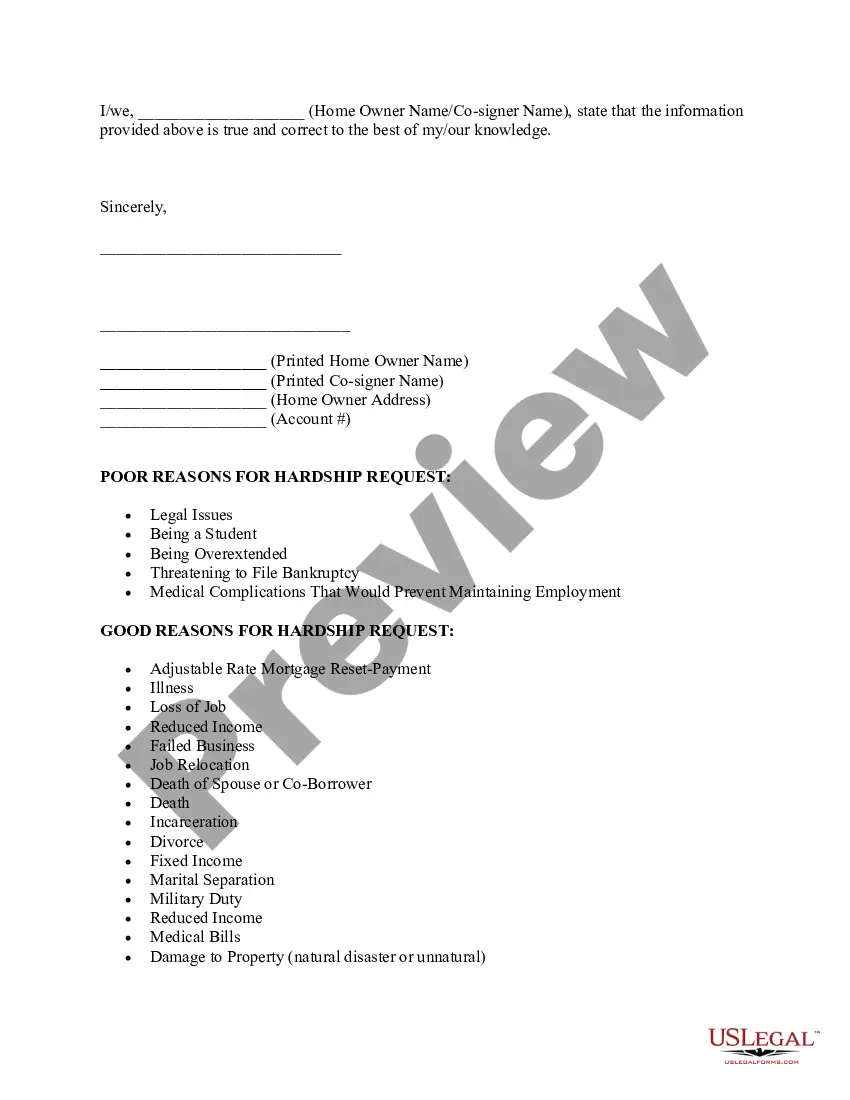

San Antonio Texas Hardship Letter to Mortgagor or Lender to Prevent Foreclosure — Detailed Description Introduction: A San Antonio Texas hardship letter is a formal document written by a homeowner facing financial difficulties, seeking assistance from their lender or mortgagor to prevent foreclosure. This letter serves as a plea for understanding and a request for viable alternatives to foreclosure, emphasizing the borrower's desire to maintain homeownership and resolve the financial hardship they are facing. Key Elements of a San Antonio Texas Hardship Letter: 1. Identification and Contact Information: The letter starts by stating the borrower's full name, address, contact number, and loan details such as loan number, account name, and lender's name. 2. Explanation of Financial Hardship: The borrower provides a detailed and honest explanation of the specific financial hardship they are experiencing. This may include unemployment, reduced income, job loss, medical issues, divorce, death in the family, or other unforeseen circumstances. The emphasis must be on the external factors that have led to the default in mortgage payments. 3. Impact on Mortgage Payments: The letter highlights the impact of the financial hardship on the borrower's ability to make timely mortgage payments. It includes detailed information about missed payments, late fees, and any other charges incurred as a result of the financial struggle. 4. Steps Taken to Mitigate the Situation: The borrower describes the steps they have taken to mitigate the financial difficulties, such as seeking new employment, enrolling in job training programs, reducing expenses, and exploring other income sources. This section demonstrates their proactive approach towards resolving the situation. 5. Request for Alternatives to Foreclosure: The borrower clearly conveys their intent to find an alternative to foreclosure and requests possible options. This may include loan modification, forbearance, repayment plans, short sale, or other alternatives available through the lender or mortgagor. 6. Enclosure of Supporting Documentation: The San Antonio Texas hardship letter should be accompanied by supporting documentation, such as proof of income, bank statements, medical bills, termination letters, divorce decrees, or any other relevant documents that substantiate the financial hardship described. Different Types of San Antonio Texas Hardship Letters: 1. Loss of Income Hardship Letter: This type of letter is applicable when the borrower experiences a significant reduction in income or job loss, making it challenging to meet mortgage obligations. It focuses on explaining the circumstances leading to income loss and proposing a solution. 2. Medical Hardship Letter: When borrowers face overwhelming medical expenses or health issues, they may write a medical hardship letter. This letter should provide medical reports, bills, and a detailed account of how the medical condition has affected their ability to make mortgage payments. 3. Divorce Hardship Letter: In cases of divorce or separation, where the borrower's financial situation is adversely affected, a divorce hardship letter can be written. This letter should detail the division of assets, reduced income, and increased expenses following the divorce or separation. Conclusion: A San Antonio Texas hardship letter is a crucial tool for homeowners facing financial challenges and seeking assistance from their lender or mortgagor to prevent foreclosure. By presenting a clear and detailed account of the circumstances leading to their financial hardship, borrowers can express their intent to find a resolution and maintain homeownership. Different types of hardship letters cater to specific situations such as loss of income, medical issues, or divorce, allowing borrowers to customize their approach based on their unique circumstances.

San Antonio Texas Hardship Letter to Mortgagor or Lender to Prevent Foreclosure

Description

How to fill out San Antonio Texas Hardship Letter To Mortgagor Or Lender To Prevent Foreclosure?

Whether you plan to open your business, enter into a contract, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare certain documentation meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business case. All files are collected by state and area of use, so picking a copy like San Antonio Hardship Letter to Mortgagor or Lender to Prevent Foreclosure is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few more steps to get the San Antonio Hardship Letter to Mortgagor or Lender to Prevent Foreclosure. Follow the instructions below:

- Make certain the sample fulfills your personal needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to get the sample once you find the proper one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the San Antonio Hardship Letter to Mortgagor or Lender to Prevent Foreclosure in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!