The Harris Texas Federal Consumer Leasing Act Disclosure Form is a legal document that provides important information to consumers who are entering into a lease agreement. This form is specifically designed to comply with the requirements of the Federal Consumer Leasing Act (CLA) and to ensure that consumers are fully informed about the terms and conditions of their lease. The purpose of the Harris Texas Federal Consumer Leasing Act Disclosure Form is to protect consumers from being taken advantage of by unscrupulous lessors. It helps to promote transparency and fairness in lease transactions by providing clear and concise information about the costs and terms associated with the lease. Key components of the Harris Texas Federal Consumer Leasing Act Disclosure Form include: 1. Identification and Contact Information: The form typically consists of a section where the lessor's name, address, and contact details are mentioned. This ensures that consumers can easily reach out to the lessor for any questions or concerns regarding the lease. 2. Description of the Vehicle or Property: This section provides a detailed description of the leased vehicle or property, including its make, model, year, and identification number. For vehicle leases, information such as mileage limitations and excessive wear and tear charges may also be included. 3. Lease Terms: The form outlines the specific terms of the lease agreement, including the lease duration, monthly payment amount, and any additional fees or charges. It may also include information about the lessee's responsibilities, such as insurance requirements and maintenance obligations. 4. Total Amount Due at Lease Signing: This section highlights the total amount the lessee is required to pay at the time of signing the lease agreement, including any down payments, security deposits, taxes, and fees. 5. Calculation of Annual Percentage Rate (APR): The Harris Texas Federal Consumer Leasing Act Disclosure Form includes an APR disclosure that provides the lessee with the effective interest rate on the lease, allowing for easy comparison with other financing options. Different types of Harris Texas Federal Consumer Leasing Act Disclosure Forms may exist to cater to various types of leased assets. For example, there could be separate forms for vehicle leases, property leases, or equipment leases. However, the core content and purpose of these forms would remain the same — to inform and protect consumers in accordance with the Federal Consumer Leasing Act. Ultimately, the Harris Texas Federal Consumer Leasing Act Disclosure Form serves as a crucial tool in promoting consumer rights, ensuring transparency, and fostering fair lease agreements between lessors and lessees.

Harris Texas Federal Consumer Leasing Act Disclosure Form

Description

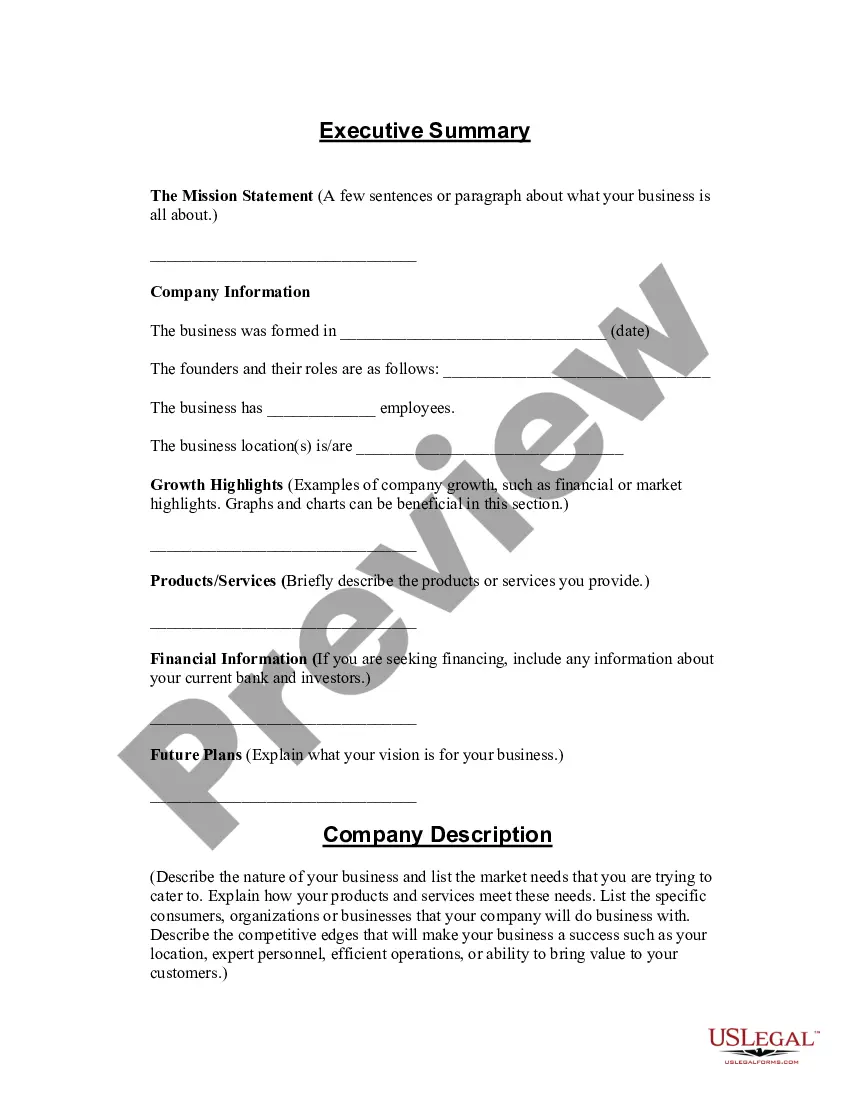

How to fill out Harris Texas Federal Consumer Leasing Act Disclosure Form?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask an attorney to write a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the Harris Federal Consumer Leasing Act Disclosure Form, it may cost you a fortune. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case collected all in one place. Consequently, if you need the recent version of the Harris Federal Consumer Leasing Act Disclosure Form, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Harris Federal Consumer Leasing Act Disclosure Form:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the document format for your Harris Federal Consumer Leasing Act Disclosure Form and save it.

When finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

Most recently amended Jan. 1, 2018. Regulation M protects people when they use consumer leases. View current regulation.

For an advertisement accessed by the consumer in electronic form, the required disclosures may be provided to the consumer in electronic form in the advertisement, without regard to the consumer consent or other provisions of the E-Sign Act.

Consumer Leasing Act1 The Consumer Leasing Act (15 U.S.C. 1667 et seq.) (CLA) was passed in 1976 to assure that meaningful and accurate disclosure of lease terms is provided to consumers before entering into a contract. It applies to consumer leases of personal property.

The Consumer Leasing Act (CLA) was enacted in 1976 as part of the Truth in Lending Act (TILA) to protect lessees from unclear or deceiving statements and advertisements by lessors.

The Act requires that certain lease costs and terms be disclosed, imposes limitations on the size of penalties for delinquency or default and on the size of residual liabilities, and requires certain disclosures in lease advertising.

A. Messages in newspapers, magazines, leaflets, catalogs, and fliers; Messages on radio, television and public address systems; Direct mail; Telephone solicitations; Signs or displays; and. Online information, such as the Internet.

2020 Adjustment and Commentary Revision. Effective January 1, 2020, the exemption threshold amount is increased from $57,200 to $58,300.

Regulation M. (a) General rule. An advertisement for a consumer lease may state that a specific lease of property at specific amounts or terms is available only if the lessor usually and customarily leases or will lease the property at those amounts or terms.

Consumer Lease. A consumer lease is a lease contract between a. lessor and a lessee. 2022 For the use of personal property by an individual. (natural person)