A Harris Texas hardship letter is a crucial document written by the mortgagor or borrower to the lender in an effort to prevent foreclosure on their property. This letter explains the unique financial difficulties faced by the borrower and demonstrates their commitment to resolving the issue and maintaining homeownership. By including relevant keywords, we can highlight specific types of hardship letters tailored to different circumstances in Harris County, Texas. 1. Loss of Income Hardship Letter: If the borrower has experienced a significant loss of income due to job loss, reduced hours, company closure, or any other reason, they can write a hardship letter emphasizing these financial struggles. Relevant keywords include unemployment, job termination, reduced income, salary cuts, business closure, recession, etc. The purpose is to demonstrate the borrower's inability to meet their mortgage obligations due to income loss. 2. Medical Hardship Letter: When unforeseen medical expenses, chronic illness, or disability make it challenging for the borrower to keep up with mortgage payments, a medical hardship letter becomes necessary. Keywords such as medical bills, hospitalization, surgeries, chronic illness, disability, insurance, etc., should be included to indicate the medical circumstances affecting the borrower's financial stability. 3. Divorce or Separation Hardship Letter: In cases of divorce or separation, where the borrower's financial situation is impacted by the end of a marriage or separation from a spouse, a hardship letter addressing this situation is appropriate. Relevant keywords include legal separation, divorce proceedings, alimony, child support, division of assets, financial instability, etc. 4. Natural Disaster Hardship Letter: If the mortgagor's property has been damaged or destroyed by natural disasters common in Harris County, Texas, such as hurricanes, floods, or storms, they can write a hardship letter describing the events and the financial hardships resulting from these calamities. Keywords may include damage, destruction, FEMA assistance, insurance claims, flood insurance, storm damage, home repairs, etc. 5. Military Duty Hardship Letter: When a borrower, who is also a military service member, faces financial hardships due to deployment, relocation, or other military obligations, a military duty hardship letter can be written. Keywords like deployment, active duty, military relocation, deployment orders, military benefits, financial challenges, etc., should be included, emphasizing how military service has affected the borrower's ability to meet mortgage obligations. It is important to adapt the content of the hardship letter to the specific circumstances of the borrower, using appropriate keywords that reflect the hardships faced in Harris County, Texas. By providing a detailed and compelling explanation of their situation, borrowers can maximize their chances of obtaining a loan modification or alternative solution to prevent foreclosure.

Harris Texas Hardship Letter to Mortgagor or Lender to Prevent Foreclosure

Description

How to fill out Harris Texas Hardship Letter To Mortgagor Or Lender To Prevent Foreclosure?

Preparing papers for the business or individual demands is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to consider all federal and state laws of the particular area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to generate Harris Hardship Letter to Mortgagor or Lender to Prevent Foreclosure without professional help.

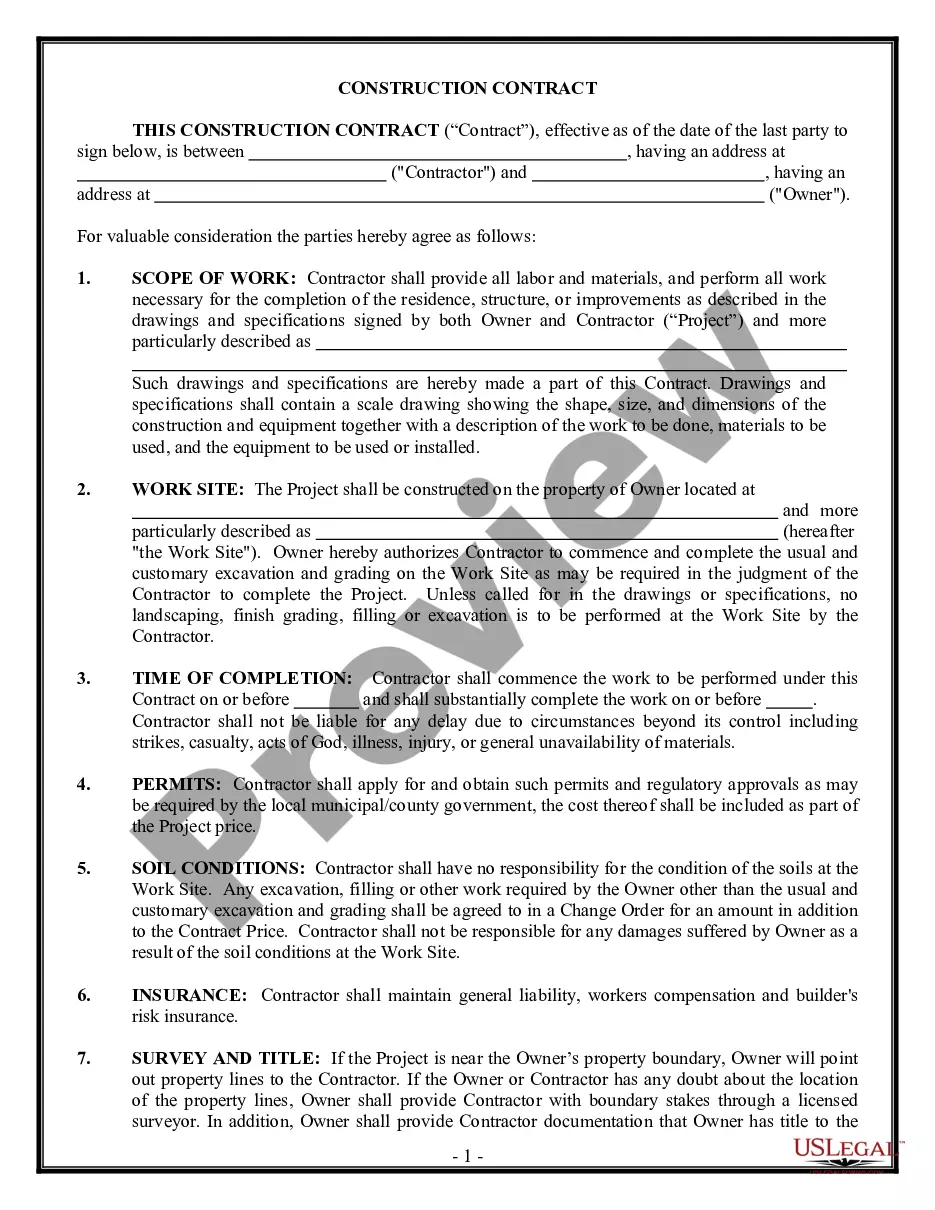

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid Harris Hardship Letter to Mortgagor or Lender to Prevent Foreclosure on your own, using the US Legal Forms web library. It is the biggest online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary document.

In case you still don't have a subscription, adhere to the step-by-step guide below to obtain the Harris Hardship Letter to Mortgagor or Lender to Prevent Foreclosure:

- Look through the page you've opened and check if it has the sample you require.

- To do so, use the form description and preview if these options are available.

- To find the one that satisfies your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any situation with just a few clicks!