Fairfax Virginia MA Request for Short Sale: A Comprehensive Guide Introduction: A Fairfax Virginia MA (Making Home Affordable) Request for Short Sale is a crucial process for distressed homeowners to seek financial relief by selling their property for less than the mortgage amount. This write-up aims to provide a detailed description of what a Fairfax Virginia MA Request for Short Sale entails, ensuring a clear understanding of the process and relevant keywords. 1. Definition of Fairfax Virginia MA Request for Short Sale: A Fairfax Virginia MA Request for Short Sale is a formal application submitted by homeowners in Fairfax, Virginia, who are experiencing financial hardship and are unable to meet their mortgage obligations. It is a request to the lender or loan service to approve a sale of the property for less than what is owed on the mortgage. 2. Eligibility Criteria: To be eligible for a Fairfax Virginia MA Request for Short Sale, homeowners must meet specific criteria, including: — Demonstrating a verifiable financial hardship. — Owning a property in Fairfax, Virginia, as a primary residence. — Owning a mortgage that originated before January 1, 2009. — Having an unpaid principal balance that does not exceed $729,750 for a single-unit property. 3. Types of Fairfax Virginia MA Request for Short Sale: While there may not be different types of Fairfax Virginia MA Request for Short Sale specifically, it is essential to understand the various programs associated with it. These programs provide homeowners with varying alternatives based on their unique circumstances. Some key programs to be aware of are: — Home Affordable Modification ProgramCAMPMP): Aims to modify the existing loan terms to make mortgage payments more affordable. — Home Affordable Foreclosure Alternatives (HAIFA): Provides incentives for homeowners to pursue alternatives to foreclosure, including short sales. — Principal Reduction Alternative (PRA): Offers principal reduction opportunities for borrowers who owe more than the current value of their homes. 4. Required Documentation for a Fairfax Virginia MA Request for Short Sale: Homeowners must submit a comprehensive package of documentation along with their Fairfax Virginia MA Request for Short Sale. This typically includes: — Hardship letter explaining the financial situation. — Financial statements, such as bank statements and income documents. — Proof of residence in Fairfax, Virginia. — Comparative market analysis (CMA) or appraisal of the property's value. — Listing agreement with a licensed real estate agent. — Purchase offer from a potential buyer. 5. Process and Benefits: Upon submitting a Fairfax Virginia MA Request for Short Sale, homeowners can expect the following process: — Initial evaluation and approval of the short sale by the lender or loan service. — Real estate agent listing the property and seeking potential buyers. — Negotiations with the lender or loaserviceer regarding the proposed sale price. — Completing the short sale transaction and potentially being released from the remaining mortgage debt. The benefits of a Fairfax Virginia MA Request for Short Sale include: — Avoiding foreclosure and its detrimental consequences. — Potentially securing a fresh financial start. — Preserving one's credit to some extent compared to a foreclosure. — Receiving financial incentives and relocation assistance in certain cases. Conclusion: A Fairfax Virginia MA Request for Short Sale is an opportunity for distressed homeowners in Fairfax, Virginia, to find relief from their mortgage burdens. By understanding the process, eligibility criteria, and required documentation, homeowners can navigate this option effectively. Considering the various MA programs available, homeowners may choose the alternative that best suits their specific circumstances.

Fairfax Virginia MHA Request for Short Sale

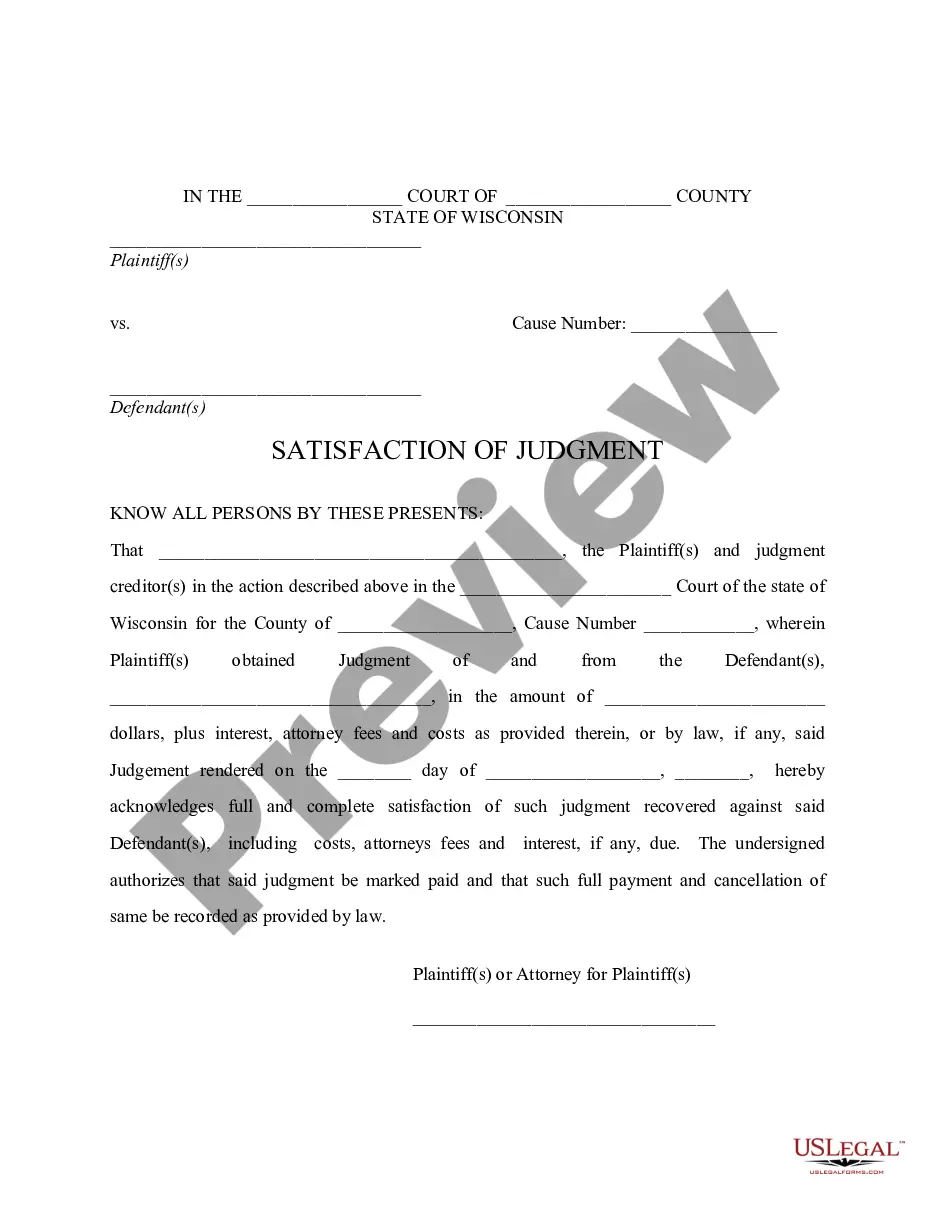

Description

How to fill out Fairfax Virginia MHA Request For Short Sale?

Draftwing paperwork, like Fairfax MHA Request for Short Sale, to take care of your legal affairs is a tough and time-consumming process. Many circumstances require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can take your legal issues into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal forms created for various scenarios and life circumstances. We ensure each form is in adherence with the regulations of each state, so you don’t have to worry about potential legal problems associated with compliance.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Fairfax MHA Request for Short Sale form. Simply log in to your account, download the template, and customize it to your needs. Have you lost your form? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is just as straightforward! Here’s what you need to do before getting Fairfax MHA Request for Short Sale:

- Make sure that your form is specific to your state/county since the rules for writing legal papers may vary from one state another.

- Learn more about the form by previewing it or going through a quick description. If the Fairfax MHA Request for Short Sale isn’t something you were hoping to find, then use the header to find another one.

- Log in or register an account to begin using our website and get the form.

- Everything looks great on your end? Click the Buy now button and select the subscription plan.

- Select the payment gateway and enter your payment details.

- Your template is all set. You can go ahead and download it.

It’s an easy task to find and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!