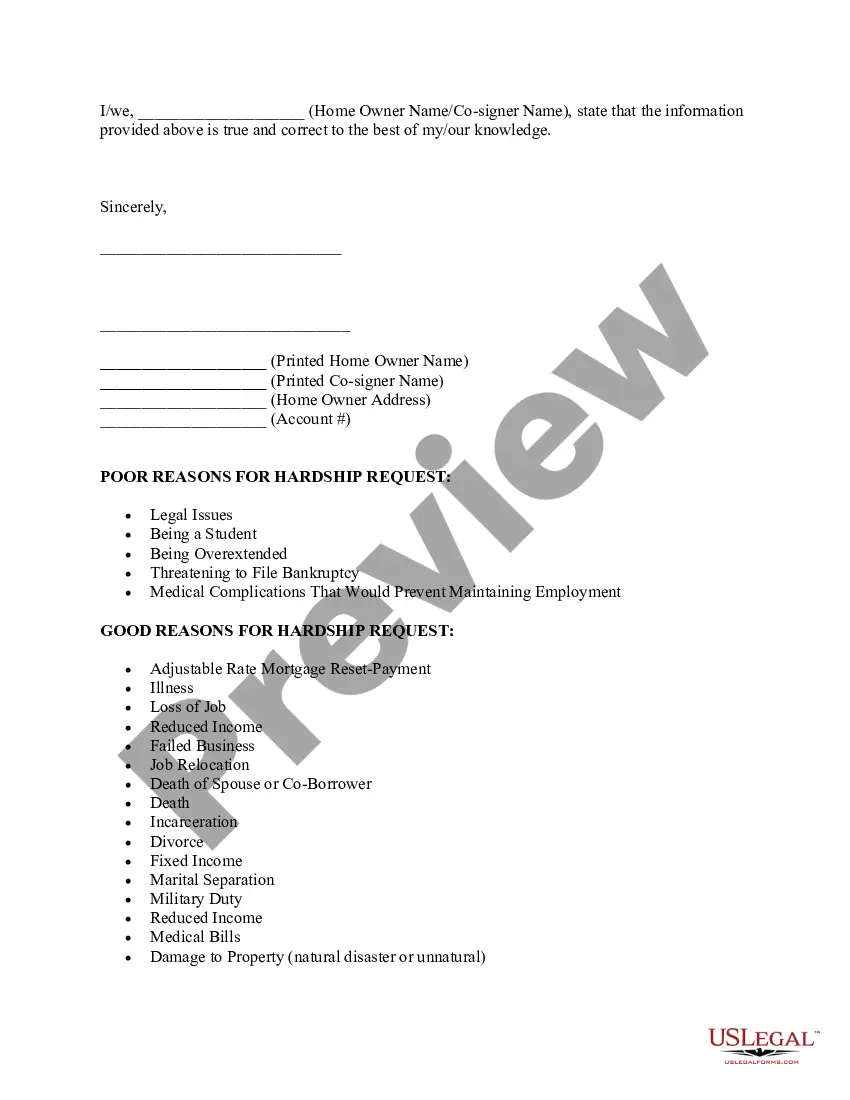

A Cook Illinois Hardship Letter to Mortgagor or Lender is a crucial document that homeowners facing financial difficulties submit to their mortgage lender in an attempt to prevent foreclosure. This letter outlines the specific hardships the homeowner is experiencing and explains why they are unable to meet their mortgage obligations. By providing detailed and relevant information about their situation, the aim is to persuade the lender to provide alternative solutions to foreclosure. Keywords: Cook Illinois, hardship letter, mortgagor, lender, prevent foreclosure There are different types of Cook Illinois Hardship Letters that homeowners can craft based on their unique situations. Some commonly known types include: 1. Unemployment Hardship Letter: This type of letter is written when an individual has lost their job, resulting in a financial setback that makes it impossible to make regular mortgage payments. 2. Medical Hardship Letter: When a homeowner or a family member experiences a serious illness or injury, resulting in significant medical expenses, this letter can be used to explain the financial strain it has caused, leading to mortgage payment challenges. 3. Divorce or Separation Hardship Letter: In situations where a homeowner faces divorce or separation, resulting in a significant decrease in household income and increased expenses, this letter can be used to highlight the impact on their ability to make mortgage payments. 4. Death of a Spouse or Family Member Hardship Letter: This type of letter is written by the surviving spouse or family member to explain the financial difficulties encountered due to the loss of a loved one and the subsequent impact on their ability to meet mortgage obligations. 5. Natural Disaster Hardship Letter: If a homeowner's property has been damaged or destroyed by a hurricane, flood, wildfire, or other natural disasters, this letter can be utilized to explain the related expenses and difficulties they are encountering in making mortgage payments. Regardless of the type of hardship letter, it is vital to include specific details about the circumstances, timelines, financial documentation (such as pay stubs, medical bills, divorce papers, etc.), and any efforts made by the homeowner to mitigate the situation (such as seeking employment, reduced expenses, etc.). Writing a Cook Illinois Hardship Letter to Mortgagor or Lender is a crucial step in attempting to prevent foreclosure. By providing a detailed description of the specific hardship faced, homeowners aim to convey their genuine willingness to resolve their financial challenges and maintain homeownership.

Cook Illinois Hardship Letter to Mortgagor or Lender to Prevent Foreclosure

Description

How to fill out Cook Illinois Hardship Letter To Mortgagor Or Lender To Prevent Foreclosure?

Whether you intend to start your business, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you must prepare certain paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business case. All files are grouped by state and area of use, so picking a copy like Cook Hardship Letter to Mortgagor or Lender to Prevent Foreclosure is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several additional steps to obtain the Cook Hardship Letter to Mortgagor or Lender to Prevent Foreclosure. Follow the instructions below:

- Make certain the sample fulfills your individual needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to get the sample once you find the correct one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Cook Hardship Letter to Mortgagor or Lender to Prevent Foreclosure in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!