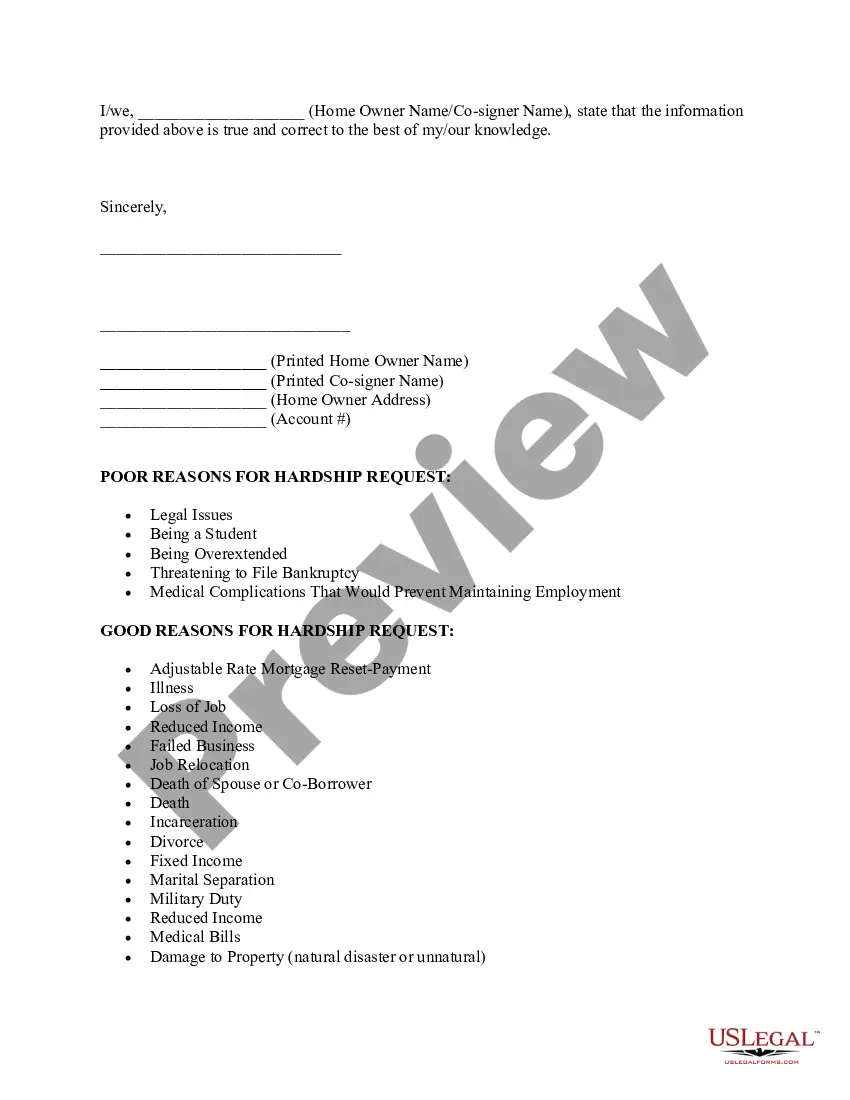

A Maricopa Arizona hardship letter to the mortgagor or lender is a written statement that explains the financial challenges faced by a homeowner, seeking assistance to prevent foreclosure on their property. This letter serves as a plea for leniency, showcasing the borrower's genuine effort to resolve the situation and maintain their ownership. Key elements commonly included in a Maricopa Arizona hardship letter are: 1. Introduction: The letter should begin with a formal greeting, address, and the date. It is crucial to address the lender or mortgagor by name whenever possible, to personalize the communication. 2. Borrower's Information: Start by providing your full name, current address, contact details, and the specific loan or account number associated with the mortgage. 3. Explanation of Hardship: Clearly describe the financial hardship that has led to the inability to make mortgage payments. Common explanations could include sudden job loss, reduced income, medical emergencies, divorce, or natural disasters affecting the property. 4. Supporting Documentation: To reinforce the authenticity of the claimed hardship, it is highly recommended attaching relevant supporting documentation. Examples include medical bills, termination notices, bank statements, or divorce papers. 5. Request for Mortgage Assistance Options: Clearly state the desired outcome, such as loan modification, forbearance, repayment plan, or any other potential options that could help prevent foreclosure. Mention any specific programs available in Maricopa Arizona that could be beneficial. 6. Financials Overview: Provide a detailed breakdown of monthly income sources, including employment, government assistance, or other means of generating income. List all essential monthly expenses, highlighting any unavoidable debts or obligations. 7. Demonstrating Willingness to Repay: Emphasize your commitment to resolving the situation by illustrating your effort to overcome the financial hardship. Mention any steps taken to increase income, reduce expenses, or seek additional financial counseling. 8. Closing Statement: Summarize the main points of your letter, expressing gratitude for their consideration and reiterating your request for assistance. Sign the letter with your full name and contact information. Types of Maricopa Arizona hardship letters include: 1. Job Loss Hardship Letter: When the primary borrower loses their job, impacting their ability to make mortgage payments. 2. Medical Hardship Letter: When unexpected medical expenses or long-term medical conditions create financial hardships. 3. Divorce or Separation Hardship Letter: If a divorce or separation results in the inability to afford the mortgage payment. 4. Natural Disaster Hardship Letter: When the property has been damaged or rendered uninhabitable due to a natural disaster, resulting in financial hardship. 5. Income Reduction Hardship Letter: When a reduction in income, such as a pay cut or reduced working hours, affects the borrower's ability to meet mortgage obligations. By providing a comprehensive, well-documented, and compelling hardship letter, Maricopa Arizona homeowners can increase their chances of receiving the necessary assistance to prevent foreclosure.

Maricopa Arizona Hardship Letter to Mortgagor or Lender to Prevent Foreclosure

Description

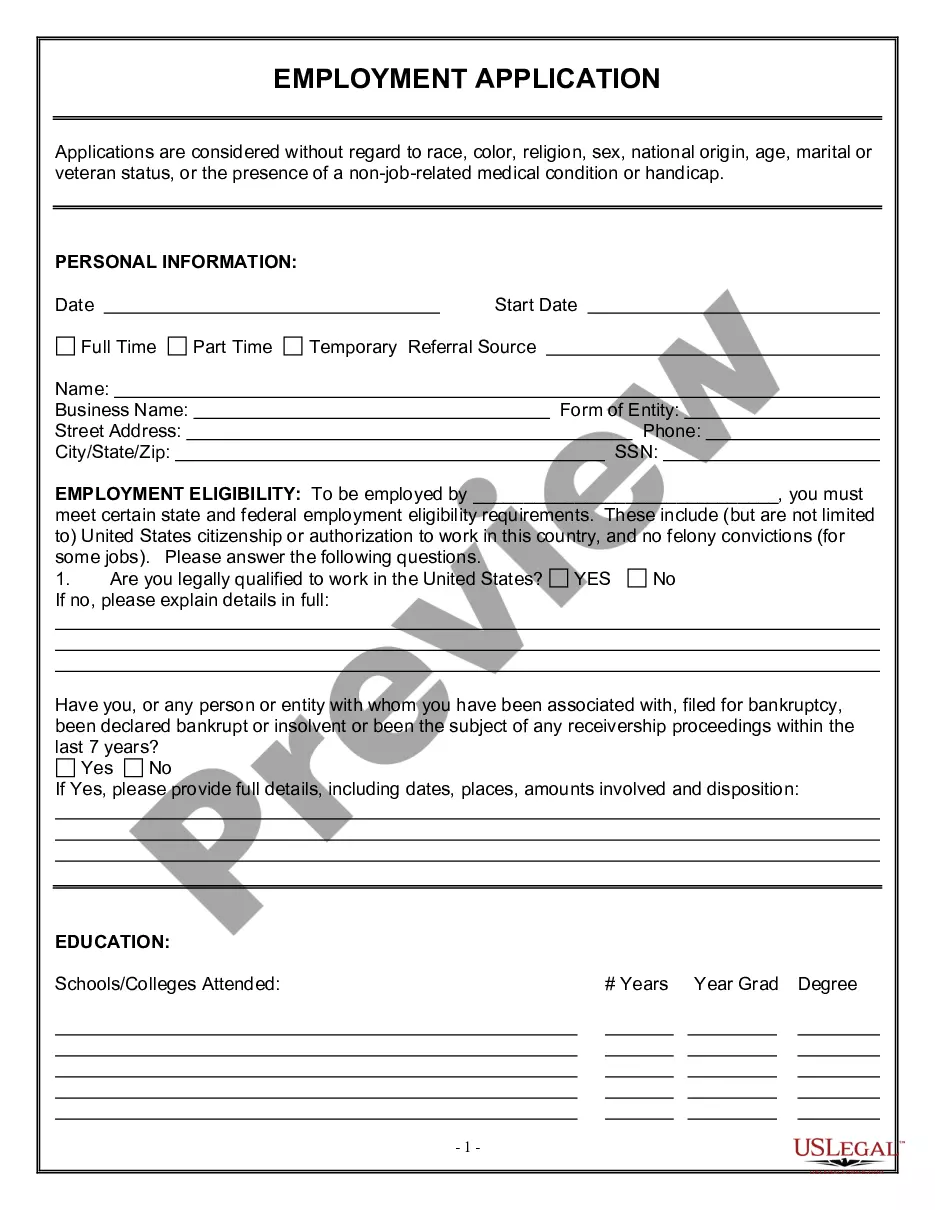

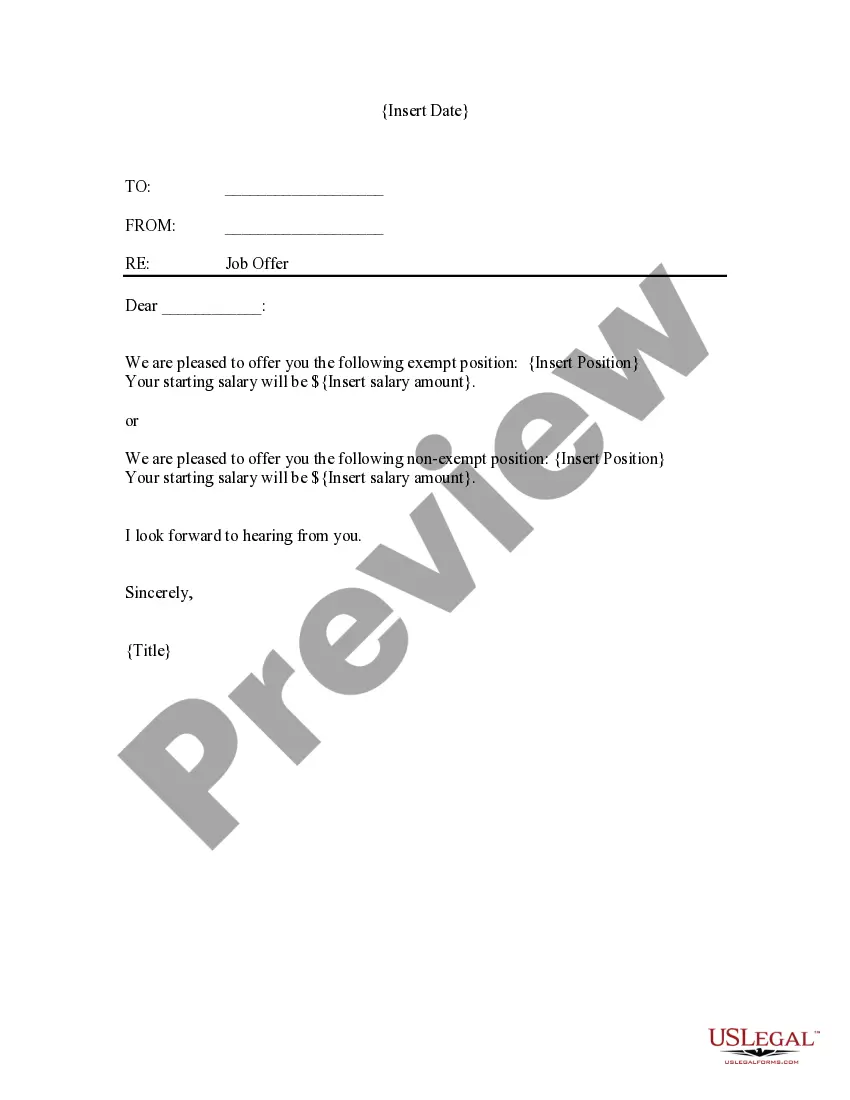

How to fill out Maricopa Arizona Hardship Letter To Mortgagor Or Lender To Prevent Foreclosure?

Drafting paperwork for the business or individual demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state laws and regulations of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to create Maricopa Hardship Letter to Mortgagor or Lender to Prevent Foreclosure without professional assistance.

It's easy to avoid wasting money on lawyers drafting your paperwork and create a legally valid Maricopa Hardship Letter to Mortgagor or Lender to Prevent Foreclosure by yourself, using the US Legal Forms web library. It is the biggest online collection of state-specific legal templates that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed form.

In case you still don't have a subscription, follow the step-by-step guideline below to get the Maricopa Hardship Letter to Mortgagor or Lender to Prevent Foreclosure:

- Look through the page you've opened and check if it has the document you need.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that satisfies your needs, use the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any situation with just a couple of clicks!