Title: Bexar Texas Hardship Letter to Mortgagor or Lender: A Comprehensive Guide to Prevent Foreclosure Introduction: In Bexar County, Texas, homeowners facing financial hardships can draft a compelling hardship letter to their mortgagor or lender to prevent foreclosure. Understanding the different types of hardship letters available can help homeowners navigate the process effectively and increase the likelihood of a positive outcome. This article will provide a detailed description of what a Bexar Texas Hardship Letter entails and highlight distinctive variations that homeowners may consider. 1. Understanding Bexar Texas Hardship Letters: A Bexar Texas Hardship Letter is a formal written document prepared by a homeowner facing financial difficulties, aiming to request a modification or alternative solution to foreclosure from their mortgagor or lender. These letters must effectively communicate the homeowner's unique hardship situation while demonstrating their commitment to resolving the issue. 2. Key Components of a Bexar Texas Hardship Letter: — Homeowner Identification and Contact Information: Begin the letter with your full name, address, and contact details. — Loan and Property Information: Include details on the mortgage loan, including the account number, property address, and any relevant documentation. — Introduction: Clearly state the purpose of the letter, emphasizing the financial hardship you are experiencing. — Explanation of Hardship: Describe the specific financial setback causing the hardship, such as a job loss, medical emergency, divorce, or reduction in income. — Supporting Documentation: Attach relevant supporting documents, including pay stubs, medical bills, termination letters, and bank statements. — Proposed Solution: Offer a realistic and reasonable solution that aligns with your financial capabilities, such as a loan modification, forbearance, or refinancing. — Future Plan: Outline your plans to improve your financial situation and indicate your commitment to resolving the issue. — Conclusion: Express gratitude for the opportunity to present your case and provide contact details for any further communication. 3. Different Types of Bexar Texas Hardship Letters: — Medical Hardship Letter: Specifically addresses medical-related financial difficulties such as high medical bills, ongoing treatments, or loss of income due to health issues. — Unemployment Hardship Letter: Focuses on job loss or unemployment, explaining the impact on mortgage payments and presenting strategies for future employment. — Financial Hardship Letter: Suitable for various unforeseen circumstances such as divorce, death in the family, or significant unexpected expenses that affect the ability to make mortgage payments. — Natural Disaster Hardship Letter: Tailored for homeowners affected by natural disasters such as floods, storms, or wildfires, outlining the financial impact and requesting assistance. Conclusion: Drafting a well-crafted Bexar Texas Hardship Letter is crucial for homeowners navigating the foreclosure prevention process. By highlighting the specific type of hardship experienced and proposing a viable solution, homeowners can increase their chances of obtaining the desired outcome from their mortgagor or lender. Remember to seek professional guidance and utilize relevant keywords when drafting your Bexar Texas Hardship Letter to ensure its effectiveness in preventing foreclosure.

Bexar Texas Hardship Letter to Mortgagor or Lender to Prevent Foreclosure

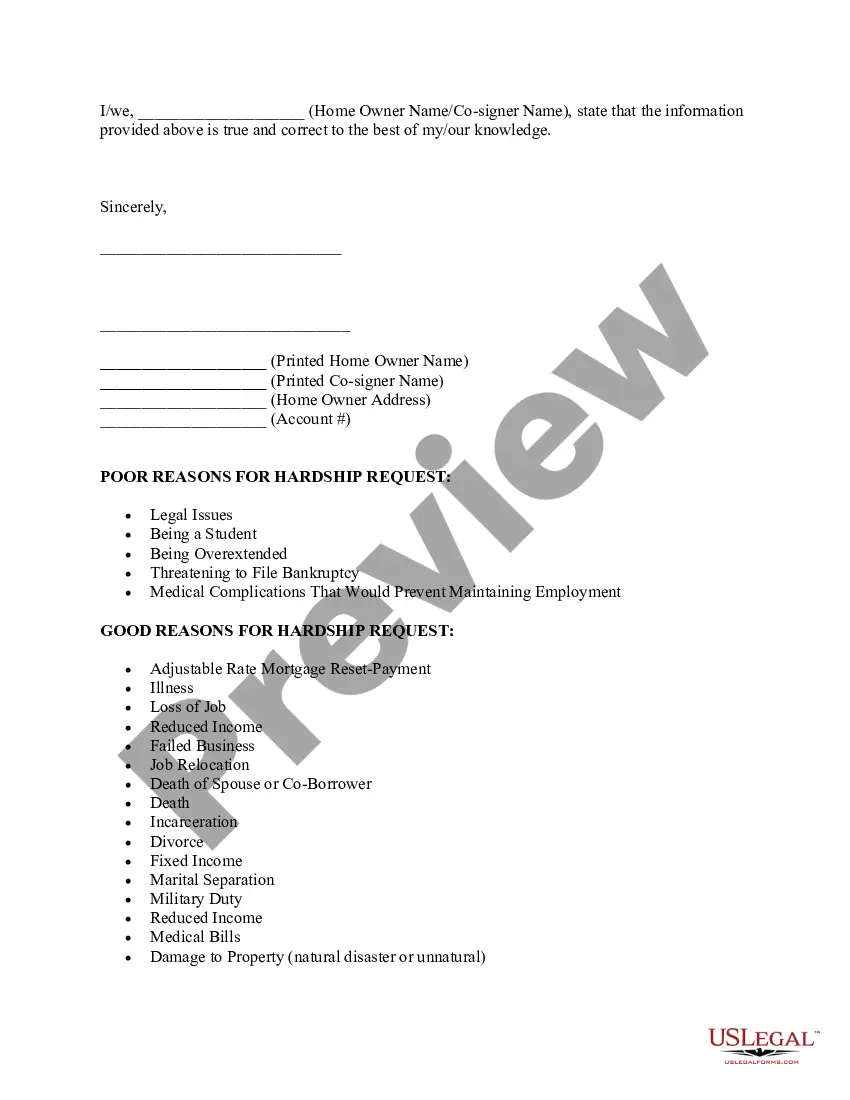

Description

How to fill out Bexar Texas Hardship Letter To Mortgagor Or Lender To Prevent Foreclosure?

Laws and regulations in every sphere vary throughout the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Bexar Hardship Letter to Mortgagor or Lender to Prevent Foreclosure, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for different life and business situations. All the documents can be used multiple times: once you purchase a sample, it remains accessible in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Bexar Hardship Letter to Mortgagor or Lender to Prevent Foreclosure from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Bexar Hardship Letter to Mortgagor or Lender to Prevent Foreclosure:

- Analyze the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the template once you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!