Cook Illinois Employer Training Memo — Payroll Deductions provides a comprehensive guide to employers regarding the proper handling and implementation of payroll deductions. This memo aims to assist Cook Illinois employers in accurately deducting and managing employee payroll. The Cook Illinois Employer Training Memo covers various aspects of payroll deductions, including legal requirements, best practices, and common deductions seen in the industry. It serves as a valuable resource for both experienced employers and those new to payroll management. Some key topics covered in the Cook Illinois Employer Training Memo — Payroll Deductions include: 1. Legal Requirements: This section outlines the federal and state laws governing payroll deductions in Illinois. It provides an overview of relevant statutes and regulations that employers must adhere to, ensuring compliance with the law. 2. Types of Deductions: The memo enumerates the various types of payroll deductions allowed in Cook Illinois. These deductions may include taxes, wage garnishments, health insurance premiums, retirement contributions, union dues, and voluntary employee benefits. 3. Calculation and Documentation: This section details the calculation methods for different types of deductions. It provides step-by-step instructions on how to compute deductions accurately, ensuring that employees receive the correct pay. Additionally, the memo emphasizes the importance of maintaining proper records and documentation to support these deductions. 4. Deduction Authorization: Employers must obtain written authorization from employees before making any payroll deductions. The memo provides guidance on the necessary documentation and procedures required to obtain valid employee consent. It also emphasizes the significance of maintaining updated authorization records. 5. Deduction Limitations: Certain deductions have limitations imposed by federal or state laws. This section informs employers about these limitations to ensure compliance. Examples include restrictions on wage garnishments and maximum deductions for employee benefits. 6. Reimbursements and Advances: The memo also covers the process of handling reimbursements and advances in payroll. It provides guidance on deducting and reconciling such payments, ensuring accuracy and transparency. Types of Cook Illinois Employer Training Memo — Payroll Deductions: 1. Cook Illinois Employer Training Memo — Federal Payroll Deductions: This memo specifically focuses on federal payroll deductions, providing detailed information about federal tax withholding, social security deductions, and Medicare contributions. 2. Cook Illinois Employer Training Memo — State Payroll Deductions: This memo outlines the specific state payroll deductions required in Cook Illinois. It includes information on state income tax withholding, state disability insurance, and other state-mandated deductions. 3. Cook Illinois Employer Training Memo — Voluntary Payroll Deductions: This memo guides employers on implementing voluntary deductions chosen by employees, such as retirement contributions, health insurance premiums, charitable contributions, and other discretionary deductions. By following the guidelines provided in the Cook Illinois Employer Training Memo — Payroll Deductions, employers can ensure accurate and lawful payroll deductions, minimizing errors, and maintaining compliance with applicable laws and regulations.

Cook Illinois Employer Training Memo - Payroll Deductions

Description

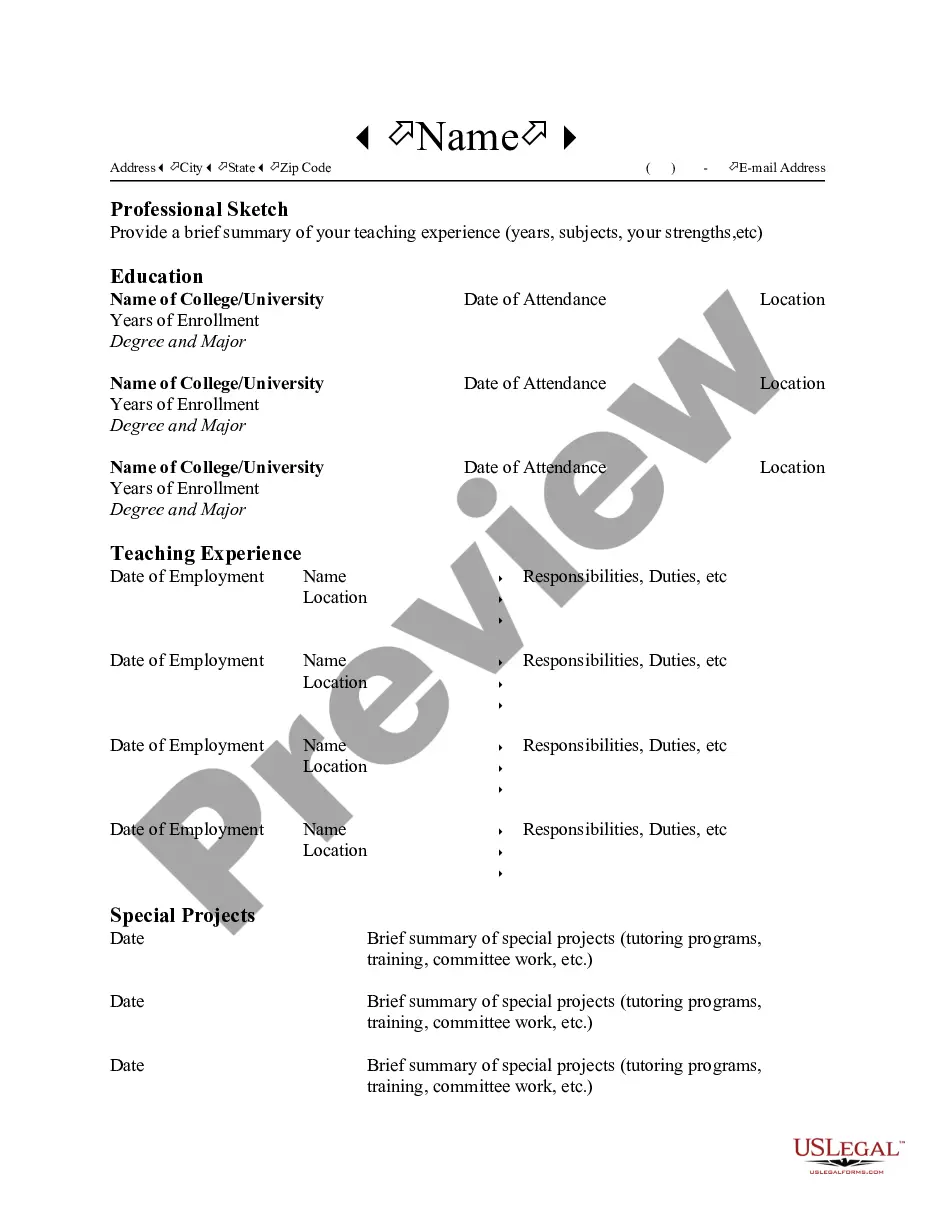

How to fill out Cook Illinois Employer Training Memo - Payroll Deductions?

If you need to get a trustworthy legal document supplier to get the Cook Employer Training Memo - Payroll Deductions, look no further than US Legal Forms. Whether you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate form.

- You can select from over 85,000 forms categorized by state/county and case.

- The intuitive interface, number of learning resources, and dedicated support make it easy to get and execute various papers.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

You can simply type to search or browse Cook Employer Training Memo - Payroll Deductions, either by a keyword or by the state/county the form is intended for. After locating necessary form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to start! Simply locate the Cook Employer Training Memo - Payroll Deductions template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Create an account and select a subscription option. The template will be immediately ready for download once the payment is completed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive collection of legal forms makes these tasks less expensive and more affordable. Set up your first company, organize your advance care planning, draft a real estate contract, or execute the Cook Employer Training Memo - Payroll Deductions - all from the comfort of your sofa.

Join US Legal Forms now!