A Wake North Carolina hardship letter, also known as a hardship letter to mortgagor or lender, is a formal document crafted by homeowners facing financial difficulties in order to appeal to their mortgage lender and prevent foreclosure. This heartfelt letter outlines the borrower's current financial crisis and convinces the lender that they should provide alternative options rather than foreclosing on their property. Keywords: Wake North Carolina, hardship letter, mortgagor, lender, prevent foreclosure, financial difficulties, mortgage lender, alternative options, property, foreclosure. There are different types of Wake North Carolina hardship letters to the mortgagor or lender that individuals can create, depending on their unique situation and circumstances. These letters may vary in content, but their primary goal remains the same: to demonstrate the homeowner's determination to resolve their financial hardship and avoid the devastating consequences of foreclosure. 1. Financial Hardship Letter: Homeowners facing a sudden and unexpected job loss, reduction in income, or a medical emergency can write a financial hardship letter to explain their current predicament and how it has affected their ability to make timely mortgage payments. This type of letter emphasizes the temporary nature of their financial setback and the steps they are taking to regain stability. 2. Divorce or Marriage Dissolution Hardship Letter: When couples are going through the challenging process of divorce or dissolution of marriage, their financial circumstances may change drastically. A hardship letter in this context aims to outline the impact of this life event on the borrower’s ability to fulfill mortgage obligations. It may include details of the division of assets and income changes, along with a plan for future financial stability. 3. Medical Hardship Letter: In cases where homeowners or their immediate family members face severe health issues, a medical hardship letter can be crafted. This letter provides the lender with comprehensive details of the medical condition, associated expenses, and the subsequent impact on the borrower's financial situation. It may also include supporting documents such as medical bills or doctor's notes. 4. Natural Disaster Hardship Letter: Wake North Carolina is susceptible to natural disasters such as hurricanes, floods, or tornadoes. Homeowners facing the aftermath of such events can write a hardship letter to notify their mortgage lender of the damage to their property and the resulting financial strain. This type of letter may include photographs, insurance claim details, or any relevant documents supporting the situation. Regardless of the type, a Wake North Carolina hardship letter to the mortgagor or lender should be succinct, honest, and provide a clear explanation of the borrower's situation. Failure to provide accurate and convincing information may hinder the possibility of obtaining favorable options such as loan modification, forbearance, or alternative repayment plans, making foreclosure more likely.

Wake North Carolina Hardship Letter to Mortgagor or Lender to Prevent Foreclosure

Description

How to fill out Wake North Carolina Hardship Letter To Mortgagor Or Lender To Prevent Foreclosure?

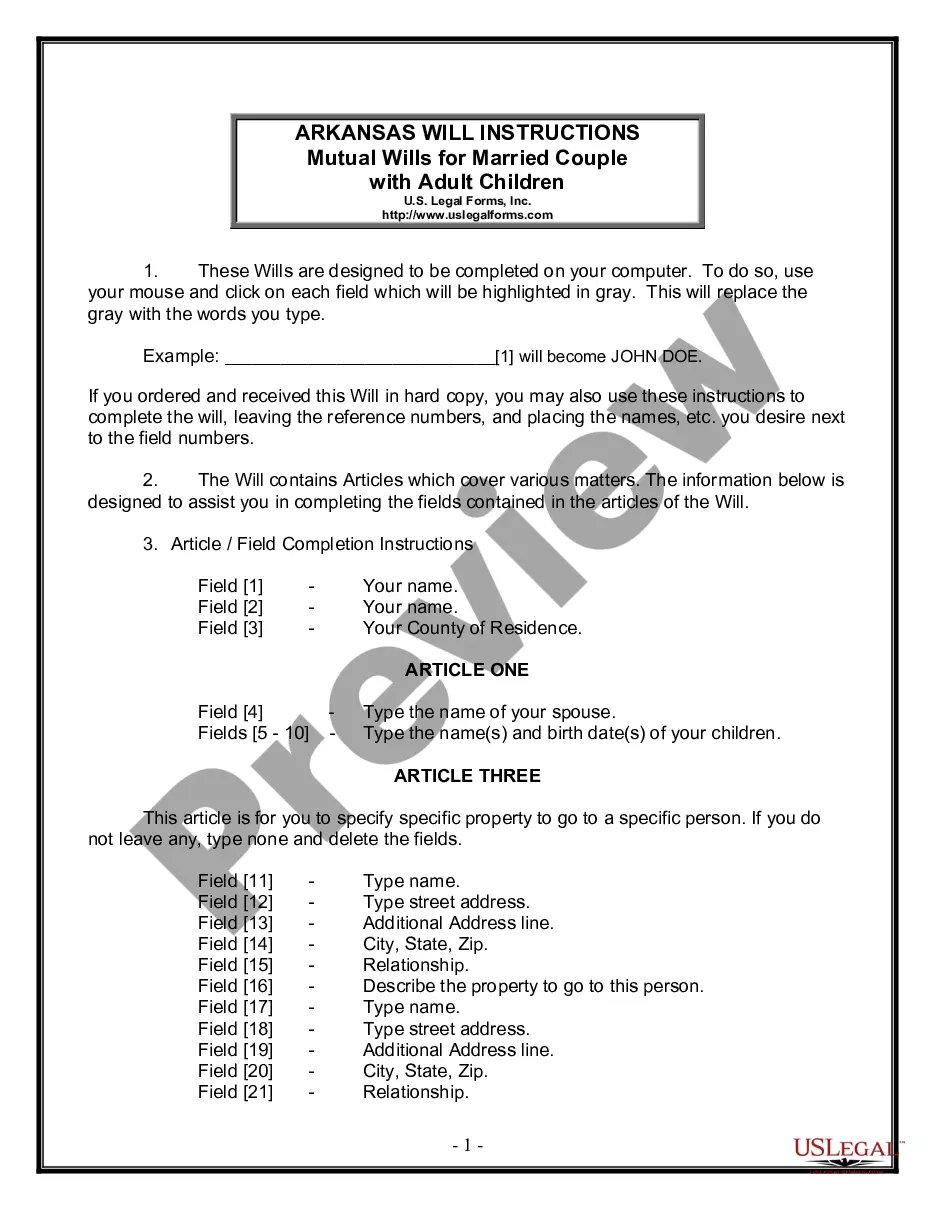

Draftwing forms, like Wake Hardship Letter to Mortgagor or Lender to Prevent Foreclosure, to take care of your legal affairs is a difficult and time-consumming task. A lot of cases require an attorney’s participation, which also makes this task expensive. Nevertheless, you can take your legal affairs into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal documents created for various scenarios and life circumstances. We ensure each document is compliant with the regulations of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how easy it is to get the Wake Hardship Letter to Mortgagor or Lender to Prevent Foreclosure template. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your document? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is fairly simple! Here’s what you need to do before getting Wake Hardship Letter to Mortgagor or Lender to Prevent Foreclosure:

- Make sure that your template is compliant with your state/county since the rules for creating legal documents may differ from one state another.

- Find out more about the form by previewing it or reading a brief intro. If the Wake Hardship Letter to Mortgagor or Lender to Prevent Foreclosure isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to start using our website and download the form.

- Everything looks good on your end? Hit the Buy now button and choose the subscription plan.

- Select the payment gateway and enter your payment information.

- Your form is good to go. You can go ahead and download it.

It’s an easy task to find and buy the needed document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich collection. Sign up for it now if you want to check what other perks you can get with US Legal Forms!