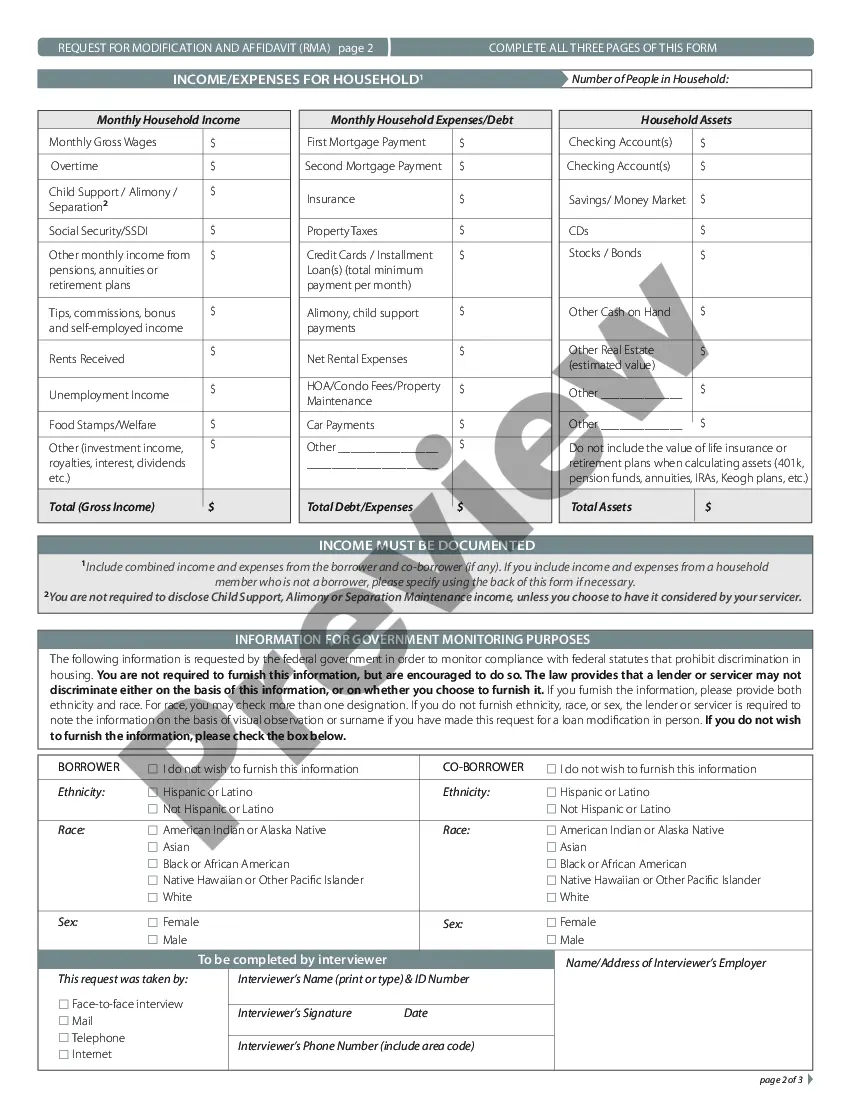

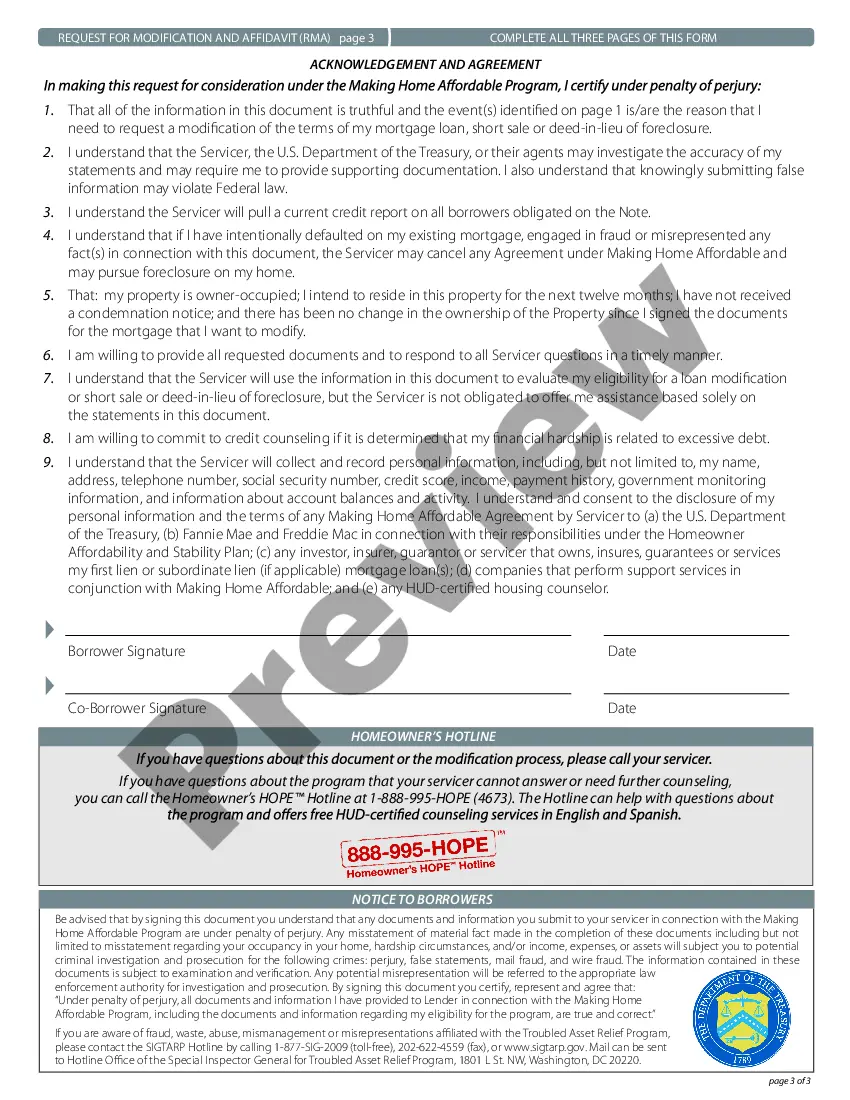

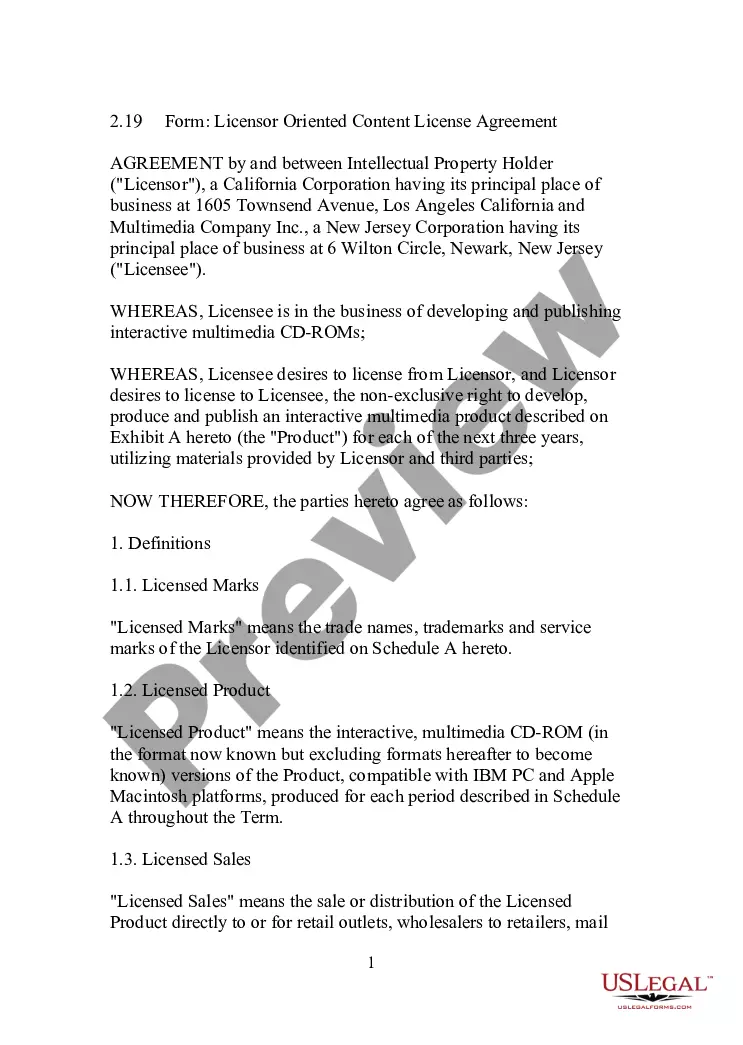

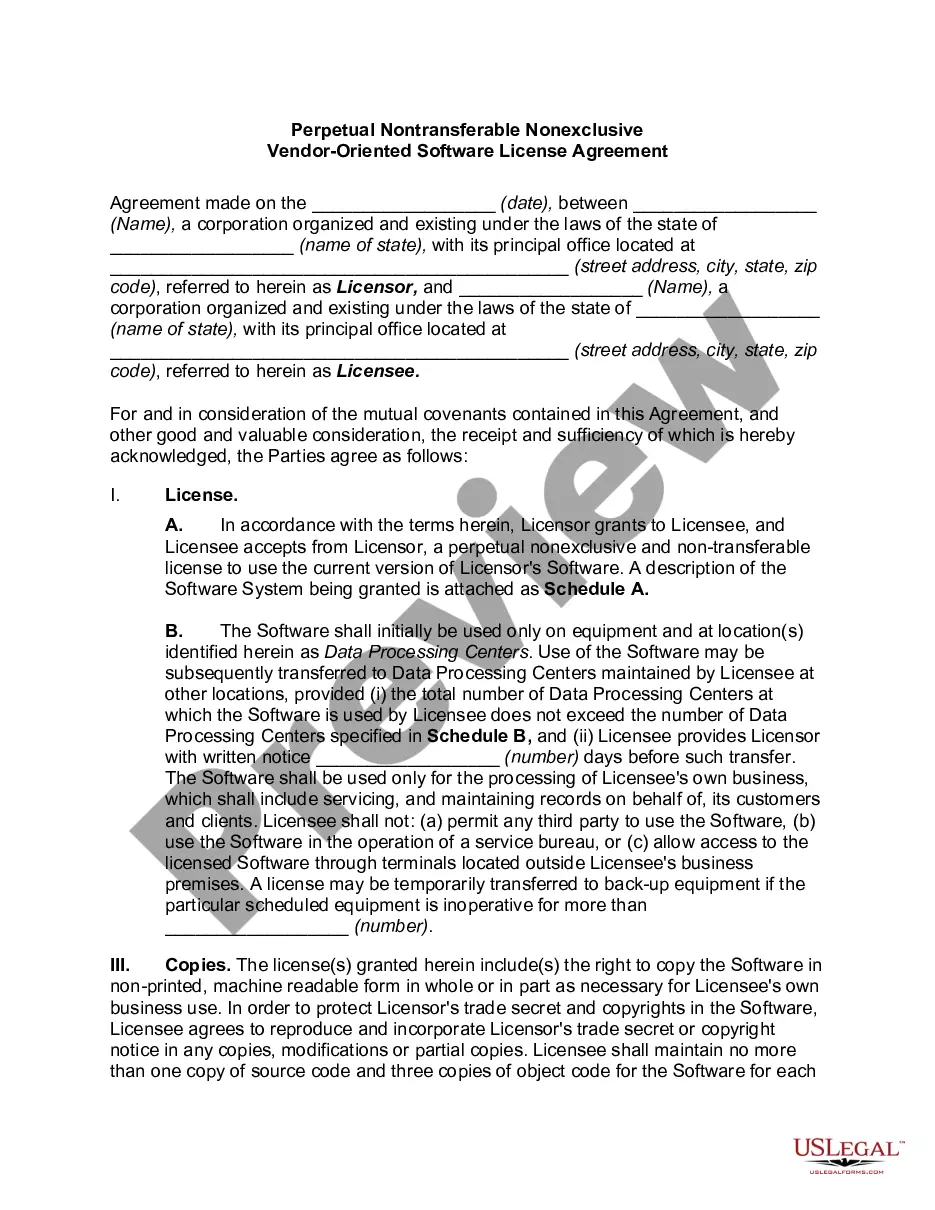

Cook Illinois Request for Loan Modification RMA Under Home Affordable Modification Program (CAMP) Cook Illinois, a major player in the transportation industry, provides a Request for Loan Modification RMA under the Home Affordable Modification Program (CAMP). This program aims to assist homeowners in financial distress by providing loan modification solutions to make their mortgage payments more affordable and sustainable. Under the Cook Illinois Request for Loan Modification RMA, homeowners facing difficulties in repaying their mortgages can submit an application to the company requesting assistance. This application includes detailed financial information, such as income, expenses, and outstanding debts, to assess the borrower's eligibility for a loan modification. The primary goal of the Cook Illinois Request for Loan Modification RMA is to help borrowers avoid foreclosure and find a viable solution to their financial challenges. By modifying key loan terms, such as interest rates, loan duration, and monthly payments, Cook Illinois aims to create a more manageable repayment plan for the homeowner. One of the main benefits of the Cook Illinois Request for Loan Modification RMA is its affiliation with the Home Affordable Modification Program (CAMP). This federal program, established during the financial crisis, provides guidelines and incentives to lenders and loan services like Cook Illinois to offer sustainable loan modifications to distressed borrowers. The Cook Illinois Request for Loan Modification RMA encompasses various types of loan modifications under CAMP, including: 1. Interest Rate Reduction: Cook Illinois may lower the interest rate on the mortgage to reduce the borrower's monthly payment, making it more affordable in the long run. 2. Loan Term Extension: This modification option allows the borrower to extend the loan term, spreading the remaining balance over a more extended period, thereby reducing the monthly payment amount. 3. Principal Forbearance: In some cases, Cook Illinois may place a portion of the principal balance in forbearance, temporarily reducing the borrower's overall debt burden. This amount typically becomes due at the end of the loan term or upon the sale of the property. 4. Capitalization of Arrears: Under this modification, any missed payments or delinquencies can be added to the loan balance, allowing the borrower to catch up on the past dues without the immediate financial strain. 5. Other Modifications: Cook Illinois may consider other adjustments based on the borrower's unique circumstances, such as reducing late fees, eliminating penalties, or forgiving a certain portion of the outstanding debt. It is important to note that the Cook Illinois Request for Loan Modification RMA goes through a comprehensive review process. The company carefully evaluates the borrower's financial situation, determining the most suitable modification options based on their eligibility and affordability. By participating in the Cook Illinois Request for Loan Modification RMA under CAMP, homeowners struggling with their mortgage payments can find potential relief and a chance to regain financial stability.

Cook Illinois Request for Loan Modification RMA Under Home Affordable Modification Program HAMP

Description

How to fill out Cook Illinois Request For Loan Modification RMA Under Home Affordable Modification Program HAMP?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and many other life situations require you prepare formal documentation that differs throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and download a document for any personal or business purpose utilized in your county, including the Cook Request for Loan Modification RMA Under Home Affordable Modification Program HAMP.

Locating templates on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Cook Request for Loan Modification RMA Under Home Affordable Modification Program HAMP will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guide to obtain the Cook Request for Loan Modification RMA Under Home Affordable Modification Program HAMP:

- Ensure you have opened the right page with your local form.

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template satisfies your needs.

- Look for another document via the search option in case the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Select the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Cook Request for Loan Modification RMA Under Home Affordable Modification Program HAMP on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!