Harris Texas is a county located in the state of Texas, United States. It is one of the most populous counties in the country and is home to the city of Houston, a major economic and cultural hub. When it comes to completing IRS Form 4506-EZ, residents of Harris Texas can follow specific instructions provided by the Internal Revenue Service (IRS). This form is used to request a copy of a previously filed tax return. To complete IRS Form 4506-EZ accurately, individuals should gather the necessary information and follow these instructions: 1. Begin by entering the taxpayer's name, Social Security number, and current address on the form. 2. If the tax return was filed jointly, both spouses must sign the form. 3. Indicate the tax years for which the transcript is requested. For example, if you need transcripts for the past three years, enter the corresponding dates. 4. Provide the address where the tax transcript should be sent. Double-check for accuracy, as any errors may cause delays or misdelivery. 5. If the transcript is required for a mortgage, enter the name and address of the mortgage company. 6. Ensure all necessary attachments are included, such as a power of attorney form if someone other than the taxpayer is requesting the transcript. 7. Review the completed form for accuracy, making sure all fields are filled out correctly, and signatures are provided where required. Different types of Harris Texas Instructions for Completing IRS Form 4506-EZ can vary based on specific circumstances or additional requirements. Some variations may include: 1. Harris Texas Instructions for Completing IRS Form 4506-EZ for Businesses: This version of the instructions would cater to businesses operating within Harris Texas, providing guidance on how to complete the form for corporate tax returns. 2. Harris Texas Instructions for Completing IRS Form 4506-EZ for Non-Residents: Non-residents of Harris Texas would require instructions tailored to their unique tax situations, which may include additional documentation or verification. 3. Harris Texas Instructions for Completing IRS Form 4506-EZ for Tax Professionals: These instructions would be geared towards tax professionals or accountants assisting clients in completing the form accurately, taking into account any specific Harris Texas regulations or guidelines. It is important to note that these variations are hypothetical and may not correspond to actual official instructions provided by the IRS or Harris Texas. When completing IRS Form 4506-EZ, individuals should always refer to the most up-to-date and official instructions provided by the IRS.

Harris Texas Instructions for Completing IRS Form 4506-EZ

Description

How to fill out Harris Texas Instructions For Completing IRS Form 4506-EZ?

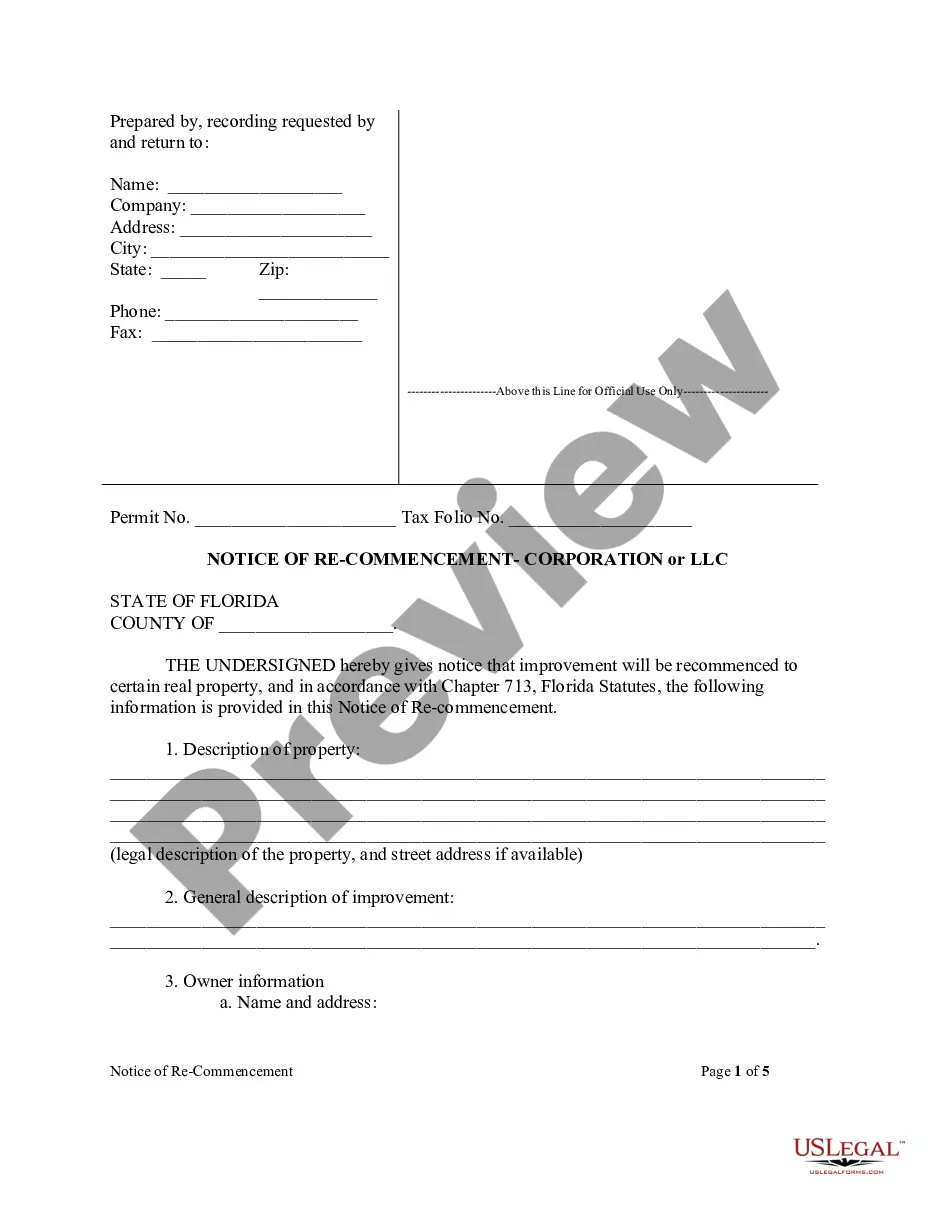

How much time does it typically take you to create a legal document? Because every state has its laws and regulations for every life scenario, locating a Harris Instructions for Completing IRS Form 4506-EZ suiting all regional requirements can be tiring, and ordering it from a professional lawyer is often costly. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. In addition to the Harris Instructions for Completing IRS Form 4506-EZ, here you can get any specific form to run your business or personal deeds, complying with your regional requirements. Specialists verify all samples for their actuality, so you can be certain to prepare your documentation properly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed form, and download it. You can pick the document in your profile anytime in the future. Otherwise, if you are new to the website, there will be a few more actions to complete before you obtain your Harris Instructions for Completing IRS Form 4506-EZ:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Harris Instructions for Completing IRS Form 4506-EZ.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!