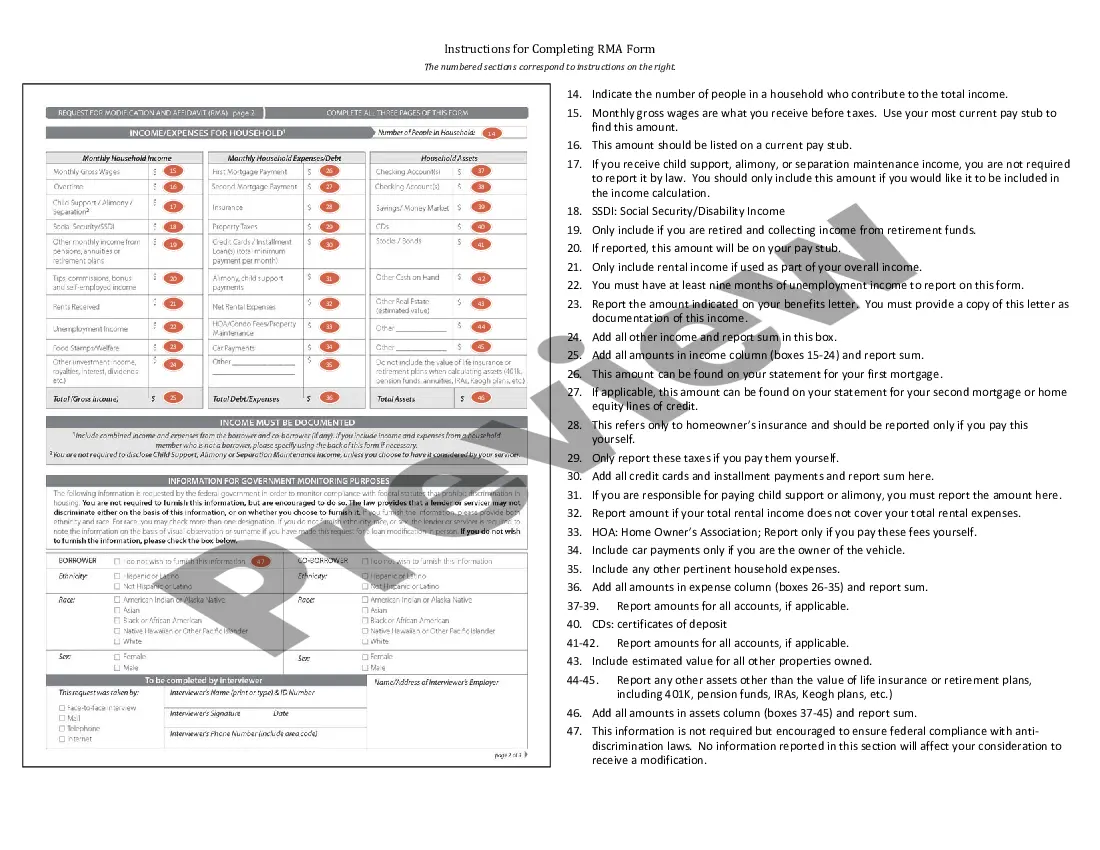

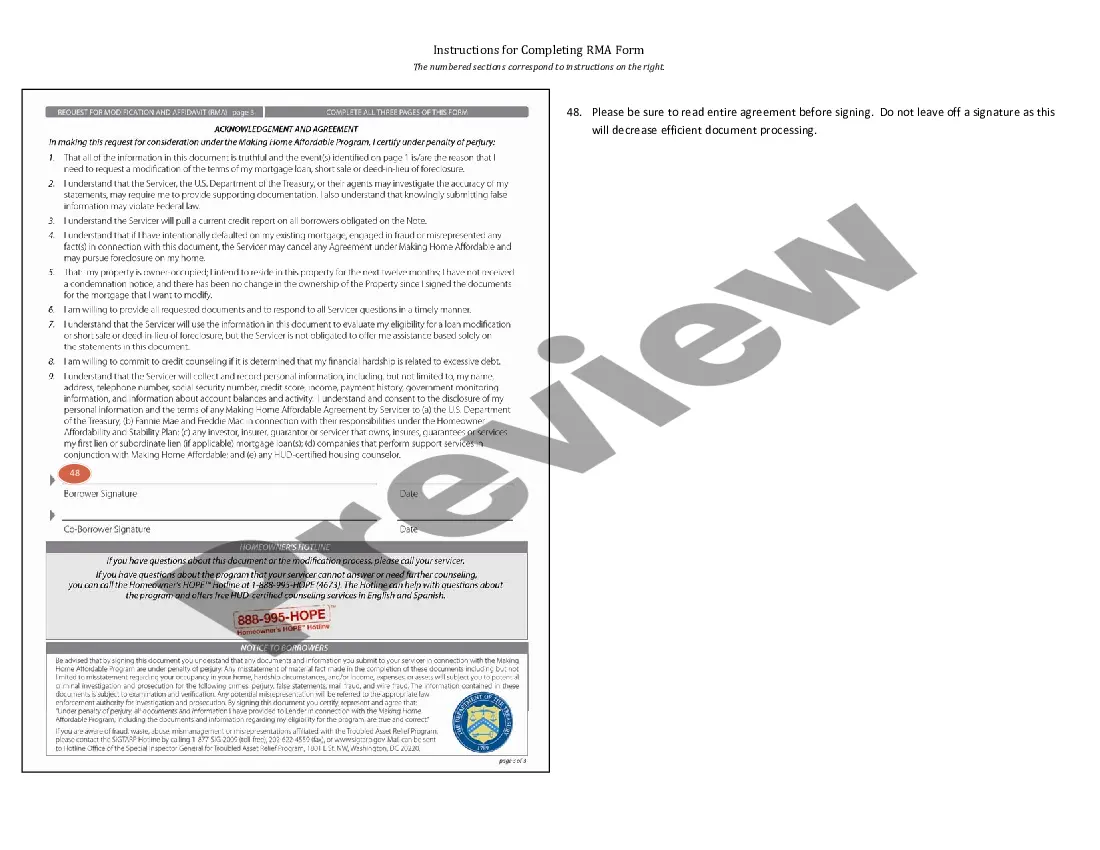

Collin, Texas is a fast-growing county located in the state of Texas, United States. With a population of over 1 million residents, Collin County is known for its prosperous economy, excellent schools, and vibrant communities. Situated just north of Dallas, Collin County offers a unique blend of suburban living and urban amenities. When it comes to requesting a loan modification and completing the Affidavit RMA form in Collin, Texas, it is important to follow the specific instructions provided by your mortgage lender or service. Typically, these instructions will be tailored to the specific loan modification program you are applying for. Here, we will provide you with a general overview of the steps involved in completing the Request for Loan Modification and Affidavit RMA form: 1. Gather the necessary documents: Before starting the process, ensure you have all the required documents readily available. These documents may include financial statements, pay stubs, bank statements, tax returns, and any other financial records that demonstrate your current financial situation. 2. Complete the borrower information section: Fill in your personal information accurately in the appropriate fields, including your name, address, contact details, and loan information. 3. Financial information: Provide detailed information about your current financial status. This includes your monthly income, expenses, assets, and liabilities. It is essential to be thorough and accurate in this section. 4. Hardship affidavit: In this section, explain the reasons for your financial hardship and the circumstances that led to your inability to meet your mortgage obligations. Be honest and specific, providing supporting documentation if required. 5. Additional information: Some loan modification programs may require you to provide additional information or documentation. Carefully review the instructions provided by your lender and provide these additional details, if applicable. 6. Review and sign the form: Carefully review all the information you have entered to ensure its accuracy. Make any necessary corrections and ensure that all required fields are filled out. Sign and date the form where indicated. 7. Submit the form: After completing the Request for Loan Modification and Affidavit RMA form, submit it to your mortgage lender or service as per their instructions. It is recommended to keep a copy for your records. Please note that these instructions provide a general guide for completing the Collin, Texas Request for Loan Modification and Affidavit RMA form. Different loan modification programs may have specific forms or additional requirements. Therefore, it is crucial to carefully review the instructions provided by your mortgage lender or service when completing the form. Remember, seeking professional advice from a housing counselor or an attorney specializing in loan modifications can be beneficial in navigating through the loan modification process. They can provide you with personalized guidance and ensure that you complete the necessary forms accurately and efficiently.

Collin Texas Instructions for Completing Request for Loan Modification and Affidavit RMA Form

Description

How to fill out Collin Texas Instructions For Completing Request For Loan Modification And Affidavit RMA Form?

Are you looking to quickly draft a legally-binding Collin Instructions for Completing Request for Loan Modification and Affidavit RMA Form or probably any other form to manage your own or business affairs? You can go with two options: contact a legal advisor to draft a legal paper for you or draft it entirely on your own. The good news is, there's a third solution - US Legal Forms. It will help you get neatly written legal papers without having to pay unreasonable prices for legal services.

US Legal Forms provides a rich collection of over 85,000 state-compliant form templates, including Collin Instructions for Completing Request for Loan Modification and Affidavit RMA Form and form packages. We provide templates for a myriad of life circumstances: from divorce papers to real estate documents. We've been out there for over 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and get the needed template without extra troubles.

- To start with, double-check if the Collin Instructions for Completing Request for Loan Modification and Affidavit RMA Form is tailored to your state's or county's regulations.

- In case the form has a desciption, make sure to verify what it's suitable for.

- Start the search over if the template isn’t what you were seeking by utilizing the search box in the header.

- Select the plan that best suits your needs and move forward to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Collin Instructions for Completing Request for Loan Modification and Affidavit RMA Form template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. Additionally, the templates we offer are updated by industry experts, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!