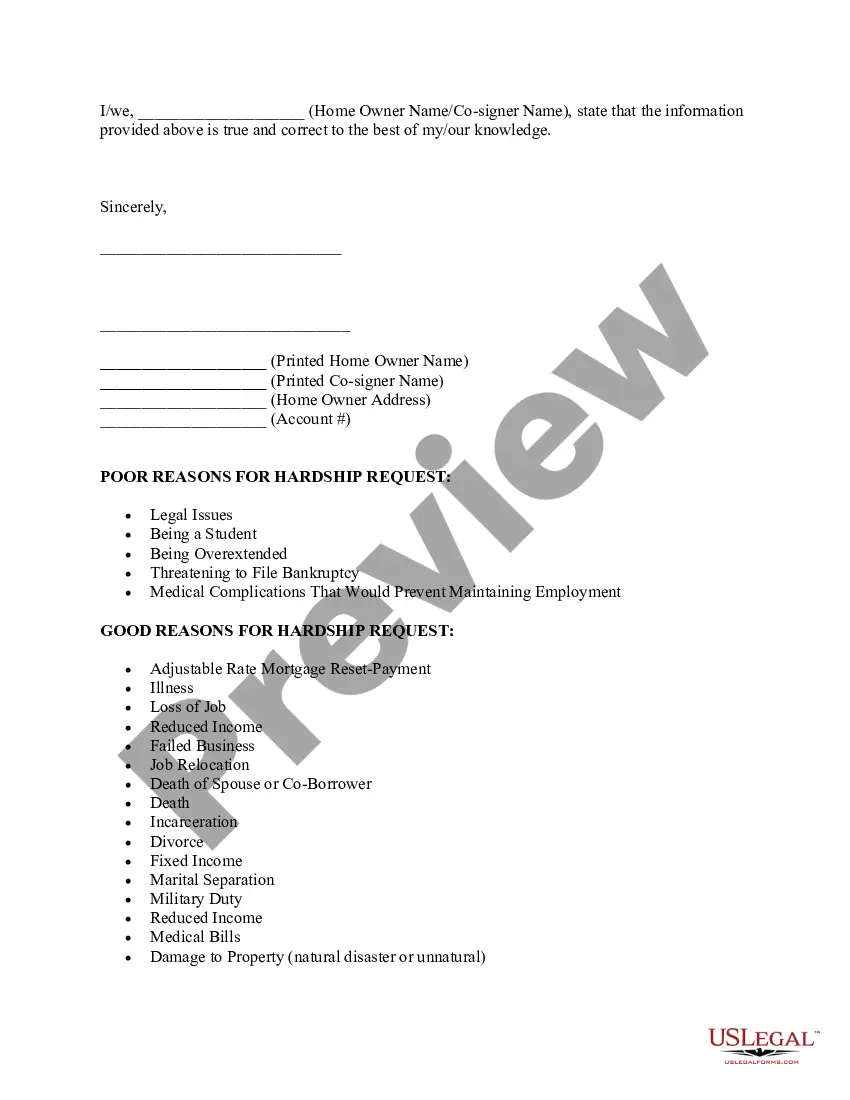

Title: Salt Lake Utah Hardship Letter to Mortgagor or Lender to Prevent Foreclosure — A Detailed Description and Types Introduction: A Salt Lake Utah hardship letter to a mortgagor or lender is a crucial document that homeowners facing financial distress can use to request assistance and prevent foreclosure. This letter outlines the homeowner's current financial situation, demonstrates genuine hardship, proposes potential solutions, and aims to negotiate alternate repayment options with their lender. In Salt Lake Utah, there are a few different types of hardship letters tailored to specific circumstances. Let's explore them in more detail: 1. Job Loss or Income Reduction Hardship Letter: This type of hardship letter is relevant for homeowners who have experienced a sudden job loss, reduced work hours, or a significant decrease in income. It emphasizes the negative impact these events have had on the homeowner's ability to meet their mortgage obligations. The letter typically includes supporting documentation such as termination letters, pay stubs, or bank statements. 2. Medical Hardship Letter: Homeowners facing mounting medical bills, long-term illnesses, or disability-related challenges can benefit from a medical hardship letter. Such a letter highlights the financial strain caused by medical expenses and the inability to maintain regular mortgage payments. Enclosures may comprise medical records, bills, insurance statements, or disability verification documents. 3. Divorce or Separation Hardship Letter: When homeowners experience a divorce or separation, it can lead to reduced income, increased expenses, and difficulty managing mortgage payments. A divorce or separation hardship letter outlines the financial impact of the situation, including legal fees, child support, or alimony payments. Relevant documentation like divorce decrees or court orders strengthens the case. 4. Natural Disaster Hardship Letter: In Salt Lake Utah, natural disasters like wildfires, earthquakes, or floods can cause extensive property damage and financial strain. A hardship letter in this context focuses on the homeowner's need for assistance due to expenses related to repairing the property, insurance claims, or temporary displacement. Including insurance claim details or property damage reports can bolster the letter's authenticity. 5. Military Hardship Letter: For active-duty military personnel deployed away from Salt Lake Utah, or veterans facing financial hardship due to service-related injuries, a military hardship letter can be prepared. This letter explains the homeowner's unique military circumstances and their impact on mortgage payment ability. Supporting documents may include deployment orders, military leave records, or injury reports. Conclusion: A Salt Lake Utah hardship letter to a mortgagor or lender serves as a crucial tool for homeowners in financial distress seeking to prevent foreclosure. By customizing the letter to their specific situation, homeowners can effectively communicate their hardship, propose alternative solutions, and request assistance from their lender. Depending on the circumstances, various types of hardship letters are available, including those related to job loss, medical issues, divorce, natural disasters, or military service. These letters, along with supporting documentation, can help homeowners navigate the foreclosure prevention process and secure a favorable outcome.

Salt Lake Utah Hardship Letter to Mortgagor or Lender to Prevent Foreclosure

Description

How to fill out Salt Lake Utah Hardship Letter To Mortgagor Or Lender To Prevent Foreclosure?

Laws and regulations in every sphere differ around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Salt Lake Hardship Letter to Mortgagor or Lender to Prevent Foreclosure, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals looking for do-it-yourself templates for different life and business occasions. All the documents can be used many times: once you obtain a sample, it remains accessible in your profile for further use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Salt Lake Hardship Letter to Mortgagor or Lender to Prevent Foreclosure from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Salt Lake Hardship Letter to Mortgagor or Lender to Prevent Foreclosure:

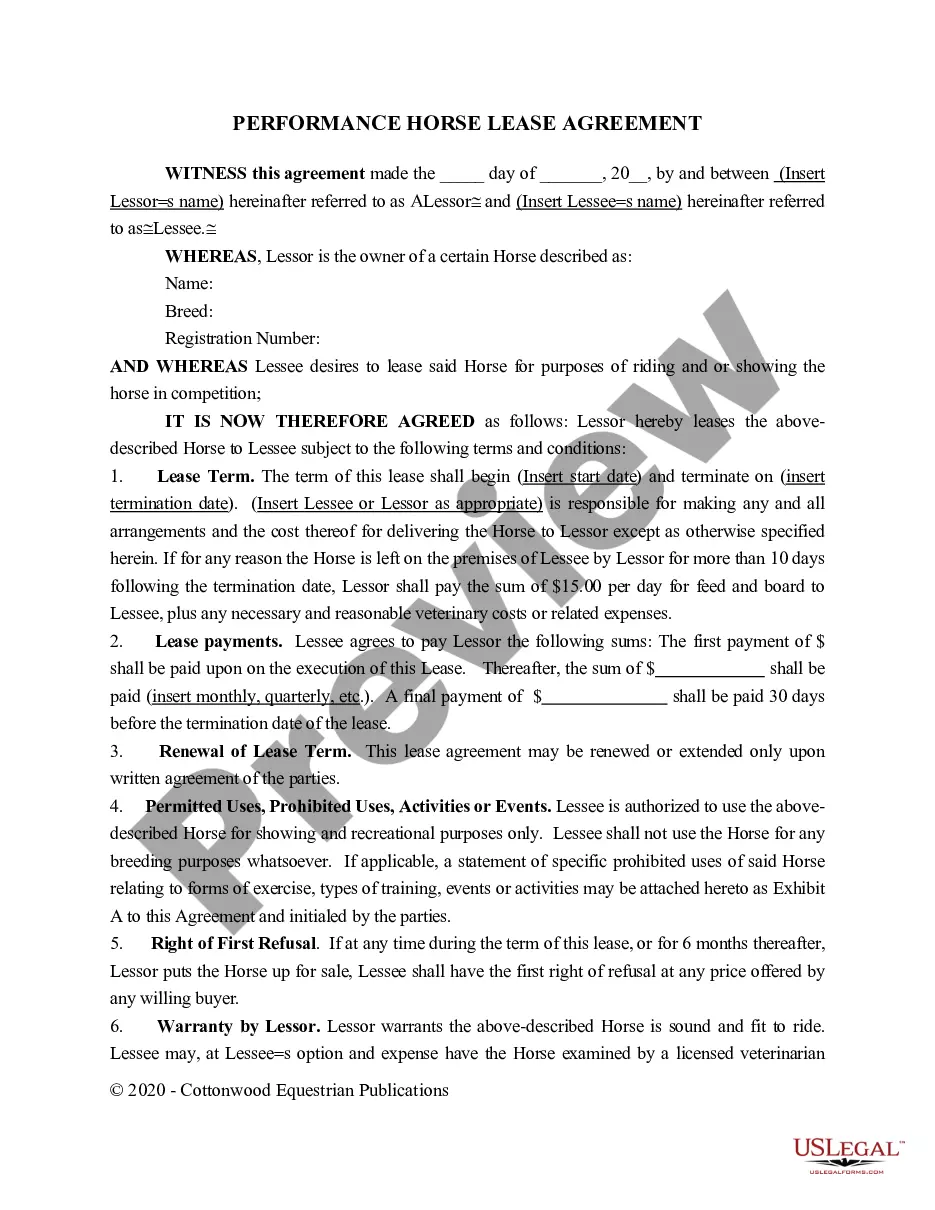

- Take a look at the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the template once you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!