Travis, Texas is a county located in the central part of the state, with its county seat being Austin, the capital of Texas. The county is named after William Barrel Travis, a commander at the Battle of the Alamo. Form 4506-EZ is an official document issued by the Internal Revenue Service (IRS) in the United States, primarily used for requesting individual tax return transcripts. It provides taxpayers with the ability to obtain copies of their previously filed tax returns and related information. Completing IRS Form 4506-EZ is a straightforward process, but it is important to follow the instructions provided by the IRS to ensure accuracy and avoid any complications. Here are some guidelines to help you complete the form: 1. Personal Information: Provide your full name, current address, and your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). Make sure the information provided matches what is on your tax return forms. 2. Tax Return Information: Enter the type of return you filed (e.g., 1040, 1040A, 1040EZ), the years you need transcripts for, and the number of transcripts you are requesting. 3. Verification of Identity: Sign and date the form, providing your telephone number and a valid email address. If the transcripts are being sent to a third party, you should also provide their name and address. 4. Delivery Options: Select how you would like to receive the transcripts — either by mail or electronically via email. Electronic delivery is usually faster and more convenient. 5. Fee Requirements: Currently, the IRS charges a fee for tax return transcripts. Refer to the IRS website or the form instructions for the most up-to-date information on fees and payment methods. In some cases, individuals may be eligible for a fee waiver. It is essential to carefully review your completed Form 4506-EZ before submitting it to the IRS. Ensure all the information provided is accurate and legible to avoid delays or rejection. Trustworthy tax professionals or the IRS website can provide additional guidance or answer any specific questions you may have during the completion process. Note: As of now, there are no known different types or variations of Travis Texas Instructions for Completing IRS Form 4506-EZ.

Travis Texas Instructions for Completing IRS Form 4506-EZ

Description

How to fill out Travis Texas Instructions For Completing IRS Form 4506-EZ?

Laws and regulations in every sphere differ throughout the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Travis Instructions for Completing IRS Form 4506-EZ, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the forms can be used many times: once you pick a sample, it remains accessible in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Travis Instructions for Completing IRS Form 4506-EZ from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Travis Instructions for Completing IRS Form 4506-EZ:

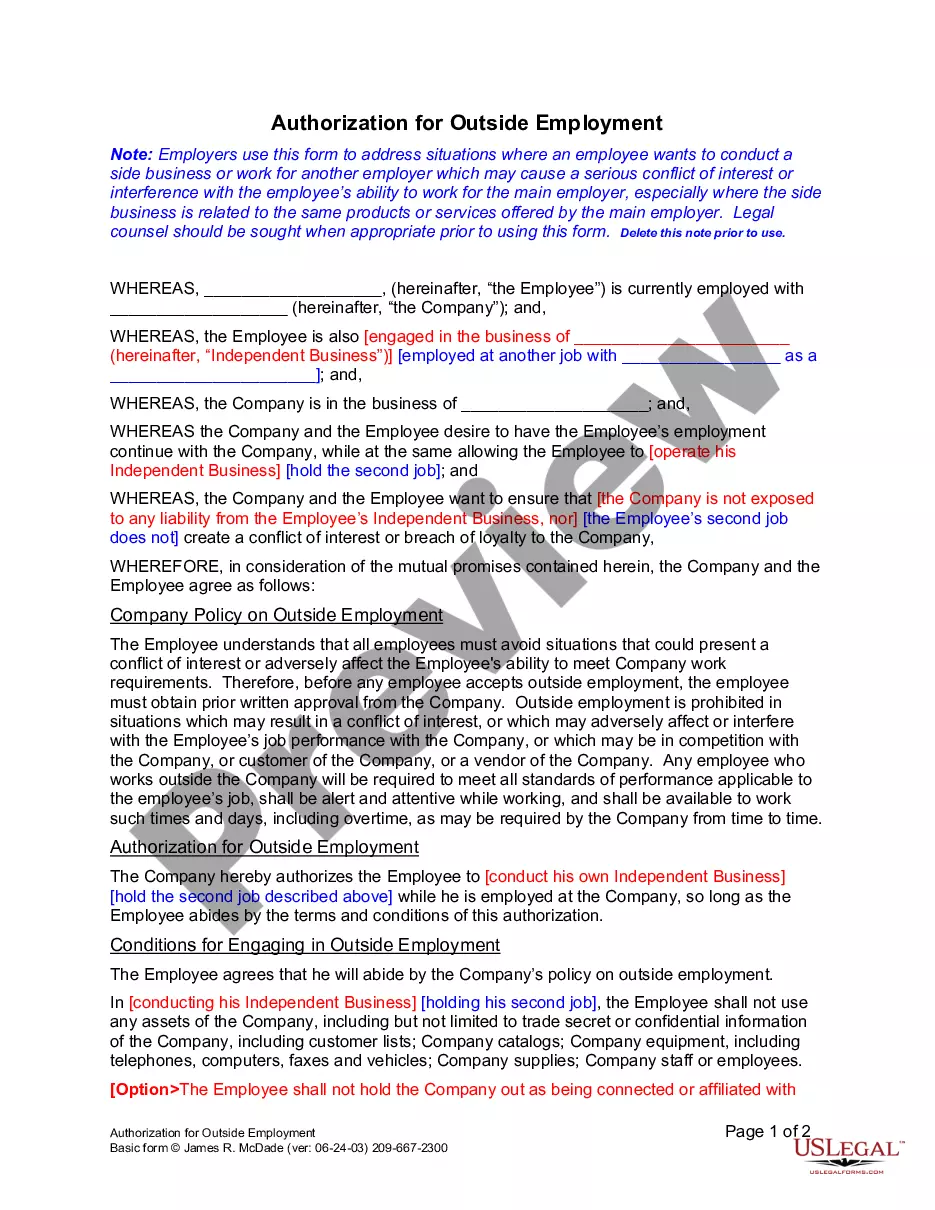

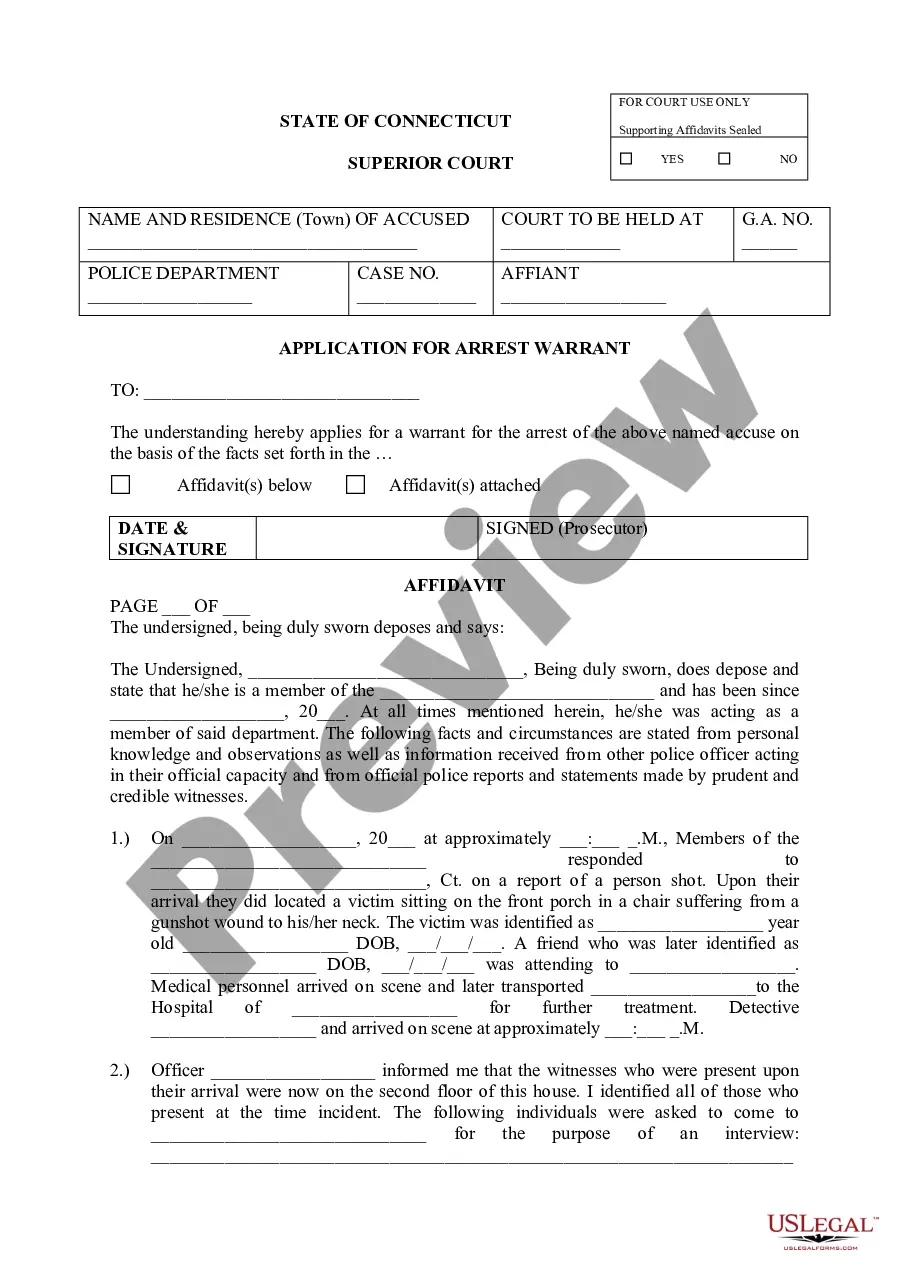

- Examine the page content to ensure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the document once you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!