The Bexar Texas Qualified Written RESP Request to Dispute or Validate Debt is an essential tool for consumers seeking to dispute or validate a debt under the Real Estate Settlement Procedures Act (RESP). This request is specifically designed to protect consumers from inaccurate or unfair debt collection practices and ensure that creditors and debt collectors adhere to their legal obligations. When a consumer believes they have been wrongly targeted for debt collection, they can utilize the Bexar Texas Qualified Written RESP Request to initiate the dispute process. By submitting this written request, individuals can challenge the validity of the debt, request supporting documentation, and seek clarification on any concerns they may have. This documentation serves as evidence of the consumer's determination to rectify any inaccuracies or inconsistencies in debt collection attempts. The Bexar Texas Qualified Written RESP Request to Dispute or Validate Debt contains specific keywords and elements necessary to make it legally effective. These keywords include the consumer's name, address, account number, and the specific details of the disputed debt. It is important to clearly state the reasons for disputing the debt and request relevant documents, such as payment history, loan agreements, or any other records that can help verify the alleged debt. It's worth noting that there may not be different types of the Bexar Texas Qualified Written RESP Request to Dispute or Validate Debt per se, as this request follows a standardized format. However, the content of the request may vary based on the unique circumstances of each consumer's situation. The specific debt details, disputed amount, and supporting documents requested may differ from case to case. In conclusion, the Bexar Texas Qualified Written RESP Request to Dispute or Validate Debt is an important tool for consumers in Bexar County, Texas, seeking to protect their rights and challenge the accuracy of debt collection attempts. By using relevant keywords and providing comprehensive details, individuals can increase their chances of successfully disputing or validating a debt under the provisions of RESP.

Bexar Texas Qualified Written RESPA Request to Dispute or Validate Debt

Description

How to fill out Bexar Texas Qualified Written RESPA Request To Dispute Or Validate Debt?

Preparing legal paperwork can be cumbersome. Besides, if you decide to ask a lawyer to draft a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Bexar Qualified Written RESPA Request to Dispute or Validate Debt, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario gathered all in one place. Therefore, if you need the latest version of the Bexar Qualified Written RESPA Request to Dispute or Validate Debt, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Bexar Qualified Written RESPA Request to Dispute or Validate Debt:

- Look through the page and verify there is a sample for your region.

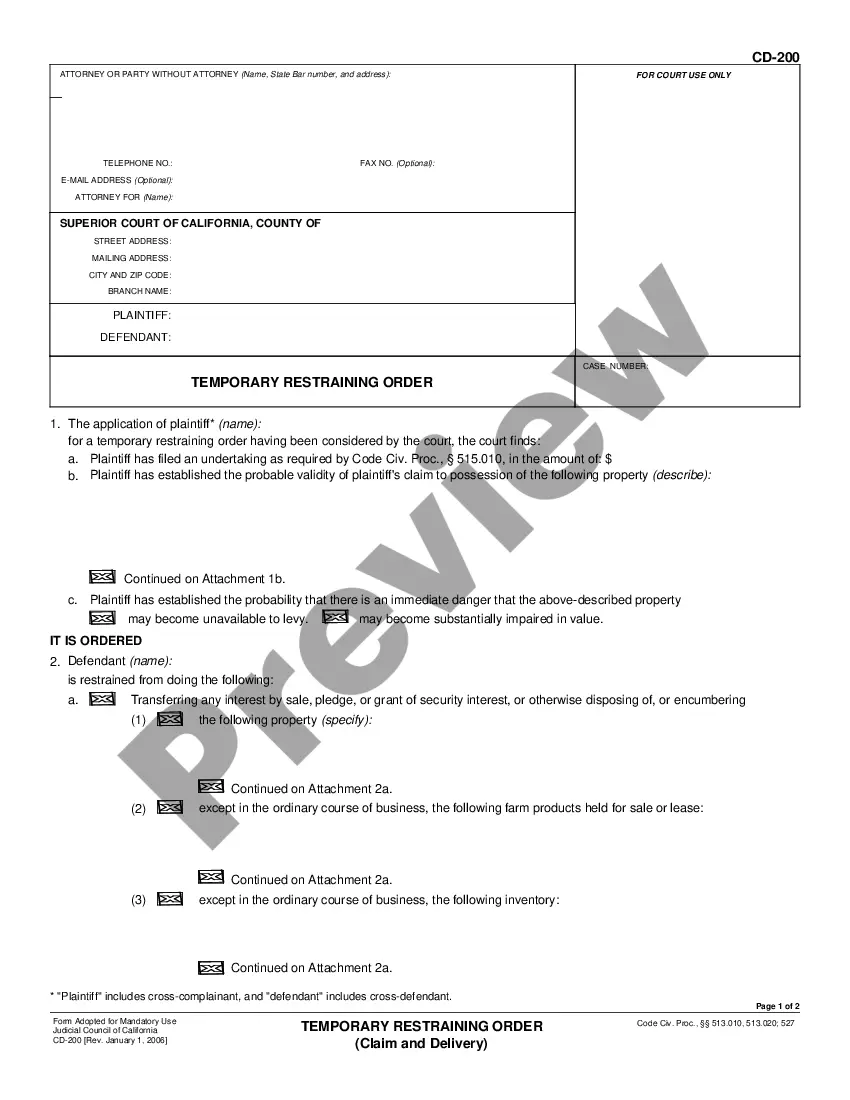

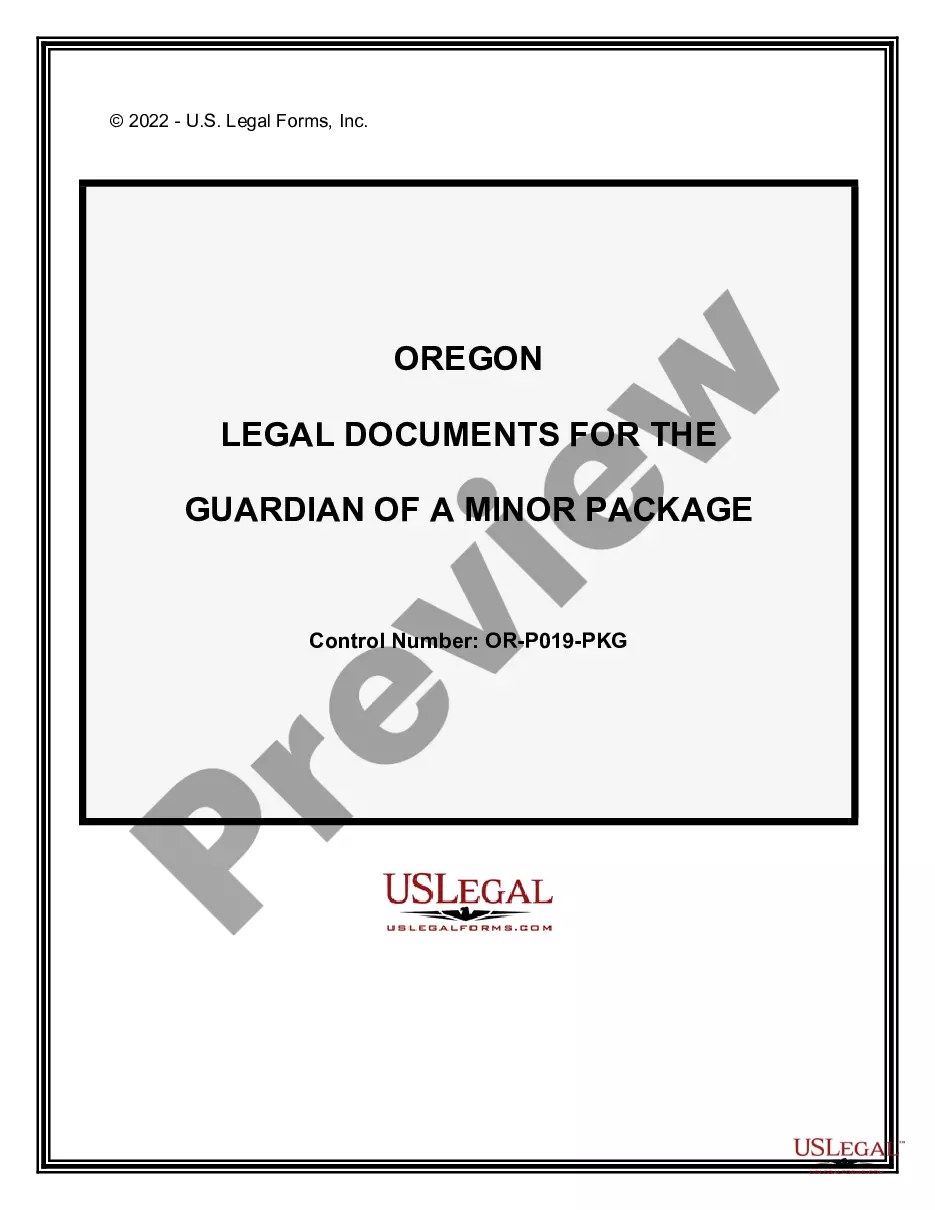

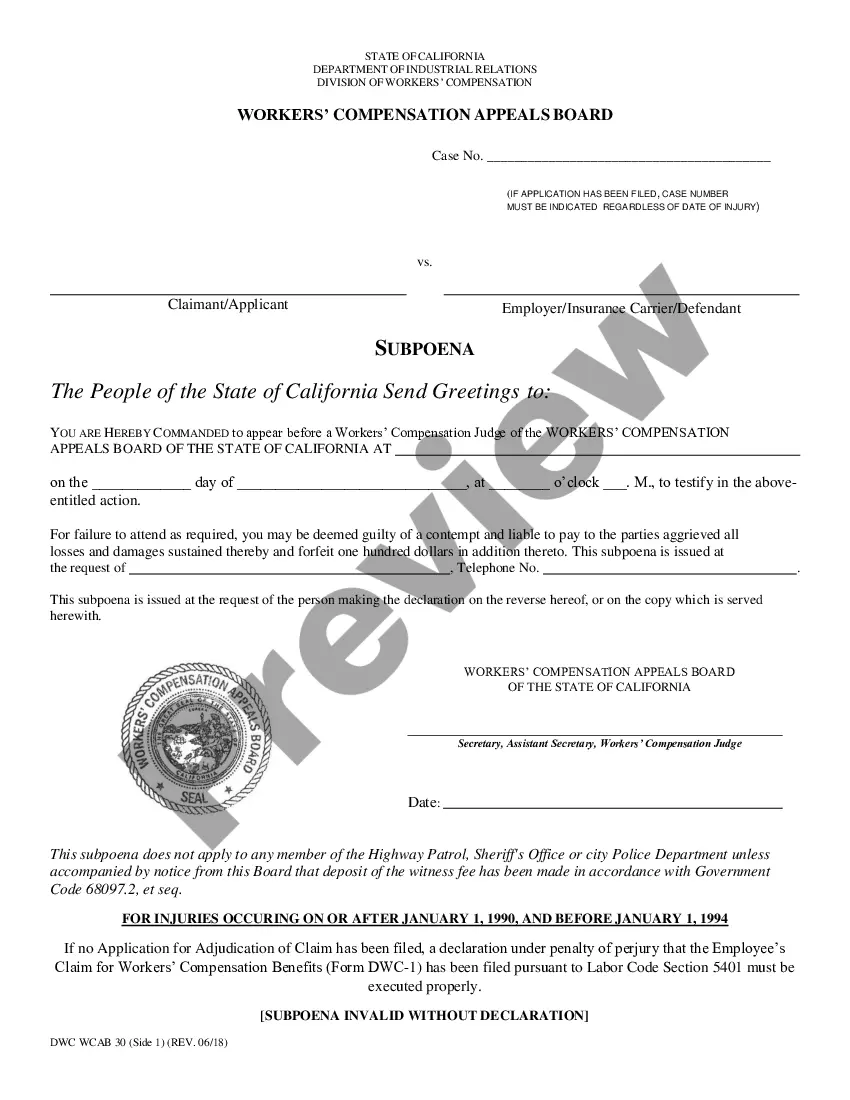

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the file format for your Bexar Qualified Written RESPA Request to Dispute or Validate Debt and download it.

Once done, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.

Step 1: Write the letter Don't contact me except to validate the debt. Report to the credit bureaus that the debt is disputed. Provide all of this information. Proof I owe the debt. The amount of the debt.If you validate the debt, cease contacting me for any reason other than to tell me you're suing me.

Keep in mind that disputing the validity of a debt does not mean you are refusing to pay. Rather, the collection agency must provide proof that you are legally obligated to pay the money to it. If the collection agency cannot provide this information, you are under no legal obligation to pay them.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

Do Debt Validation Letters really work? Yes, they do. When a debt collector receives a Debt Validation Letter, they are legally required to provide validation of the debt. Debt Validation Letter's work best when they include a cease and desist clause that forces a lawsuit.

How to Write a Debt Verification Letter Determine the exact amounts you owe. Gather documents that verify your debt. Get information on who you owe. Determine how old the debt is. Place a pause on the collection proceedings.

What Happens Now? If a debt collector can't verify your debt, then they must stop contacting you about it. And they have to let credit bureaus know so they can remove the debt from your credit report.

Do Debt Validation Letters really work? Yes, they do. When a debt collector receives a Debt Validation Letter, they are legally required to provide validation of the debt. Debt Validation Letter's work best when they include a cease and desist clause that forces a lawsuit.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

You have 30 days to dispute a debt or part of a debt within 30 days from when you first receive the required information from the debt collector.