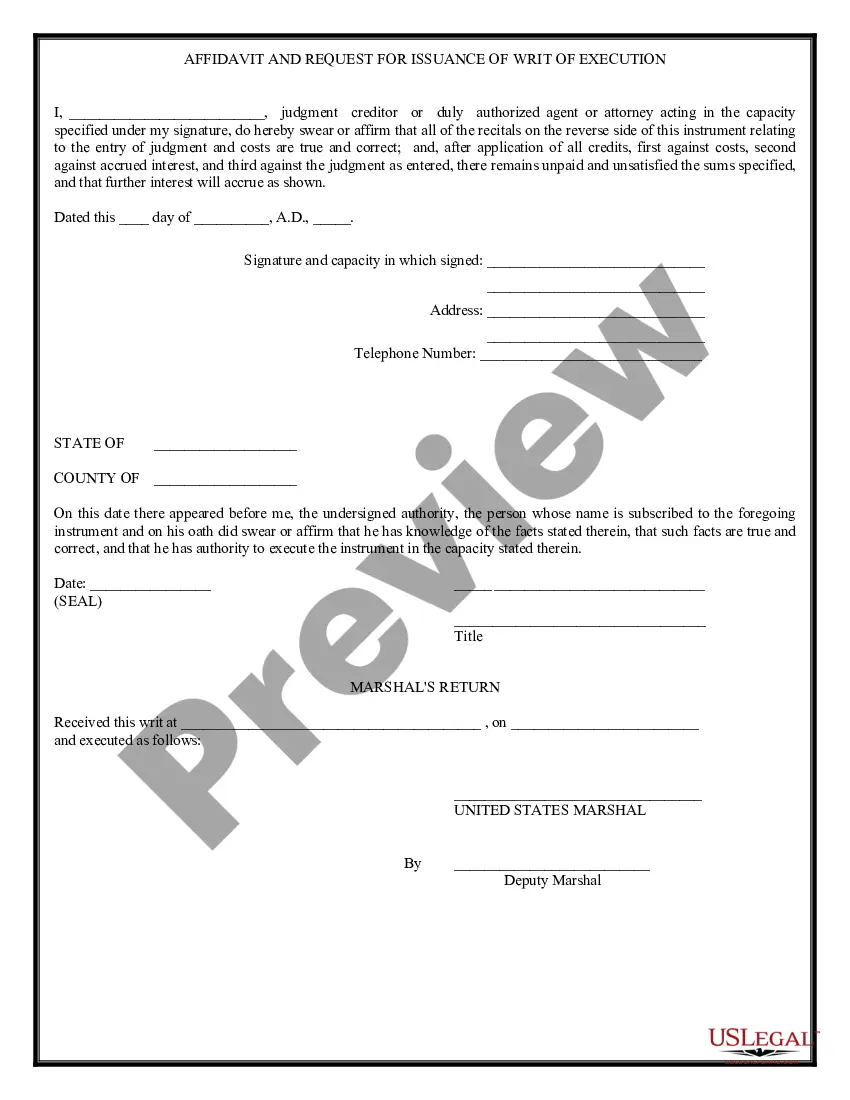

San Antonio Texas Writ of Execution is a legal document issued by the court that authorizes the enforcement of a judgment against a debtor's property to satisfy a debt. It is an important step in the collection process when a creditor is unable to collect the debt through other means, such as negotiation or wage garnishment. Below are relevant keywords and different types of Writ of Execution commonly associated in San Antonio, Texas: 1. San Antonio: San Antonio is a bustling city located in south-central Texas, known for its rich history, vibrant culture, and popular tourist attractions such as the Alamo, River walk, and historic missions. 2. Writ of Execution: A Writ of Execution is a legal order issued by the court upon request from a judgment creditor to enforce the collection of a debt through the seizure and sale of the debtor's assets. 3. Judgment: A judgment is a decision made by the court declaring that a debtor owes a specific amount of money to a creditor. This judgment serves as the basis for pursuing further legal action, including the issuance of a Writ of Execution. 4. Debtor: A debtor is an individual or entity that owes money to a creditor and is subject to the enforcement actions outlined in a Writ of Execution. 5. Creditor: A creditor is an individual, company, or organization that is owed money by a debtor and seeks legal remedies, such as a Writ of Execution, to collect the debt. 6. Property: The Writ of Execution enables the creditor to seize and sell a debtor's non-exempt property to satisfy the outstanding debt. Properties subject to execution can include real estate, vehicles, bank accounts, investments, and other valuable assets. 7. Exemptions: Certain types of property may be exempt from execution, meaning they cannot be seized by the creditor to satisfy the debt. Exemptions often include necessities like a primary residence, clothing, and personal effects. 8. Homestead Exemption: In Texas, there are specific exemptions related to homestead properties, protecting a certain amount of equity in a debtor's primary residence from being sold to satisfy the debt. 9. Wage Garnishment: While not directly related to a Writ of Execution, wage garnishment is another method by which creditors in Texas can collect debts. It involves deducting a portion of the debtor's paycheck to satisfy the outstanding obligation. 10. Multiple Writs: Depending on the number of judgments against a debtor, multiple Writs of Execution can be issued to seize different types of the debtor's assets and satisfy various debts. It is important to note that the specifics of San Antonio Texas Writ of Execution, including procedures, exemptions, and enforcement, may be subject to state laws, court rules, and individual circumstances. Legal advice from an attorney familiar with Texas law is advisable to navigate the process effectively.

San Antonio Texas Writ of Execution

Description

How to fill out San Antonio Texas Writ Of Execution?

Creating forms, like San Antonio Writ of Execution, to manage your legal matters is a difficult and time-consumming task. A lot of cases require an attorney’s involvement, which also makes this task expensive. However, you can acquire your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal forms intended for a variety of cases and life situations. We make sure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already aware of our website and have a subscription with US, you know how effortless it is to get the San Antonio Writ of Execution form. Simply log in to your account, download the form, and customize it to your requirements. Have you lost your document? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is just as straightforward! Here’s what you need to do before getting San Antonio Writ of Execution:

- Ensure that your template is specific to your state/county since the regulations for writing legal paperwork may vary from one state another.

- Learn more about the form by previewing it or going through a quick intro. If the San Antonio Writ of Execution isn’t something you were hoping to find, then use the header to find another one.

- Log in or register an account to start using our service and get the document.

- Everything looks good on your end? Click the Buy now button and select the subscription option.

- Pick the payment gateway and enter your payment details.

- Your form is good to go. You can go ahead and download it.

It’s an easy task to locate and purchase the appropriate template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!