Hennepin Minnesota IRS 20 Quiz to Determine 1099 vs Employee Status refers to a quiz or assessment conducted by the Internal Revenue Service (IRS) in Hennepin County, Minnesota, to help individuals and businesses determine whether their workers should be classified as independent contractors (1099) or employees. This quiz is crucial as it determines the correct tax treatment for workers, affecting how payroll taxes, benefits, and legal obligations are handled. The Hennepin Minnesota IRS 20 Quiz consists of a series of questions that evaluate various factors to gauge the level of control an employer has over the worker. By analyzing aspects such as behavioral control, financial control, and the nature of the working relationship, the quiz aims to establish the appropriate worker classification. Different types of Hennepin Minnesota IRS 20 Quizzes to Determine 1099 vs Employee Status may include: 1. Core Hennepin Minnesota IRS 20 Quiz: This is the basic quiz that covers the fundamental factors used to determine worker classification. It assesses elements such as the worker's ability to control when, where, and how they perform their tasks, their investment in equipment or materials used, and their opportunity for profit or loss. 2. Advanced Hennepin Minnesota IRS 20 Quiz: This quiz builds upon the core quiz by delving deeper into additional factors that may influence classification. It may consider aspects such as the presence of written contracts, the provision of employee benefits, the longevity of the working relationship, and the extent of the worker's reliance on the employer. 3. Industry-specific Hennepin Minnesota IRS 20 Quiz: Certain industries have unique characteristics that require specific considerations for worker classification. The IRS may develop tailored quizzes for industries such as construction, healthcare, transportation, or technology. These quizzes account for industry-specific factors and regulations that impact worker status determination. The Hennepin Minnesota IRS 20 Quiz to Determine 1099 vs Employee Status is crucial for both employers and workers as it helps ensure proper compliance with tax laws and regulations. It provides valuable guidance in determining whether a worker should be treated as an employee or an independent contractor, ultimately impacting tax obligations, benefits eligibility, and legal responsibilities.

Hennepin Minnesota IRS 20 Quiz to Determine 1099 vs Employee Status

Description

How to fill out Hennepin Minnesota IRS 20 Quiz To Determine 1099 Vs Employee Status?

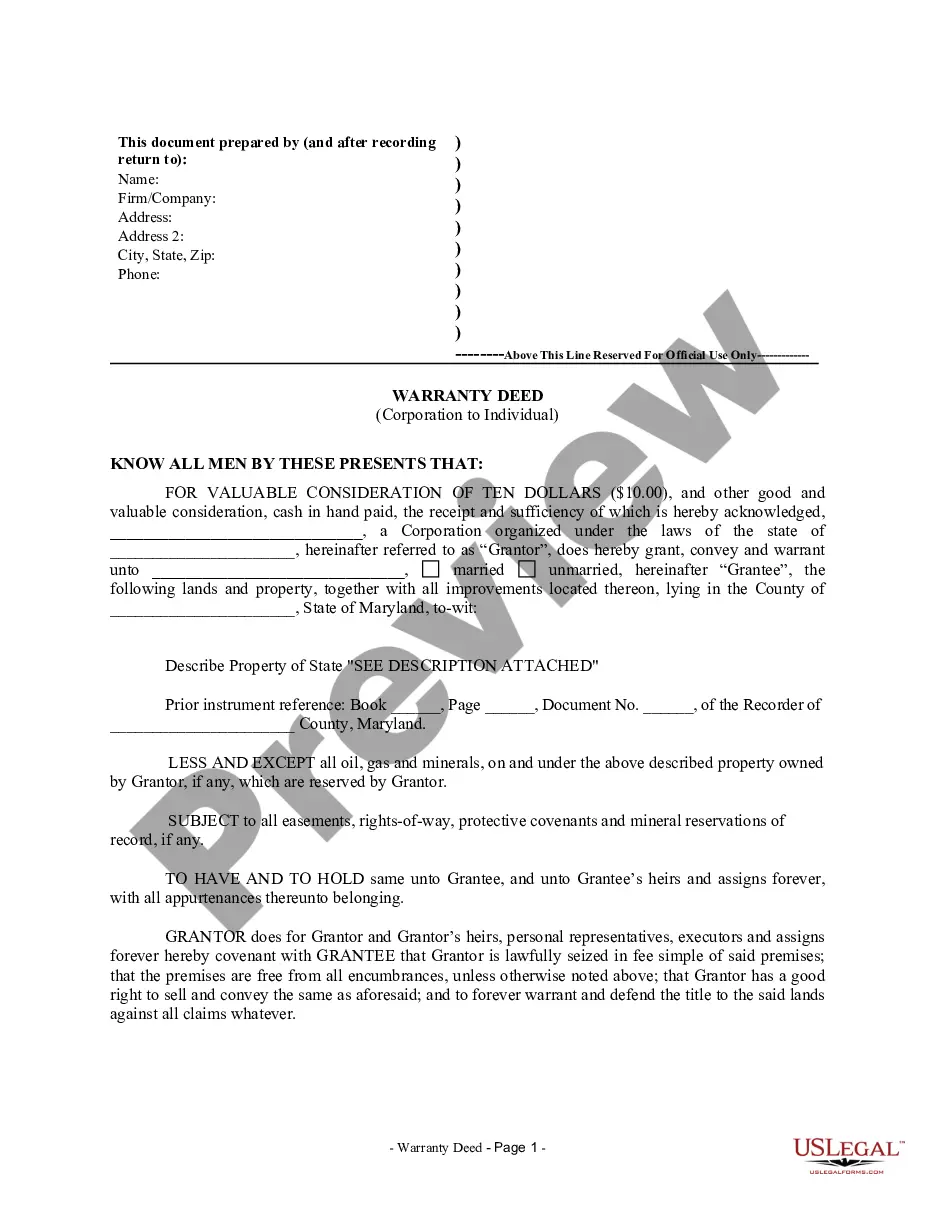

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare official paperwork that varies from state to state. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. Here, you can easily locate and get a document for any personal or business objective utilized in your region, including the Hennepin IRS 20 Quiz to Determine 1099 vs Employee Status.

Locating templates on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. After that, the Hennepin IRS 20 Quiz to Determine 1099 vs Employee Status will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guide to get the Hennepin IRS 20 Quiz to Determine 1099 vs Employee Status:

- Make sure you have opened the right page with your local form.

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Look for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Decide on the suitable subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Hennepin IRS 20 Quiz to Determine 1099 vs Employee Status on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!