Dallas Texas Statutory Notices Required for California Foreclosure Consultants in California are subject to specific statutory notices requirements, even if they operate in Dallas, Texas. It is crucial for foreclosure consultants in Dallas, Texas, to understand and comply with these requirements to operate legally in California. Failure to adhere to these rules can result in penalties, legal complications, and potential damage to a consultant's reputation. The following are the various statutory notices required for California foreclosure consultants in Dallas, Texas: 1. Notice of Foreclosure Consultant Services: Foreclosure consultants must provide a written notice to homeowners, clearly stating the nature of their services and specifying any fees charged for such services. This notice must be presented to the homeowner before any consulting agreement is signed or any compensation is received. 2. Notice of Cancellation Rights: Foreclosure consultants must offer homeowners a statutory notice of cancellation rights. This notice informs homeowners of their right to cancel the consulting agreement within a specific period, typically five business days after signing the agreement. 3. Notice of Mortgage Modification Restriction: Consultants must provide a written notice to homeowners, explicitly stating that they cannot guarantee a loan modification or any specific results regarding foreclosure prevention. Homeowners must be made aware that the consultant's role is to negotiate with lenders on their behalf and provide guidance throughout the process. 4. Notice of Right to Receive Money Paid: A foreclosure consultant must provide homeowners with a written notice explaining their right to receive any money that the consultant receives on their behalf. If the consultant receives funds from a lender or any other source, they must promptly forward these funds to the homeowner without any deductions. 5. Notice of Pending Legal Action: If a foreclosure consultant has knowledge of any pending legal action or lawsuit against a homeowner related to their property, they are obligated to inform the homeowner in writing. This notice must include details about the lawsuit, the parties involved, and any potential consequences that may affect the homeowner. It is important for Dallas, Texas, foreclosure consultants offering services in California to remember that these statutory notice requirements are specific to California law. Therefore, they must carefully review and understand the state regulations to ensure compliance when assisting homeowners facing foreclosure in California. In conclusion, Dallas, Texas, foreclosure consultants operating in California need to be well-versed in the statutory notices required for their practice. They must provide homeowners with notices regarding their services, cancellation rights, mortgage modification restrictions, right to receive funds, and any pending legal action. These notices safeguard homeowner's rights and maintain transparency in the foreclosure consulting process.

Dallas Texas Statutory Notices Required for California Foreclosure Consultants

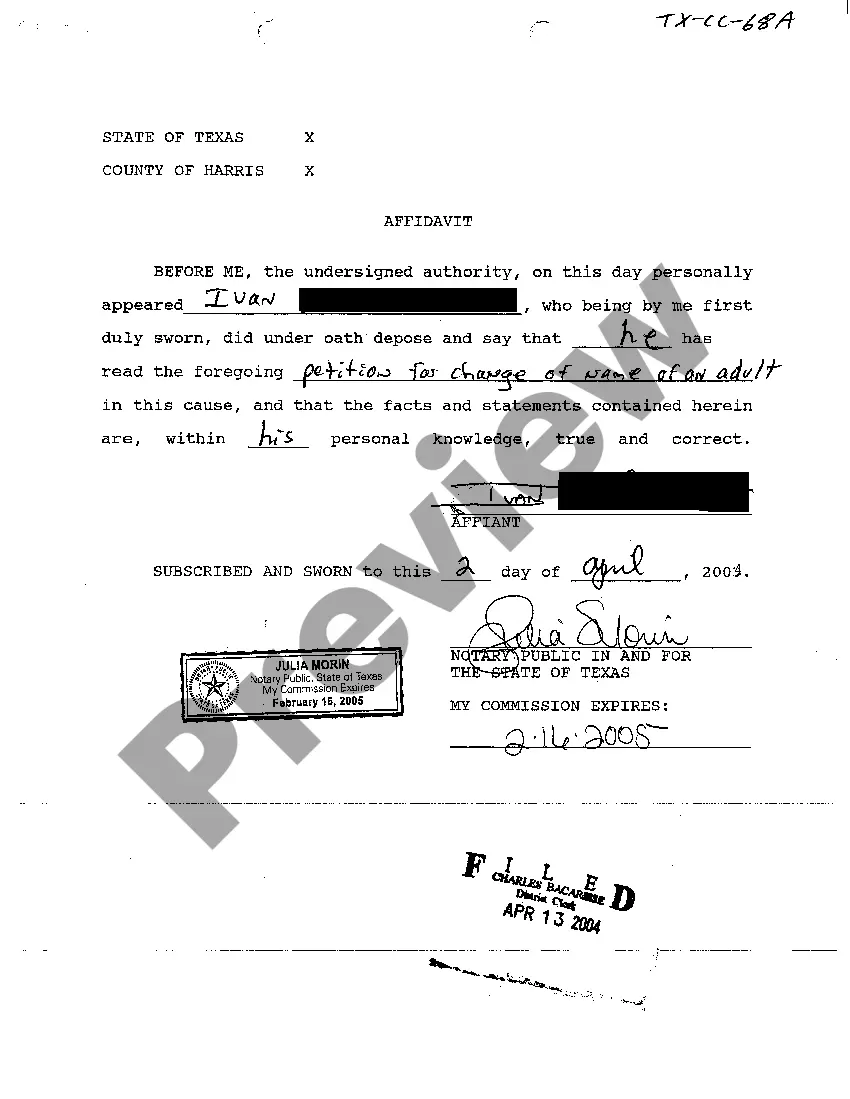

Description

How to fill out Dallas Texas Statutory Notices Required For California Foreclosure Consultants?

Preparing paperwork for the business or individual demands is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to draft Dallas Statutory Notices Required for California Foreclosure Consultants without expert assistance.

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid Dallas Statutory Notices Required for California Foreclosure Consultants by yourself, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required form.

In case you still don't have a subscription, follow the step-by-step instruction below to obtain the Dallas Statutory Notices Required for California Foreclosure Consultants:

- Examine the page you've opened and check if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that fits your needs, utilize the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any situation with just a few clicks!