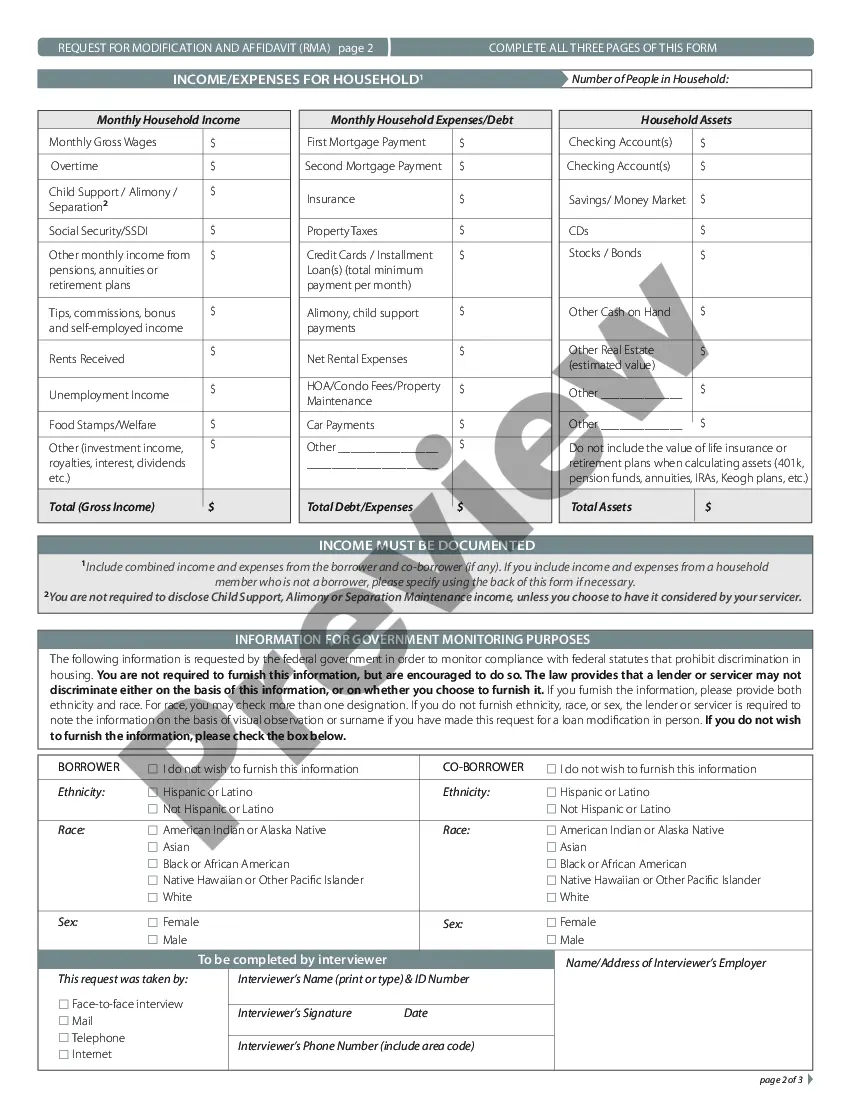

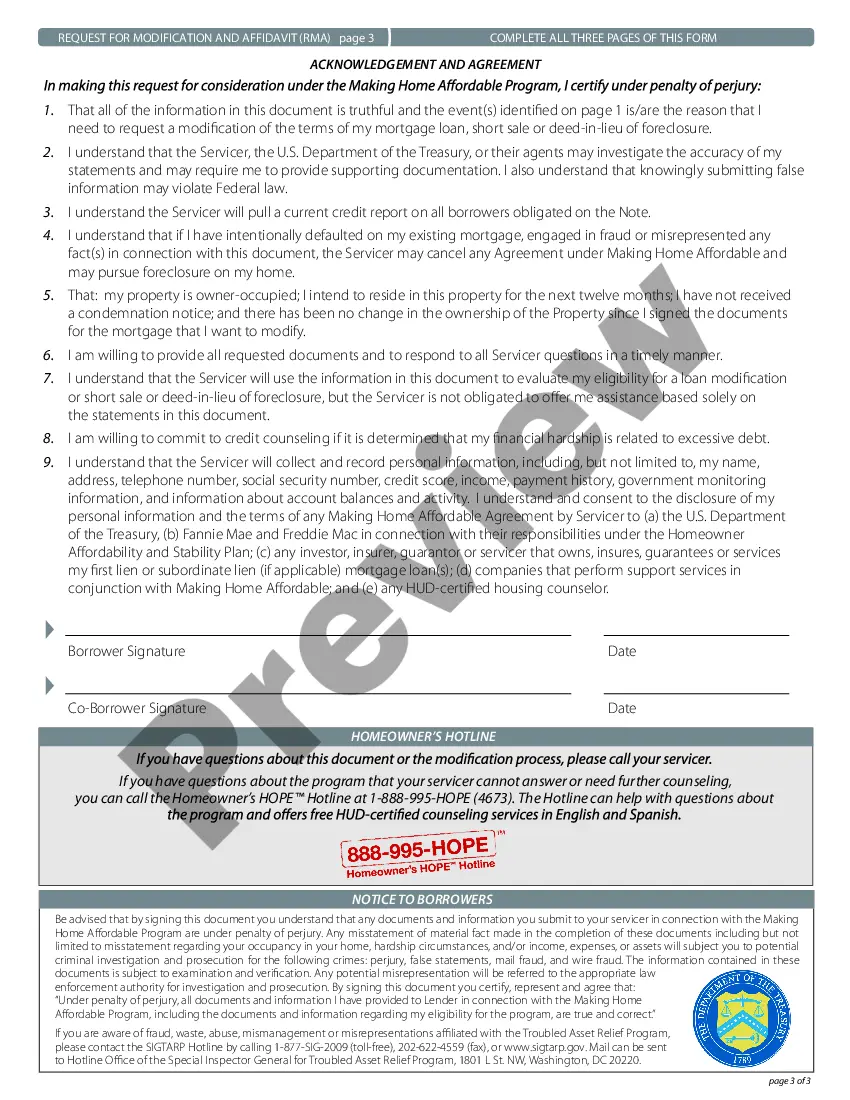

Title: San Jose California Request for Loan Modification RMA Under Home Affordable Modification Program (CAMP) Introduction: Welcome to San Jose, California, a vibrant city known for its technological innovation and economic growth. If you are a homeowner facing financial hardship and seeking mortgage assistance, the Home Affordable Modification Program (CAMP) can potentially provide relief. In this detailed description, we will delve into the process of requesting a loan modification under CAMP, outlining its benefits, eligibility criteria, and various types available. 1. San Jose California Request for Loan Modification RMA under CAMP: As a resident of San Jose, California, you may find yourself struggling to keep up with your mortgage payments due to unforeseen circumstances. Requesting a Loan Modification under CAMP allows eligible homeowners to modify their mortgage terms, resulting in more affordable monthly payments and increased chances of retaining their homes. 2. Benefits of San Jose California Request for Loan Modification RMA under CAMP: By applying for a Loan Modification under CAMP in San Jose, California, you can enjoy several benefits such as: a. Reduced Monthly Payments: The modification may lead to lower monthly mortgage payments, making it more manageable for homeowners. b. Interest Rate Reduction: CAMP may provide an opportunity to lower the interest rate on your mortgage, resulting in substantial savings over the loan term. c. Extended Loan Term: The program offers the possibility of extending the loan term, increasing the time available for repayment and reducing the overall financial burden. d. Avoiding Foreclosure: By securing a loan modification through CAMP, homeowners can potentially avoid foreclosure and maintain homeownership. 3. Eligibility Criteria for San Jose California Request for Loan Modification RMA under CAMP: To qualify for a Loan Modification under CAMP in San Jose, California, homeowners typically need to meet certain eligibility criteria, including: a. Financial Hardship: Documented proof of financial hardship, such as loss of employment, reduction in income, medical expenses, divorce, or another qualifying event. b. Owner-Occupied Property: The property in question must be the homeowner's primary residence. c. Current Mortgage Payment Burden: Demonstrating an inability to afford your current mortgage payments while maintaining basic living expenses. d. Loan Origination Date: The mortgage loan must have originated on or before January 1, 2009. e. Loan Amount Limit: The outstanding loan balance must not exceed certain limits based on the property's location in San Jose, California. 4. Different Types of San Jose California Request for Loan Modification RMA under CAMP: While there is generally only one Loan Modification option under CAMP, specific scenarios may result in slightly different approaches. Some potential variations include: a. Principal Reduction Alternative (PRA): In certain cases with significant negative equity, CAMP may offer principal reduction to help homeowners bring their loan amount in line with the current market value. b. Second Lien Modification Program (2MP): If you have a second mortgage or home equity line of credit (HELOT) on your property, CAMP offers opportunities for modifications on these secondary loans as well. Conclusion: San Jose, California, homeowners facing financial hardship have the opportunity to request a Loan Modification under the Home Affordable Modification Program (CAMP). By understanding the benefits, eligibility criteria, and potential variations, you can take proactive steps toward a more affordable mortgage and the potential preservation of your beloved home. Remember to consult with a qualified mortgage professional or contact CAMP directly for personalized guidance throughout the application process.

San Jose California Request for Loan Modification RMA Under Home Affordable Modification Program HAMP

Description

How to fill out San Jose California Request For Loan Modification RMA Under Home Affordable Modification Program HAMP?

How much time does it normally take you to draw up a legal document? Given that every state has its laws and regulations for every life sphere, finding a San Jose Request for Loan Modification RMA Under Home Affordable Modification Program HAMP meeting all regional requirements can be stressful, and ordering it from a professional lawyer is often costly. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web collection of templates, grouped by states and areas of use. In addition to the San Jose Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, here you can find any specific document to run your business or individual deeds, complying with your county requirements. Specialists check all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can get the document in your profile anytime in the future. Otherwise, if you are new to the platform, there will be some extra steps to complete before you obtain your San Jose Request for Loan Modification RMA Under Home Affordable Modification Program HAMP:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the San Jose Request for Loan Modification RMA Under Home Affordable Modification Program HAMP.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!