Orange California is a city located in Orange County, California. It is known for its rich history, beautiful parks, and vibrant community. One important aspect of employment in Orange California is understanding the IRS 20 Quiz to Determine 1099 vs Employee Status. The IRS 20 Quiz is a tool used by the Internal Revenue Service (IRS) to determine whether a worker should be classified as an independent contractor (1099) or an employee. This classification is crucial as it determines the tax responsibilities and benefits for both the worker and the employer. The IRS 20 Quiz consists of a series of questions that assess various aspects of the working relationship between the employer and the worker. These questions cover factors such as control, financial aspects, and the relationship between the parties. By answering these questions, the IRS can determine whether a worker has enough control over their work and the business aspects of their job to be considered an independent contractor. Alternatively, if the employer has a significant degree of control over the worker and provides them with the tools and resources necessary to perform their job, they may be classified as an employee. It is important for both employers and workers in Orange California to understand the IRS 20 Quiz as misclassification can lead to serious consequences such as penalties, back taxes, and legal disputes. By accurately determining the worker's status, employers can ensure compliance with tax laws and avoid potential liabilities. There are no specific types of Orange California IRS 20 Quiz to Determine 1099 vs Employee Status as it is a standardized set of questions set by the IRS. However, employers in Orange California may seek guidance from tax professionals or use online tools to help navigate the quiz and ensure accurate classification. In conclusion, the IRS 20 Quiz to Determine 1099 vs Employee Status is an important tool used in Orange California and other parts of the United States to assess the employment status of workers. Understanding and correctly applying the quiz's principles is essential for both employers and workers in Orange California to ensure compliance with tax laws and avoid any legal complications.

Orange California IRS 20 Quiz to Determine 1099 vs Employee Status

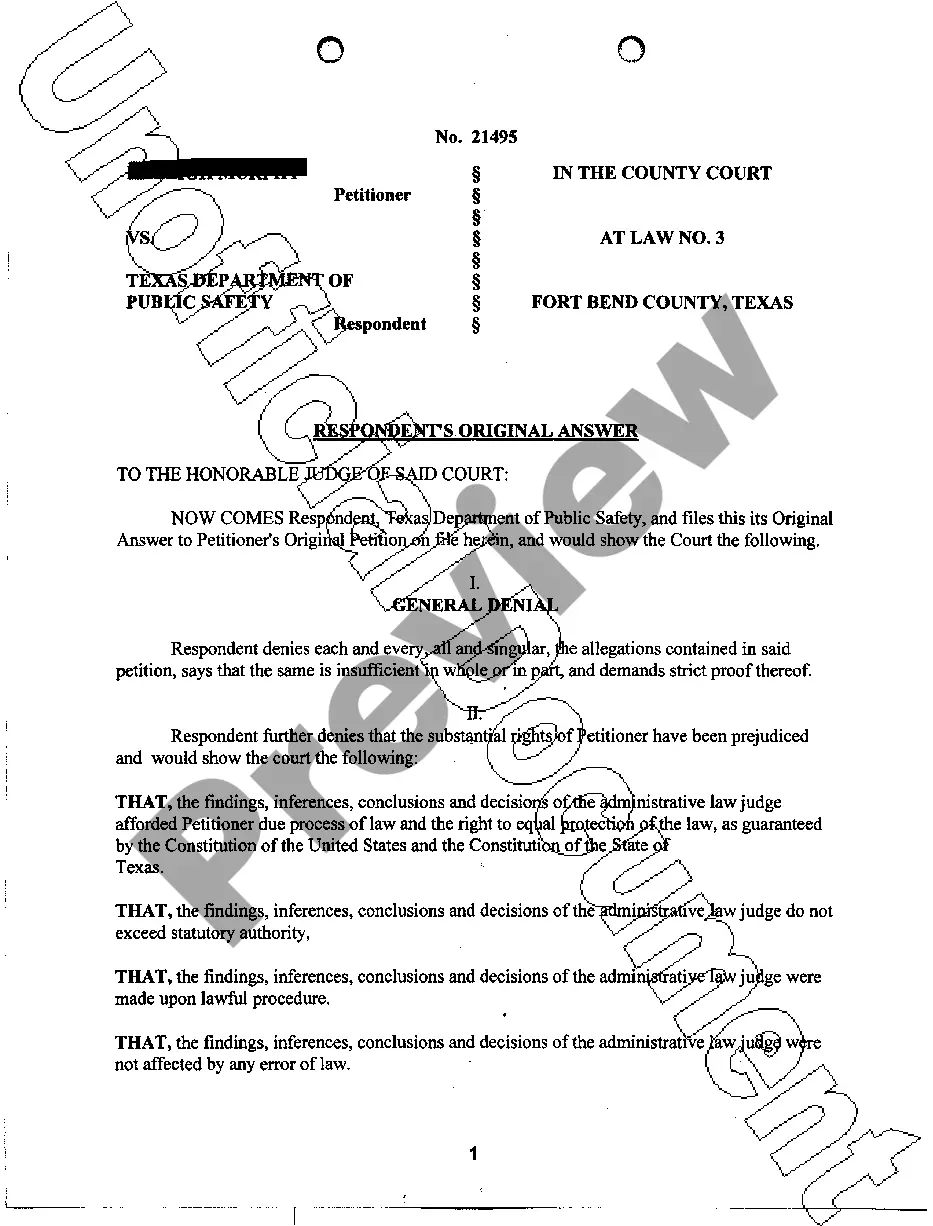

Description

How to fill out Orange California IRS 20 Quiz To Determine 1099 Vs Employee Status?

How much time does it normally take you to draft a legal document? Since every state has its laws and regulations for every life sphere, locating a Orange IRS 20 Quiz to Determine 1099 vs Employee Status meeting all regional requirements can be stressful, and ordering it from a professional lawyer is often costly. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, gathered by states and areas of use. In addition to the Orange IRS 20 Quiz to Determine 1099 vs Employee Status, here you can get any specific form to run your business or personal deeds, complying with your county requirements. Specialists verify all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required sample, and download it. You can get the file in your profile at any moment later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Orange IRS 20 Quiz to Determine 1099 vs Employee Status:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now once you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Orange IRS 20 Quiz to Determine 1099 vs Employee Status.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!