Salt Lake City, the capital of Utah, is home to several statutory notices required for California foreclosure consultants. These notices play a crucial role in ensuring transparency, protecting homeowners' rights, and keeping the foreclosure process in compliance with state laws. Here is a detailed description of some of these statutory notices: 1. Notice of Default (NOD): The Notice of Default is typically the first step in the foreclosure process. It is a formal notice that informs the homeowner of their default on mortgage payments and initiates the foreclosure proceedings. This notice must be filed with the county recorder's office and mailed to the homeowner within a specified period, as stated by California law. 2. Notice of Trustee's Sale (NTS): Once the foreclosure process has progressed, and the homeowner has not reinstated the loan or resolved the default, the lender can issue a Notice of Trustee's Sale. This notice announces the upcoming public auction of the property. It must be recorded with the county recorder's office, posted in a visible location on the property, and published in a newspaper of general circulation in the county where the property is located. 3. Notice of Rescission: If the homeowner qualifies for a loan modification or successfully resolves the default, the lender may issue a Notice of Rescission to stop the foreclosure proceedings. This notice signifies the cancellation or withdrawal of the foreclosure process, ensuring that the homeowner retains their property. 4. Notice to Tenants: In case the property being foreclosed is tenant-occupied, California law requires the foreclosure consultant to serve a Notice to Tenants. This notice informs the tenants about the foreclosure proceedings, the new owner's rights, and any changes that might occur during or after the foreclosure process. 5. Certificate of Compliance: Foreclosure consultants in California must provide a Certificate of Compliance to the homeowner. This document certifies that the consultant has complied with all the statutory requirements and has registered with the California Secretary of State as mandated by law. These statutory notices are critical in protecting homeowners' rights, promoting transparency in the foreclosure process, and ensuring that all parties involved are aware of their rights and responsibilities. By adhering to these obligations, foreclosure consultants in Salt Lake City, Utah can conduct their business ethically and in compliance with the law.

Salt Lake Utah Statutory Notices Required for California Foreclosure Consultants

Description

How to fill out Salt Lake Utah Statutory Notices Required For California Foreclosure Consultants?

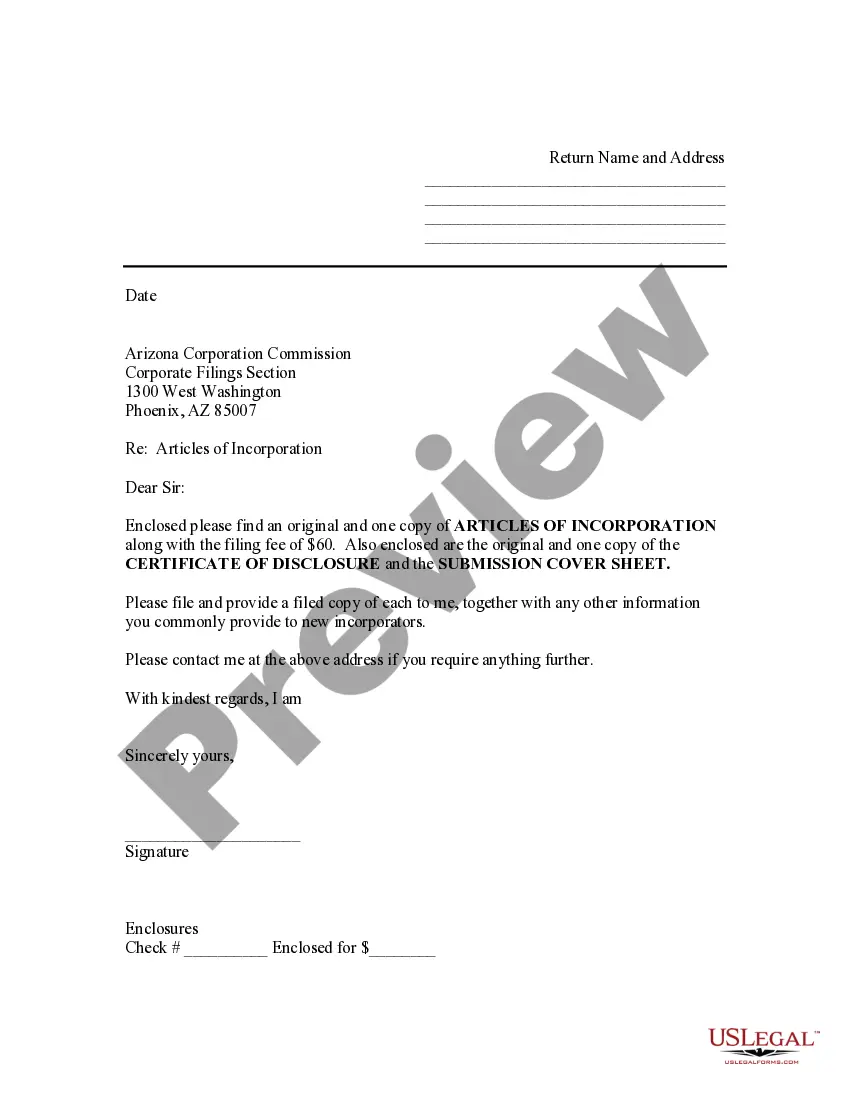

How much time does it normally take you to draw up a legal document? Because every state has its laws and regulations for every life situation, locating a Salt Lake Statutory Notices Required for California Foreclosure Consultants suiting all regional requirements can be tiring, and ordering it from a professional lawyer is often costly. Numerous web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web collection of templates, grouped by states and areas of use. In addition to the Salt Lake Statutory Notices Required for California Foreclosure Consultants, here you can get any specific form to run your business or individual deeds, complying with your county requirements. Experts check all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can retain the document in your profile anytime in the future. Otherwise, if you are new to the website, there will be a few more actions to complete before you get your Salt Lake Statutory Notices Required for California Foreclosure Consultants:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Salt Lake Statutory Notices Required for California Foreclosure Consultants.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

Nonjudicial Pre-foreclosure Periods Pre-foreclosure in California is as short as 111 days, consisting of a 90-day default notice period followed by a 21-day foreclosure sale notice period.

In general, a judicial foreclosure can take two to three years to complete in California. A judicial foreclosure is subject to a four-year statute of limitations and is subject to a post-sale redemption right unless the deficiency claim is waived.

Right to Redeem After a Judicial Foreclosure Under California Law. If the foreclosure is judicial, you may generally redeem the home within: three months after the foreclosure sale, if the proceeds from the sale satisfy the indebtedness or. one year, if the sale resulted in a deficiency.

In order to legally operate as a Foreclosure Consultant in California, you must obtain a Certificate of Registration as a Mortgage Foreclosure Consultant from the Department of Justice. To do so, you must submit the following: A completed application. A copy of the contract you will use with clients.

The period of limitation for foreclosure by a mortgagee is also 30 years and the starting point of limitation is the same. The deposit can be made by the mortgagor so long as the relationship of mortgagor and mortgagee subsists.

Under the CARES (Coronavirus Relief and Economic Security) Act, homeowners were provided foreclosure and eviction protections in 2020, which was federally extended through July 31, 2021. In California, Gov. Gavin Newsom signed a new law extending the state's eviction moratorium through Sept. 30, 2021.

Under the CARES (Coronavirus Relief and Economic Security) Act, homeowners were provided foreclosure and eviction protections in 2020, which was federally extended through July 31, 2021. In California, Gov. Gavin Newsom signed a new law extending the state's eviction moratorium through Sept. 30, 2021.

California (non judicial foreclosure) Extends to September 1, 2021 the requirement that mortgage servicers provide borrowers with written notices of grounds for denial of COVID-related forbearance relief.

The California foreclosure process can last up to 200 days or longer. Day 1 is when a payment is missed; your loan is officially in default around day 90. After 180 days, you'll receive a notice of trustee sale. About 20 days later, your bank can then set the auction.

It has to wait at least 20 days after the Notice of Trustee Sale is sent to you. The sale may be postponed by a court or by the bank for up to a year, after which point they'll need to send you a new Notice of Trustee Sale in order to send the house to auction.