San Jose, California is a vibrant city located in the heart of Silicon Valley. It is home to a diverse population and serves as a major technological hub with numerous tech companies, startups, and research institutions. Being a part of this bustling city, San Jose residents and businesses must adhere to the guidelines set forth by the Internal Revenue Service (IRS) when it comes to determining whether a worker should be classified as an independent contractor receiving a 1099 form or as an employee. To ensure compliance with the IRS regulations and avoid potential legal and tax consequences, the San Jose IRS offers a comprehensive quiz known as the "IRS 20 Quiz to Determine 1099 vs Employee Status." This quiz is designed to assess various factors that contribute to determining the employment classification of an individual or a worker engaged by a business. The San Jose California IRS 20 Quiz evaluates critical elements such as behavioral control, financial control, and the relationship between the worker and the employer. By analyzing these factors, the quiz aims to provide clarity on whether a worker should be considered an independent contractor or an employee. The IRS 20 Quiz consists of a series of questions, each addressing a particular aspect of the employment relationship. These questions help employers and workers understand the dynamics of their working arrangement and assess whether it aligns more with a 1099 independent contractor or W-2 employee status. The quiz results are crucial for determining payroll taxes, benefits eligibility, worker protections, and overall compliance with federal and state regulations. Specialized versions of the San Jose California IRS 20 Quiz may exist in different industries or sectors to cater to specific needs. For instance, there can be adaptations of the quiz tailored for the technology industry, healthcare sector, or the gig economy. These variations acknowledge the unique characteristics and nuances of different professions while applying the general principles outlined by the IRS. It is important to note that the San Jose California IRS 20 Quiz is just one of many tools and resources available to assist in determining employment status. Employers and workers are encouraged to consult tax professionals or legal experts to navigate the complexities of employment classification accurately. Overall, the San Jose California IRS 20 Quiz serves as an essential tool for individuals and businesses operating in the city, ensuring compliance with IRS regulations, and facilitating proper classification of workers as either 1099 independent contractors or W-2 employees.

San Jose California IRS 20 Quiz to Determine 1099 vs Employee Status

Description

How to fill out San Jose California IRS 20 Quiz To Determine 1099 Vs Employee Status?

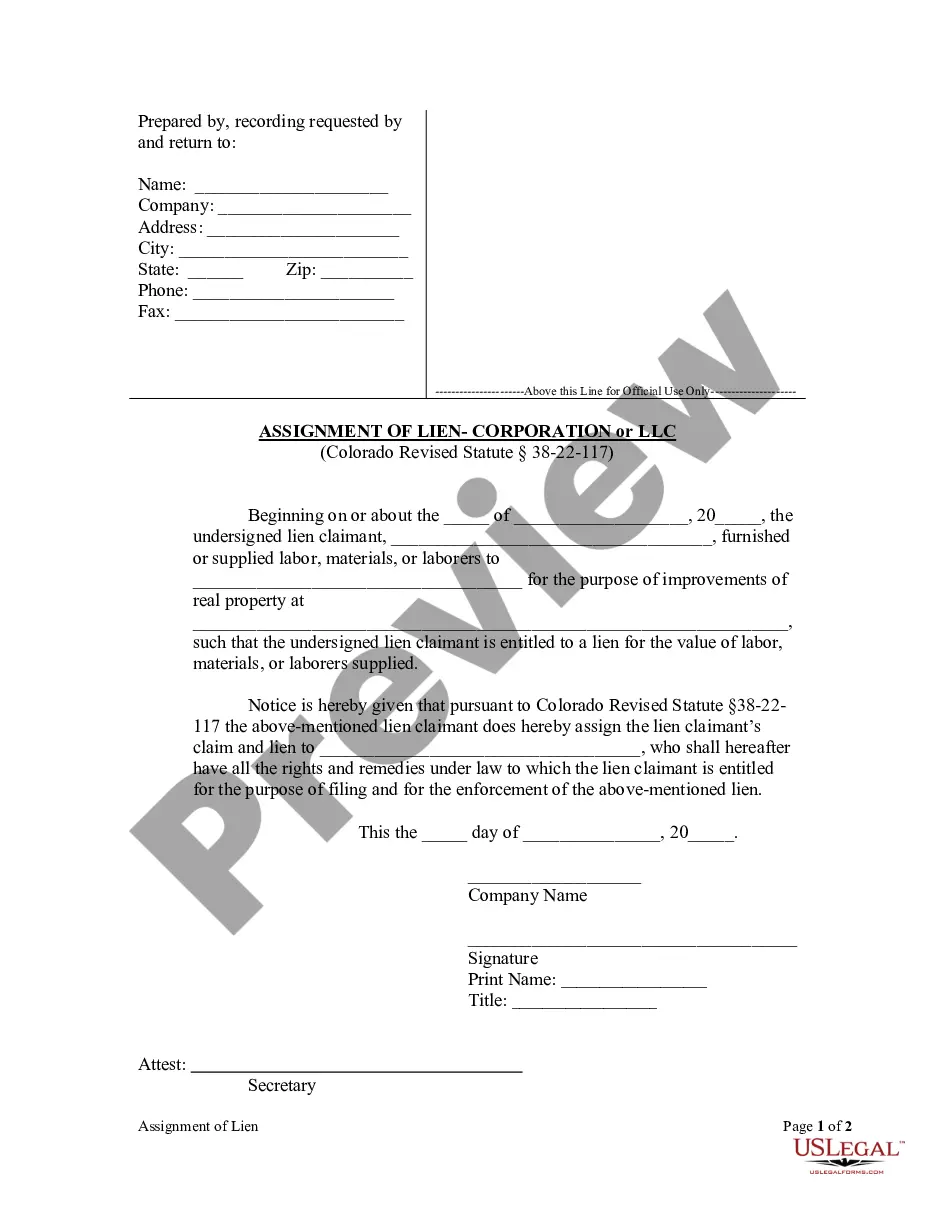

Do you need to quickly create a legally-binding San Jose IRS 20 Quiz to Determine 1099 vs Employee Status or probably any other form to manage your own or business matters? You can go with two options: contact a professional to draft a valid paper for you or draft it completely on your own. Thankfully, there's an alternative solution - US Legal Forms. It will help you get neatly written legal papers without paying unreasonable prices for legal services.

US Legal Forms offers a rich catalog of over 85,000 state-specific form templates, including San Jose IRS 20 Quiz to Determine 1099 vs Employee Status and form packages. We offer templates for a myriad of life circumstances: from divorce papers to real estate document templates. We've been on the market for over 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and obtain the needed document without extra hassles.

- To start with, double-check if the San Jose IRS 20 Quiz to Determine 1099 vs Employee Status is adapted to your state's or county's laws.

- If the form has a desciption, make sure to verify what it's intended for.

- Start the searching process again if the template isn’t what you were hoping to find by using the search bar in the header.

- Select the plan that is best suited for your needs and move forward to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the San Jose IRS 20 Quiz to Determine 1099 vs Employee Status template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to buy and download legal forms if you use our catalog. Additionally, the paperwork we provide are updated by industry experts, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Courts examine the following five factors: (1) the extent of the employer's control and supervision over the worker, including directions on scheduling and performance of work, (2) the kind of occupation and nature of skill required, including whether skills are obtained in the work place, (3) responsibility for the

The Common Law Test is a guide used by the IRS to determine if a worker should be classified as an employee or an independent contractor. The standard Common Law test indicates a worker is likely an employee if the employer has control over what work is to be done and how to get it done.

Employers can determine most workers' classification under the 'common law test. ' The IRS itself uses this test to classify its workers. Under the common law test, control of what work will be done and how it will be done is key. If an employer has this control, then that person being tested is a common law employee.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

When deciding whether you can safely treat a worker as an independent contractor, there are two separate tests you should consider: The common law test; and The reasonable basis test. The common law test: IRS examiners use the 20-factor common law test to measure how much control you have over the worker.

A 1099 worker is one that is not considered an employee. Rather, this type of worker is usually referred to as a freelancer, independent contractor or other self-employed worker that completes particular jobs or assignments. Since they're not deemed employees, you don't pay them wages or a salary.

If you have a written contract to complete a specific task or project for a predetermined sum of money, you are probably a 1099 worker. However, if your employment is open-ended, without a contract and subject to a job description, you will typically be considered an employee.

MISC is used to report payments made to independent contractors (who cover their own employment taxes). A W2 form, on the other hand, is used for employees (whose employer withholds payroll taxes from their earnings).

The IRS 20-Factor Test, commonly referred to as the Right-to-Control Test, is designed to evaluate who controls how the work is performed. According to the IRS's Common-Law Rules, a worker's status corresponds to the level of control and independence they have over their work.

If the company controls most of the person's work, then the worker is most likely a W2 employee. If the person has a good degree of independence, they're most likely a 1099 independent contractor.