Houston Texas Hardship Letter to Mortgagor or Lender to Prevent Foreclosure

Description

How to fill out Hardship Letter To Mortgagor Or Lender To Prevent Foreclosure?

Are you seeking to swiftly generate a legally-enforceable Houston Hardship Letter to Mortgagor or Lender to Avert Foreclosure or perhaps another document to manage your personal or business issues.

You have two choices: engage a professional to draft a legal document for you or craft it independently. Fortunately, there is a third option - US Legal Forms. This platform enables you to obtain expertly written legal documents without incurring excessive charges for legal services.

Restart the search process if the document does not meet your expectations using the search bar in the header.

Choose the plan that best meets your requirements and continue to payment. Select the file format you prefer for your document and download it. Print it, fill it out, and sign on the designated line. If you already have an account, you can simply Log In to it, find the Houston Hardship Letter to Mortgagor or Lender to Avert Foreclosure template, and download it. To re-download the form, navigate to the My documents tab.

- US Legal Forms boasts an extensive library of over 85,000 state-compliant form templates, including the Houston Hardship Letter to Mortgagor or Lender to Avert Foreclosure and various form packages.

- We provide documents for a wide range of scenarios: from divorce filings to real estate papers.

- Having operated for over 25 years, we've earned an impeccable reputation among our users.

- Here’s a way to join our satisfied customers and acquire the needed template without hassle.

- Firstly, ensure that the Houston Hardship Letter to Mortgagor or Lender to Avert Foreclosure aligns with your state’s or county’s regulations.

- If the document includes a description, verify its applicability.

Form popularity

FAQ

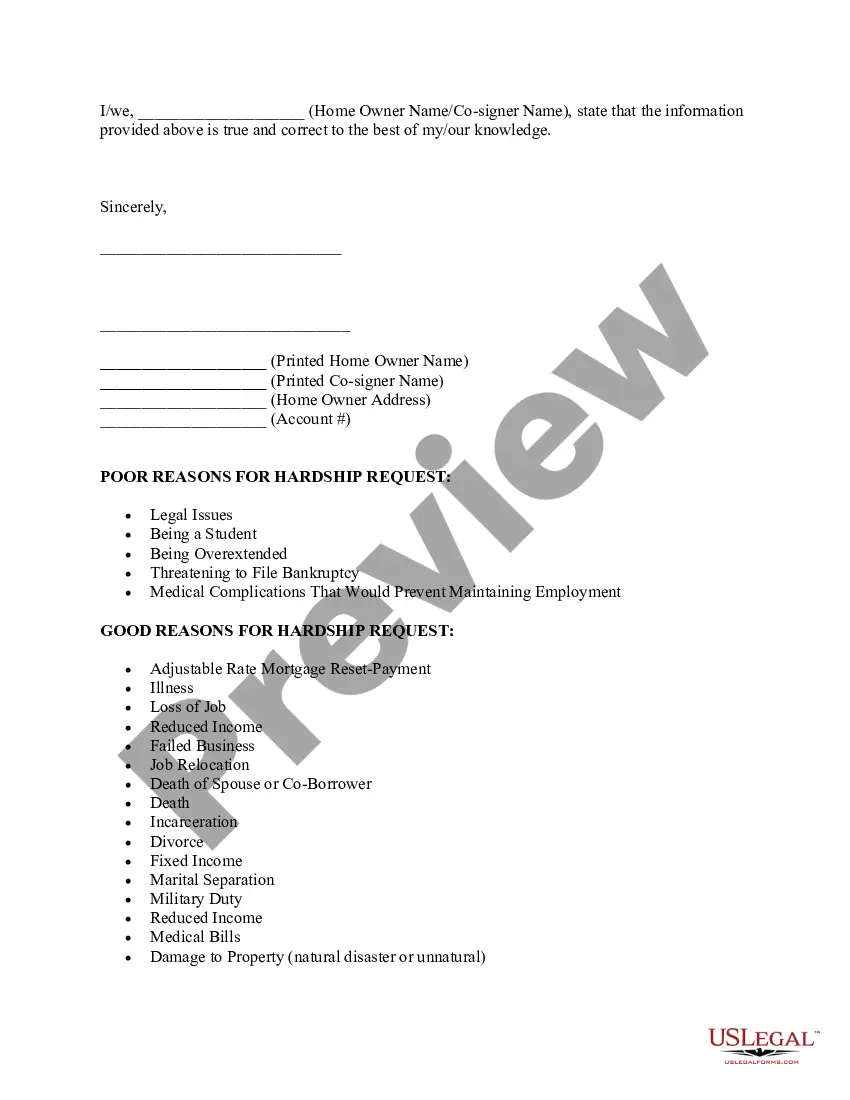

Begin your hardship letter by addressing the recipient appropriately and thanking them for their time. Then, introduce your situation succinctly, mentioning your mortgage account details for clarity. It is helpful to affirm your intention to work collaboratively towards a solution. Starting your Houston Texas Hardship Letter to Mortgagor or Lender to Prevent Foreclosure in this way sets a positive tone for the rest of the communication.

When crafting your hardship letter, avoid blaming others or making unrealistic demands. Steer clear of emotional appeals that do not provide factual support for your situation. It is also not advisable to include any personal details that do not relate to your financial hardship directly. A focused Houston Texas Hardship Letter to Mortgagor or Lender to Prevent Foreclosure will be most effective at conveying your message.

To write a hardship letter to stop foreclosure, begin by detailing your financial situation clearly. Include relevant information about job loss, medical bills, or other difficulties affecting your payments. Clearly state your request for assistance and express your commitment to resolving the situation. A well-structured Houston Texas Hardship Letter to Mortgagor or Lender to Prevent Foreclosure can serve as a strong tool for negotiation.

A hardship statement outlines the difficulties one faces that impact their ability to make mortgage payments. For instance, an unexpected job loss or a medical emergency can be included. This statement should express your situation clearly, showing why you can no longer meet your obligations. A well-crafted Houston Texas Hardship Letter to Mortgagor or Lender to Prevent Foreclosure should convey these details effectively.

A mortgage hardship letter is a written document that explains your financial difficulties to your lender. It should detail why you are unable to make your mortgage payments and outline your plans to recover. By including a Houston Texas Hardship Letter to Mortgagor or Lender to Prevent Foreclosure, you can enhance your appeal for relief options. This letter can help your lender understand your situation better and consider granting you the assistance you need.

Avoid including unnecessary personal information or emotional rants in a hardship letter. Steer clear of blaming others or making demands without context. Instead, focus on providing factual details that justify your request in the Houston Texas Hardship Letter to Mortgagor or Lender to Prevent Foreclosure, ensuring your message remains professional and persuasive.

An example of a letter explaining hardship should detail the specific circumstances that led to your financial struggles. It should articulate your current situation with clear examples and maintain a respectful tone. Utilizing the format of the Houston Texas Hardship Letter to Mortgagor or Lender to Prevent Foreclosure can serve as a valuable guide as you draft your letter.

Start a hardship letter by addressing the lender or mortgagor directly, using their name if possible. Begin with a brief introduction, stating your purpose and the specifics of your situation. This opening establishes the context for the Houston Texas Hardship Letter to Mortgagor or Lender to Prevent Foreclosure and engages the reader right away.

When writing a letter explaining your financial situation, be honest and direct about your challenges. Provide specific examples of your hardships and how they have affected your ability to meet financial obligations. A well-crafted Houston Texas Hardship Letter to Mortgagor or Lender to Prevent Foreclosure helps convey your emotions and intentions effectively.

A good hardship letter clearly outlines your situation and presents your request in a straightforward manner. For instance, it should include details about your financial difficulties, such as medical expenses or income loss. The Houston Texas Hardship Letter to Mortgagor or Lender to Prevent Foreclosure should also express your willingness to work towards a solution, which demonstrates accountability.