Title: Nassau New York — Sample Letter for Short Sale Request to Lender Introduction: In Nassau County, New York, homeowners facing financial challenges often consider a short sale as a viable solution. A short sale allows homeowners to sell their property for less than the outstanding mortgage balance, with the lender's approval. This article provides a detailed description of what Nassau New York's short sale request letter to the lender should include. Keywords: Nassau New York, short sale, request letter, lender, mortgage, foreclosure, financial distress. 1. Nassau New York Short Sale Request Overview: — Gain insight into the intricacies of the short sale process in Nassau County, New York. — Understand the importance of a well-written short sale request letter to the lender. — Learn how to navigate the short sale process effectively and communicate with the lender. 2. Importance of a Short Sale Request Letter: — Explain why a well-crafted short sale request letter is essential in Nassau New York. — Discuss how the request letter serves as an opportunity for homeowners to demonstrate financial distress and present a compelling case to the lender. — Emphasize that without a persuasive request letter, the short sale request may be denied. 3. Components of a Nassau New York Short Sale Request Letter: — Addressing the lender professionally and accurately. — Clearly stating the homeowner's intention to seek a short sale, providing reasons for the request. — Presenting detailed financial information, including income, expenses, and assets. — Providing supporting documents such as bank statements, pay stubs, tax returns, and hardship letters. — Requesting the lender's cooperation, considering foreclosure alternatives. 4. Different Types of Short Sale Request Letters: — Financial Hardship Short Sale Request Letter: Focuses on the homeowner's financial distress caused by circumstances like job loss, divorce, disability, or unexpected expenses. — Strategic Short Sale Request Letter: Pertains to homeowners facing negative equity situations due to declining property values. 5. Tips for Writing an Effective Nassau New York Short Sale Request Letter: — Use a polite and professional tone throughout the letter. — Review and proofread the letter to ensure clarity and accuracy. — Be honest and transparent about the financial situation. — Seek assistance from a real estate agent or attorney experienced in short sales for guidance and support. Conclusion: Crafting a compelling short sale request letter is crucial for Nassau New York homeowners seeking financial relief through a short sale. Understanding the key components and types of request letters can greatly increase the chances of a successful outcome. Collaborating with professionals knowledgeable in the short sale process can further enhance the effectiveness of the letter.

Nassau New York Sample Letter for Short Sale Request to Lender

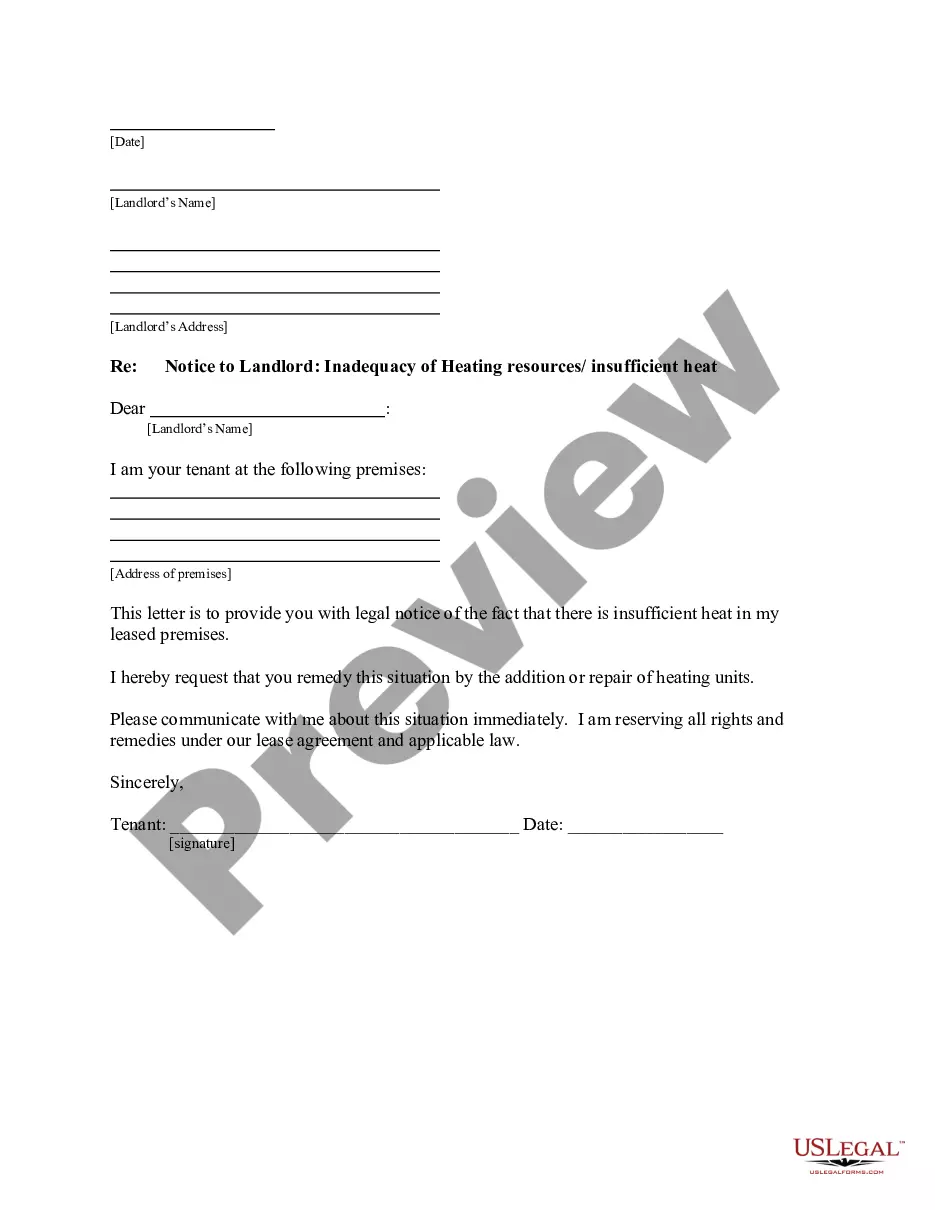

Description

How to fill out Nassau New York Sample Letter For Short Sale Request To Lender?

Creating documents, like Nassau Sample Letter for Short Sale Request to Lender, to manage your legal matters is a difficult and time-consumming task. A lot of cases require an attorney’s involvement, which also makes this task not really affordable. However, you can consider your legal matters into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal forms intended for a variety of cases and life situations. We make sure each document is in adherence with the regulations of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Nassau Sample Letter for Short Sale Request to Lender form. Go ahead and log in to your account, download the template, and personalize it to your needs. Have you lost your document? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is just as simple! Here’s what you need to do before getting Nassau Sample Letter for Short Sale Request to Lender:

- Ensure that your form is compliant with your state/county since the regulations for writing legal papers may vary from one state another.

- Find out more about the form by previewing it or reading a quick intro. If the Nassau Sample Letter for Short Sale Request to Lender isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to begin utilizing our website and get the form.

- Everything looks good on your end? Hit the Buy now button and select the subscription option.

- Pick the payment gateway and type in your payment details.

- Your template is all set. You can go ahead and download it.

It’s easy to find and buy the needed document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!