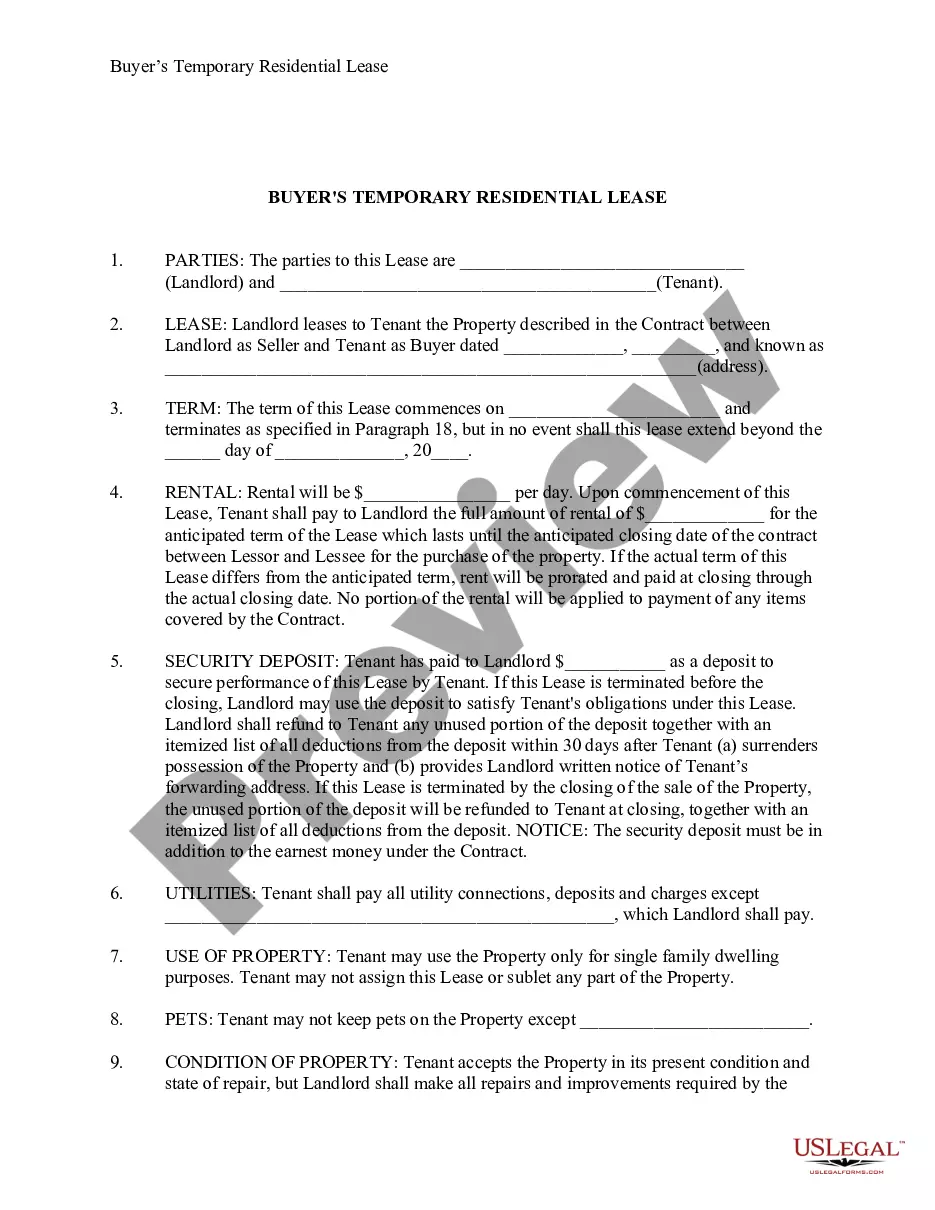

Nassau New York Employer Training Memo — Payroll Deductions Keywords: Nassau, New York, employer training, memo, payroll deductions Description: The Nassau New York Employer Training Memo on Payroll Deductions provides comprehensive information and guidelines to employers in Nassau County, New York, regarding payroll deductions. This memo, designed to educate employers, includes detailed instructions on various types of payroll deductions, their legal requirements, and their proper implementation. It serves as a valuable resource to help employers stay compliant with relevant laws and regulations, ensuring accurate and lawful payroll practices. Different Types of Nassau New York Employer Training Memo — Payroll Deductions: 1. Mandatory Payroll Deductions: This type of payroll deduction refers to deductions that employers are legally obligated to withhold from employee wages, such as federal income tax, state income tax, social security tax, and Medicare tax. The memo provides detailed instructions on calculating and implementing mandatory deductions accurately, ensuring payroll compliance. 2. Voluntary Payroll Deductions: Nassau New York employers may offer voluntary payroll deductions, which are optional deductions agreed upon between employees and employers. These deductions may include retirement contributions, health insurance premiums, charitable donations, or union dues. The memo outlines the procedures for setting up and executing voluntary payroll deductions correctly. 3. Wage Garnishments: When required by law, employers may be obligated to subtract wage garnishments from employees' paychecks to satisfy a debt or legal obligation. This memo provides guidelines on how to handle wage garnishments legally and maintain confidentiality while processing such deductions. 4. Reimbursements and Advances: In some instances, employers may provide employees with advances or reimbursements for expenses incurred on behalf of the company. The memo covers the appropriate payroll deduction procedures for recouping these advances or reconciling employee expenses. 5. Uniform or Equipment Deductions: If an employer provides uniforms or specialized equipment for employees, they may legally deduct the cost of these items from employee wages. The Nassau New York Employer Training Memo guides employers on implementing uniform or equipment deductions accurately, including relevant laws and limitations. 6. Loan or Overpayment Deductions: In situations where an employee owes the company money due to a loan or an accidental overpayment, employers can deduct the owed amount from future paychecks. The memo explains the process of notifying employees and obtaining their consent for such deductions, ensuring legal compliance. Nassau New York Employer Training Memo on Payroll Deductions provides employers in Nassau County with comprehensive guidance on various types of deductions. By following these guidelines, employers can maintain payroll accuracy, comply with relevant laws, and establish fair and transparent payroll processes.

Nassau New York Employer Training Memo - Payroll Deductions

Description

How to fill out Nassau New York Employer Training Memo - Payroll Deductions?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios require you prepare formal paperwork that varies throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any personal or business purpose utilized in your region, including the Nassau Employer Training Memo - Payroll Deductions.

Locating samples on the platform is amazingly straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the Nassau Employer Training Memo - Payroll Deductions will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guideline to obtain the Nassau Employer Training Memo - Payroll Deductions:

- Ensure you have opened the correct page with your regional form.

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Look for another document using the search option in case the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Select the appropriate subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Nassau Employer Training Memo - Payroll Deductions on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!