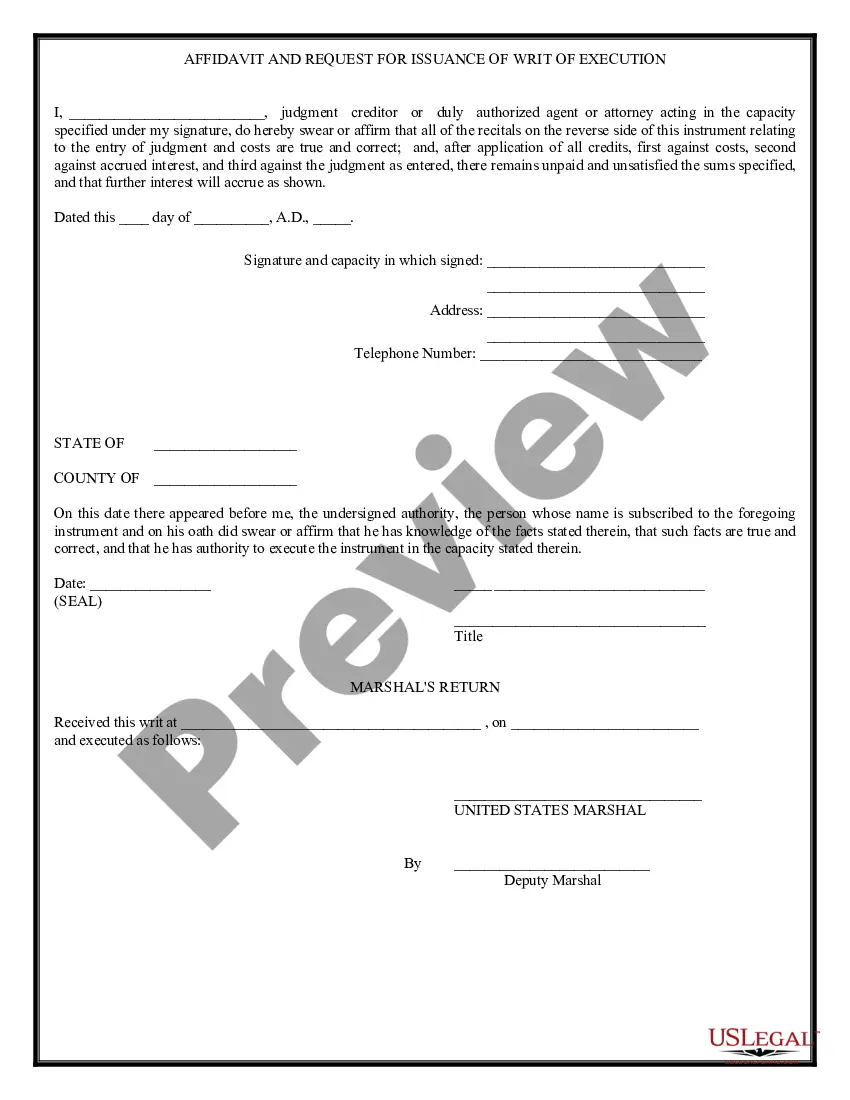

Description

How to fill out Chicago Illinois Writ Of Execution?

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask an attorney to write a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Chicago Writ of Execution, it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario collected all in one place. Consequently, if you need the latest version of the Chicago Writ of Execution, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Chicago Writ of Execution:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the document format for your Chicago Writ of Execution and save it.

When done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!