Title: Comprehensive Guide to Bronx, New York Employer Training Memo — Payroll Deductions Keywords: Bronx, New York, employer training, memo, payroll deductions 1. Introduction to the Bronx, New York Employer Training Memo — Payroll Deductions In this detailed description, we will explore the various aspects of the Bronx, New York Employer Training Memo — Payroll Deductions. This memo serves as a valuable resource for employers in the Bronx, New York area who aim to navigate payroll deductions legally and effectively. 2. Understanding Payroll Deductions The Bronx, New York Employer Training Memo educates employers about different types of payroll deductions, such as income tax, Social Security, Medicare, retirement contributions, health insurance premiums, and more. It provides comprehensive guidance on how to calculate these deductions accurately. 3. Compliance with Federal, State, and Local Laws The Bronx, New York Employer Training Memo outlines the crucial obligations employers have in adhering to federal, state, and local laws related to payroll deductions. It highlights tax regulations, minimum wage laws, and other legal aspects that employers must consider avoiding penalties. 4. Deduction Authorization and Employee Consent This training memo emphasizes the significance of obtaining proper authorization and consent from employees before initiating any payroll deductions. It elaborates on the legal frameworks surrounding consent to ensure compliance and maintain employee trust. 5. Voluntary Deductions and Employee Benefits The Bronx, New York Employer Training Memo discusses voluntary deductions that employers may provide for additional employee benefits such as retirement plans, health savings accounts, flexible spending accounts, and charitable contributions. It outlines procedures to implement and manage these deductions accurately. 6. Overcoming Common Challenges in Payroll Deductions The memo provides practical solutions and recommendations for addressing common challenges employers often face when managing payroll deductions. It covers scenarios like missed deductions, correcting errors, resolving disputes, and maintaining accurate records. 7. Timing and Reporting Requirements This section of the training memo clarifies the importance of meeting appropriate timing and reporting requirements for payroll deductions. Employers will learn about filing deadlines, reporting formats, effective dates, electronic filing, and the various forms required by federal, state, and local authorities. 8. Additional Resources and Support To further enhance their understanding of payroll deductions, employers are provided with a list of additional resources and support services available in the Bronx, New York area. This includes government websites, helpful publications, workshops, and local organizations that offer guidance on related matters. Different Types of Bronx, New York Employer Training Memo — Payroll Deductions: 1. Bronx, New York Employer Training Memo — Payroll Deductions for Small Businesses: — Tailored specifically for small businesses operating in the Bronx, NY area. — Focuses on addressing common challenges faced by small business owners. — Provides practical solutions and guidelines to simplify payroll deduction processes. 2. Bronx, New York Employer Training Memo — Payroll Deductions for Non-profit Organizations: — Caters to non-profit organizations in the Bronx, NY area. — Highlights unique considerations related to payroll deductions in the non-profit sector. — Explores tax-exempt deductions, charitable contributions, and specific compliance requirements. 3. Bronx, New York Employer Training Memo — Payroll Deductions for Start-ups— - Geared towards newly established start-ups in the Bronx, NY area. — Offers guidance on setting up payroll systems and deduction processes from scratch. — Provides insights into legal obligations and employee benefit considerations for start-ups.

Bronx New York Employer Training Memo - Payroll Deductions

Description

How to fill out Bronx New York Employer Training Memo - Payroll Deductions?

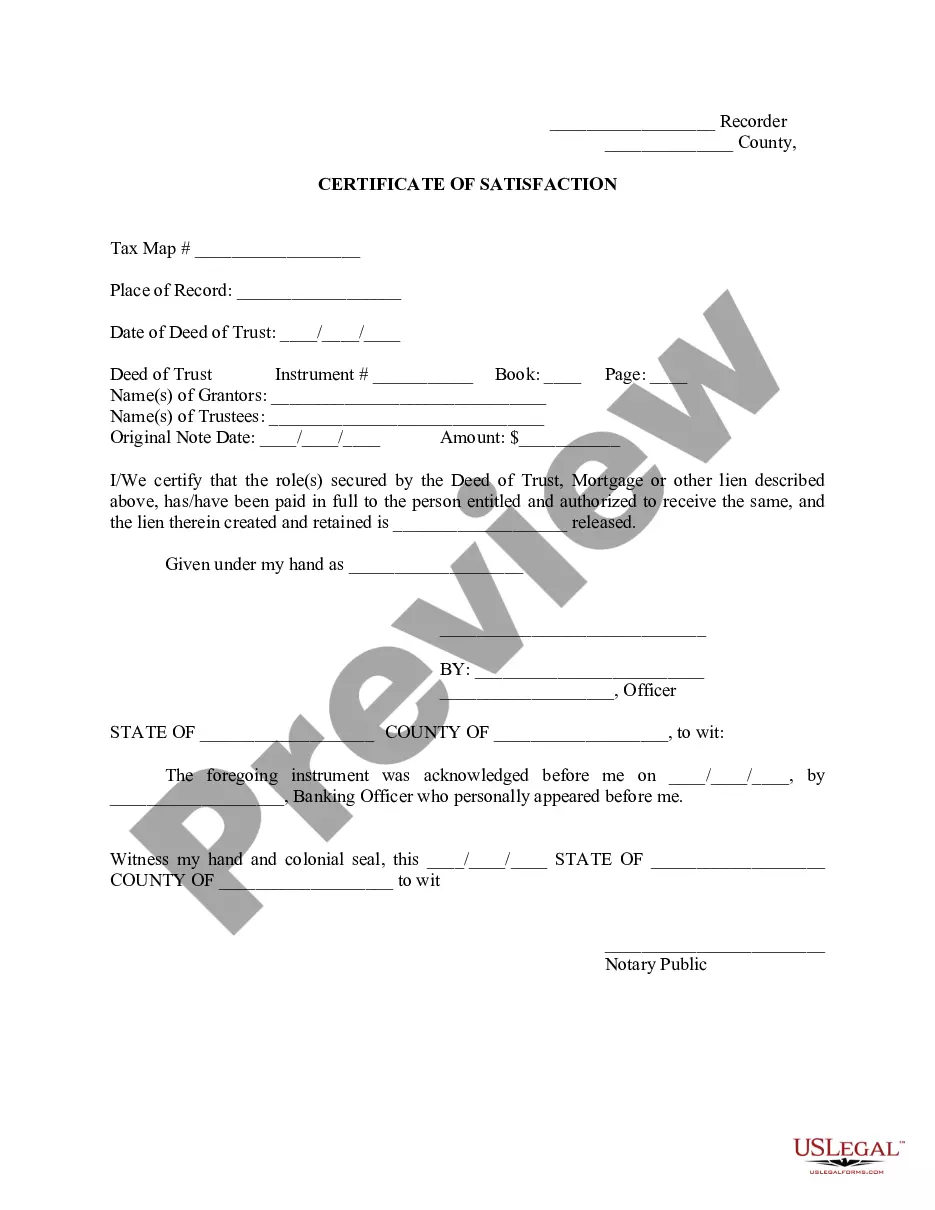

Do you need to quickly draft a legally-binding Bronx Employer Training Memo - Payroll Deductions or probably any other document to handle your personal or business affairs? You can go with two options: contact a professional to draft a valid paper for you or create it completely on your own. Luckily, there's another option - US Legal Forms. It will help you get professionally written legal documents without paying sky-high prices for legal services.

US Legal Forms offers a rich catalog of over 85,000 state-specific document templates, including Bronx Employer Training Memo - Payroll Deductions and form packages. We provide documents for an array of life circumstances: from divorce paperwork to real estate documents. We've been out there for over 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and get the needed template without extra troubles.

- First and foremost, carefully verify if the Bronx Employer Training Memo - Payroll Deductions is adapted to your state's or county's regulations.

- In case the form comes with a desciption, make sure to check what it's intended for.

- Start the search again if the form isn’t what you were seeking by using the search bar in the header.

- Choose the plan that is best suited for your needs and move forward to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Bronx Employer Training Memo - Payroll Deductions template, and download it. To re-download the form, just go to the My Forms tab.

It's stressless to find and download legal forms if you use our services. Additionally, the documents we provide are reviewed by law professionals, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!