Collin Texas IRS 20 Quiz to Determine 1099 vs Employee Status is an assessment tool designed by the Internal Revenue Service (IRS) to determine whether a worker should be classified as an independent contractor (1099) or an employee. This quiz is specifically tailored to the regulations and guidelines applicable within Collin County, Texas. The Collin Texas IRS 20 Quiz to Determine 1099 vs Employee Status helps employers and workers navigate the complex classification rules established by the IRS to ensure proper tax treatment and compliance with labor laws. By answering a series of questions, both parties can assess the worker's relationship and determine the appropriate employment status. There are different types of Collin Texas IRS 20 Quiz to Determine 1099 vs Employee Status assessments based on specific industries or professions. These variations consider the unique characteristics and working arrangements typically found in certain sectors. Some named versions of the quiz can include: 1. Collin Texas IRS 20 Quiz for Construction Industry: This variant addresses the nuances of worker classification in the construction sector, taking into account factors such as contract durations, project-based work, and subcontractor relationships. 2. Collin Texas IRS 20 Quiz for Gig Economy Workers: This version caters to individuals engaged in app-based or short-term gig work, where the boundaries between independent contractors and employees can be more ambiguous. It may focus on elements like control over work schedule, ability to accept or decline assignments, and use of personal equipment. 3. Collin Texas IRS 20 Quiz for Professional Services: Targeting professionals such as attorneys, consultants, and accountants, this quiz emphasizes factors like specialized knowledge, client relationships, and the level of autonomy in providing services. Regardless of the specific variant, the Collin Texas IRS 20 Quiz aims to ensure accurate classification of workers for tax purposes and to protect the rights and benefits entitled to employees under labor laws. Employers and workers are encouraged to consult IRS guidelines and seek professional advice to navigate these assessments accurately and comply with relevant regulations.

Collin Texas IRS 20 Quiz to Determine 1099 vs Employee Status

Description

How to fill out Collin Texas IRS 20 Quiz To Determine 1099 Vs Employee Status?

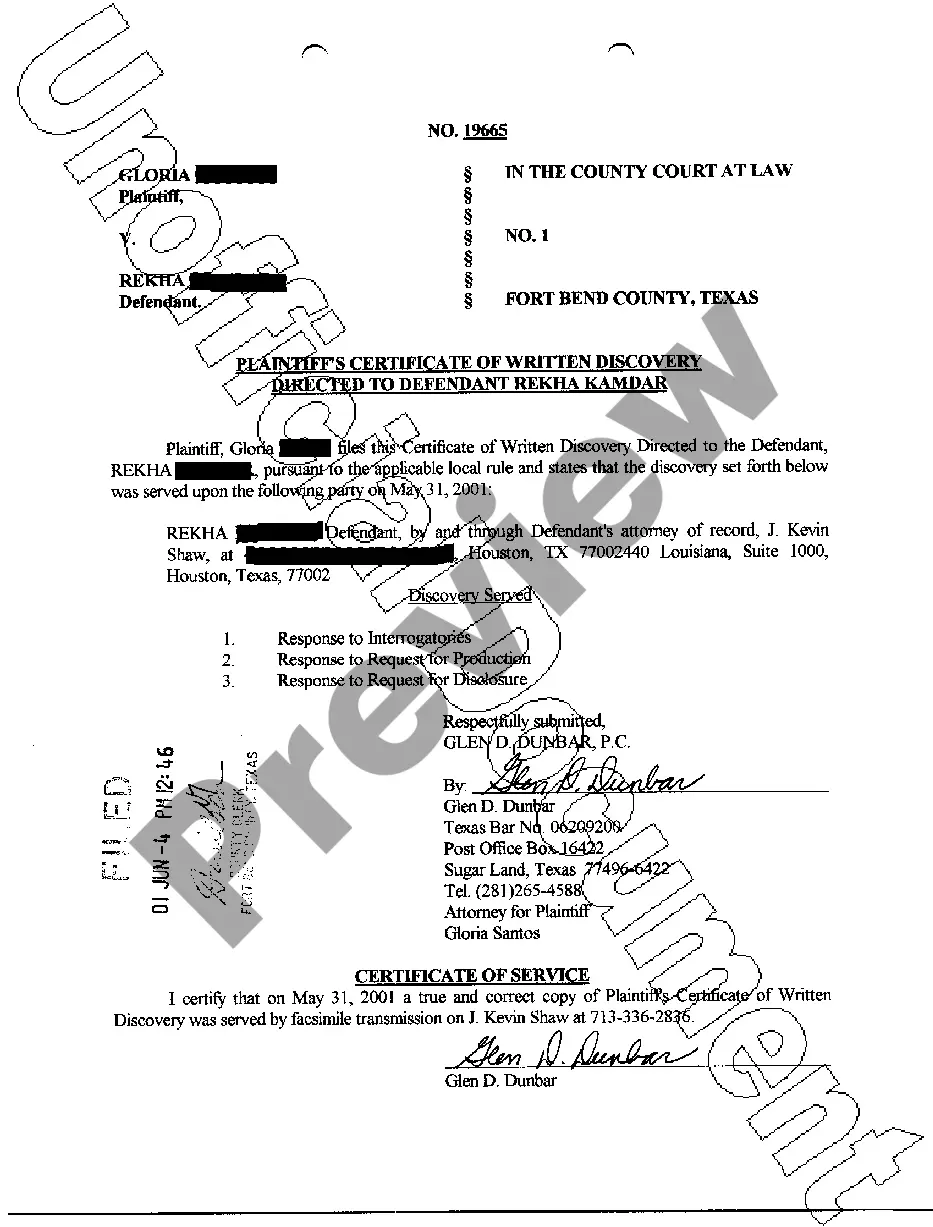

Draftwing documents, like Collin IRS 20 Quiz to Determine 1099 vs Employee Status, to manage your legal matters is a tough and time-consumming task. Many cases require an attorney’s involvement, which also makes this task expensive. However, you can consider your legal issues into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal forms crafted for different cases and life situations. We make sure each form is compliant with the laws of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how easy it is to get the Collin IRS 20 Quiz to Determine 1099 vs Employee Status form. Go ahead and log in to your account, download the template, and personalize it to your needs. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is fairly simple! Here’s what you need to do before getting Collin IRS 20 Quiz to Determine 1099 vs Employee Status:

- Ensure that your document is specific to your state/county since the rules for writing legal papers may differ from one state another.

- Discover more information about the form by previewing it or reading a quick intro. If the Collin IRS 20 Quiz to Determine 1099 vs Employee Status isn’t something you were hoping to find, then use the header to find another one.

- Sign in or create an account to start using our website and download the document.

- Everything looks great on your end? Click the Buy now button and choose the subscription option.

- Select the payment gateway and type in your payment details.

- Your form is all set. You can go ahead and download it.

It’s easy to find and purchase the appropriate template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!

Form popularity

FAQ

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Florida uses a right of control test to determine whether a worker is an employee or independent contractor in most areas of the law.

Control testing is an audit procedure used to determine whether internal controls effectively prevent or discover material misstatements at the appropriate assertion level. Control tests determine whether a policy or practice is well-designed to prevent or detect significant misstatements in a financial statement.

AB 5 requires the application of the ABC test to determine if workers in California are employees or independent contractors for purposes of the Labor Code, the Unemployment Insurance Code, and the Industrial Welfare Commission (IWC) wage orders.

The IRS looks to common law tests to determine whether or not someone is an employee or an independent contractor. The common law test requires examination of all evidence of the degree of control and independence in the relationship.

When deciding whether you can safely treat a worker as an independent contractor, there are two separate tests you should consider: The common law test; and The reasonable basis test. The common law test: IRS examiners use the 20-factor common law test to measure how much control you have over the worker.

What is the IRS 20-Factor Test? The IRS 20-Factor Test, commonly referred to as the Right-to-Control Test, is designed to evaluate who controls how the work is performed. According to the IRS's Common-Law Rules, a worker's status corresponds to the level of control and independence they have over their work.

The 5 personality traits that make a successful contractor Confidence. To become a successful contractor - it's important to have confidence in your own abilities.Personable.Flexibility.Problem Solving.Honesty.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

There are three different tests commonly used to determine if a worker is an employee or independent contractor: 1) the IRS 20-factor analysis; 2) the economic realities test; and, 3) the common law agency test.