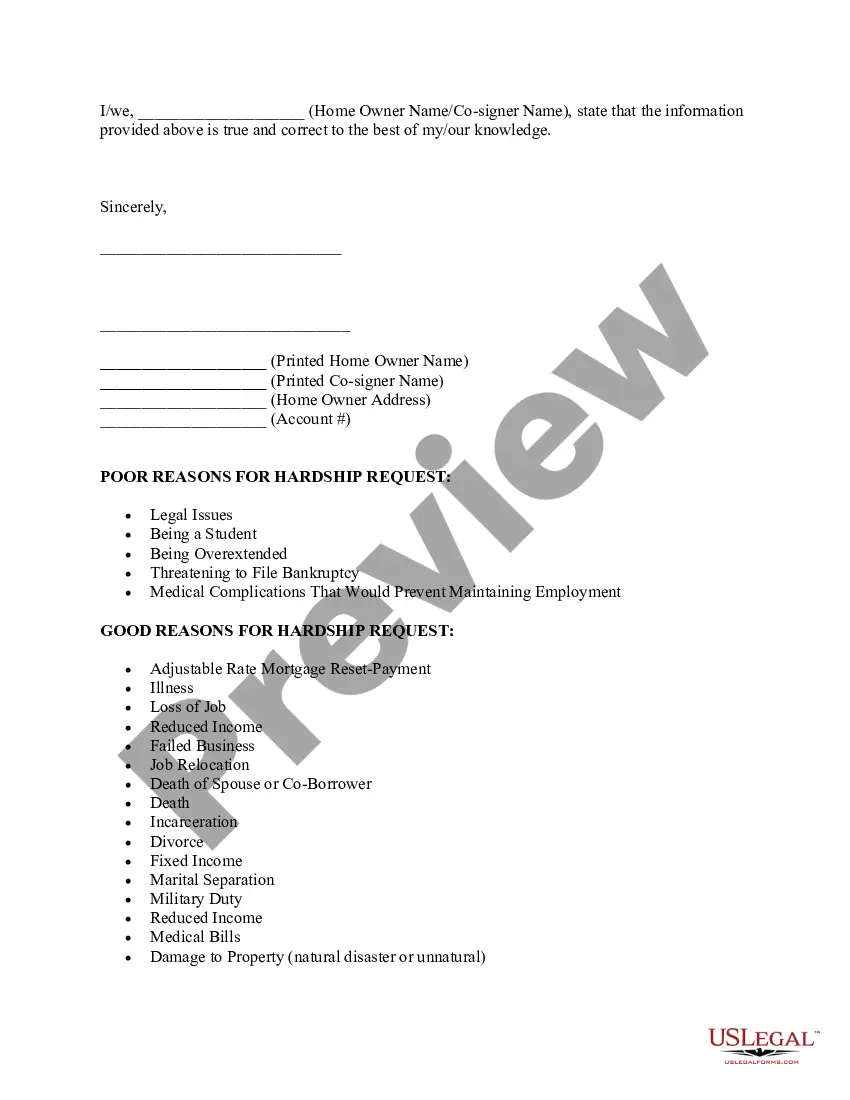

Middlesex Massachusetts is a county located in eastern Massachusetts that is known for its diverse population, vibrant communities, and rich history. It is home to numerous cities and towns, including Lowell, Cambridge, and Newton, among others. A Middlesex Massachusetts Hardship Letter to a Mortgagor or Lender is a document submitted by a homeowner facing financial difficulties to request assistance and prevent foreclosure on their property. This letter serves as a personal appeal to the lender, outlining the borrower's current hardship and the steps they have taken or plan to take to resolve the issue. It is important to note that there may not be specific "types" of Middlesex Massachusetts Hardship Letters, as the content typically revolves around the borrower's unique circumstances. However, there are common elements and keywords that should be included in the letter to effectively communicate the borrower's situation. 1. Introduction: The letter should begin with a respectful salutation and an introduction that clearly states the intention of the letter — to request assistance in avoiding foreclosure. 2. Personal Information: Include the borrower's full name, address, contact information, and mortgage account details to ensure the lender can identify the specific loan in question. 3. Description of Hardship: Provide a detailed explanation of the financial hardship that is making it difficult to meet mortgage payments. It could be due to job loss, reduced income, medical issues, divorce, or other valid reasons. 4. Supporting Documentation: Include any supporting documents that validate the claim made in the hardship letter, such as medical records, termination letters, bank statements, or any other evidence of the financial crisis. 5. Actions Taken: Outline the steps taken to address the hardship, such as seeking new employment, attending financial counseling, or exploring loan modification options. 6. Financial Information: Provide a comprehensive overview of the borrower's current financial situation, including income, expenses, assets, and liabilities. This information helps the lender assess the borrower's ability to resume regular mortgage payments in the future. 7. Proposed Solutions: Suggest possible solutions to resolve the financial difficulties and prevent foreclosure. For instance, requesting a loan modification, forbearance, or proposing a repayment plan that suits the borrower's current financial capabilities. 8. Conclusion: Express gratitude for the lender's attention and consideration, and request a timely review of the hardship letter. Provide contact information for further communication and clarify the desired outcome, such as a loan modification agreement. It is crucial to write the hardship letter concisely, clearly, and with a tone of sincerity and desperation. The letter should effectively communicate the borrower's genuine need for assistance while highlighting their commitment to finding a solution and maintaining homeownership.

Middlesex Massachusetts Hardship Letter to Mortgagor or Lender to Prevent Foreclosure

Description

How to fill out Middlesex Massachusetts Hardship Letter To Mortgagor Or Lender To Prevent Foreclosure?

Preparing legal documentation can be difficult. In addition, if you decide to ask a lawyer to draft a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Middlesex Hardship Letter to Mortgagor or Lender to Prevent Foreclosure, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario collected all in one place. Consequently, if you need the current version of the Middlesex Hardship Letter to Mortgagor or Lender to Prevent Foreclosure, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Middlesex Hardship Letter to Mortgagor or Lender to Prevent Foreclosure:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the document format for your Middlesex Hardship Letter to Mortgagor or Lender to Prevent Foreclosure and save it.

When finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!