The Houston Texas Payroll Deduction Authorization Form for Optional Matters — Employee is an essential document that allows employees in Houston, Texas, to authorize specific deductions from their salary for optional matters. This form serves as a written agreement between the employer and employee regarding the deductions that will be made from the employee's paycheck. The Payroll Deduction Authorization Form for Optional Matters — Employee is designed to provide flexibility and convenience to employees who wish to utilize various optional benefits or services available to them. By completing this form, employees grant permission to their employers to deduct specific amounts from their wages on a regular basis. Keywords: Houston, Texas, payroll deduction authorization form, optional matters, employee, deductions, salary, paycheck, written agreement, employer, benefits, services, flexibility, convenience, permission, wages. Different Types of Houston Texas Payroll Deduction Authorization Form for Optional Matters — Employee: 1. Health Insurance Deduction Authorization Form: This form allows employees to authorize deductions from their salary to cover health insurance premiums offered by their employer. By completing this form, employees give consent to have a specific amount deducted from their wages to maintain their health insurance coverage. 2. Retirement Plan Deduction Authorization Form: For employees wishing to participate in employer-sponsored retirement plans or contribute to individual retirement accounts (IRAs), this form serves as a means to authorize regular deductions from their paycheck. By completing this form, employees can determine the amount they wish to contribute towards their retirement savings. 3. Charitable Donation Deduction Authorization Form: Some employers offer employees the option to contribute to charitable organizations through payroll deductions. This form enables employees to specify the amount they wish to donate and authorize their employer to deduct that amount from their wages regularly. 4. Employee Loan Repayment Deduction Authorization Form: In cases where employees have taken loans from their employers, this form allows them to authorize regular deductions from their salary to repay the loan amount. By signing this form, employees agree to have a specific portion of their wages deducted until the loan is fully repaid. 5. Education or Training Program Deduction Authorization Form: Employers who offer educational assistance or training programs may require employees to complete this form to authorize deductions from their wages for the costs associated with such programs. This form ensures that employees' consent is obtained before any deductions are made. Keywords: Houston, Texas, payroll deduction authorization form, optional matters, employee, health insurance, retirement plan, charitable donation, loan repayment, education, training program.

Houston Texas Payroll Deduction Authorization Form for Optional Matters - Employee

Description

How to fill out Houston Texas Payroll Deduction Authorization Form For Optional Matters - Employee?

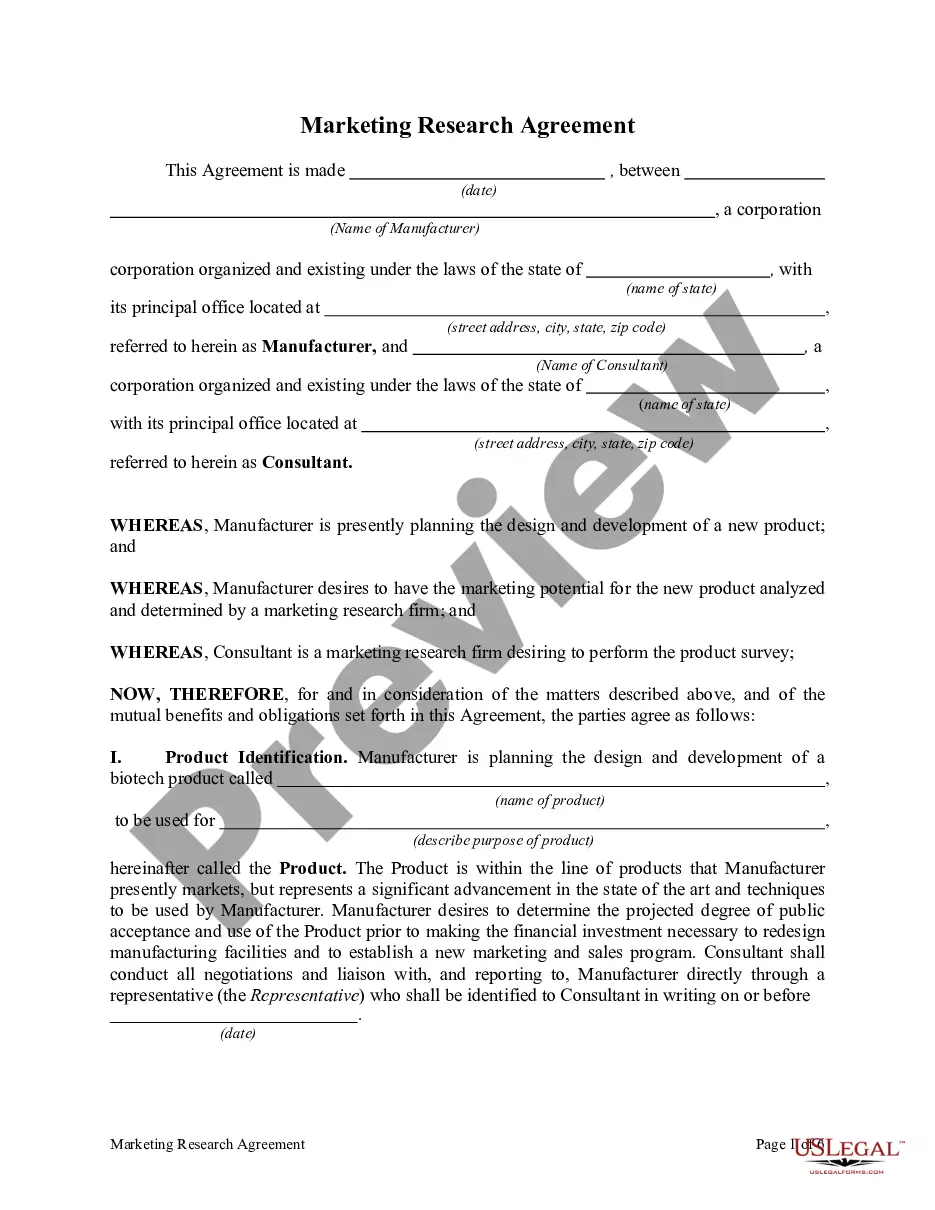

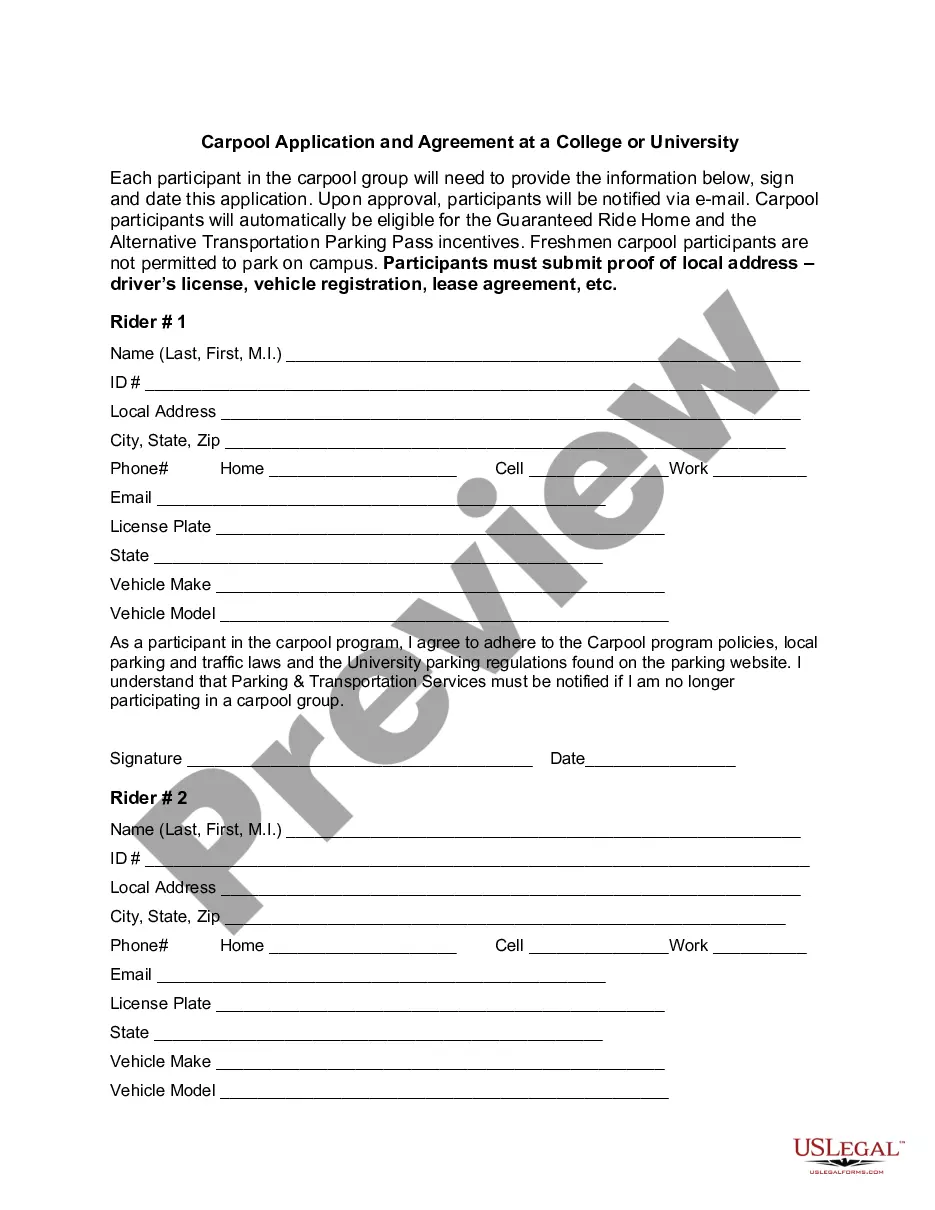

Preparing legal documentation can be burdensome. Besides, if you decide to ask a legal professional to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the Houston Payroll Deduction Authorization Form for Optional Matters - Employee, it may cost you a lot of money. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario accumulated all in one place. Consequently, if you need the latest version of the Houston Payroll Deduction Authorization Form for Optional Matters - Employee, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Houston Payroll Deduction Authorization Form for Optional Matters - Employee:

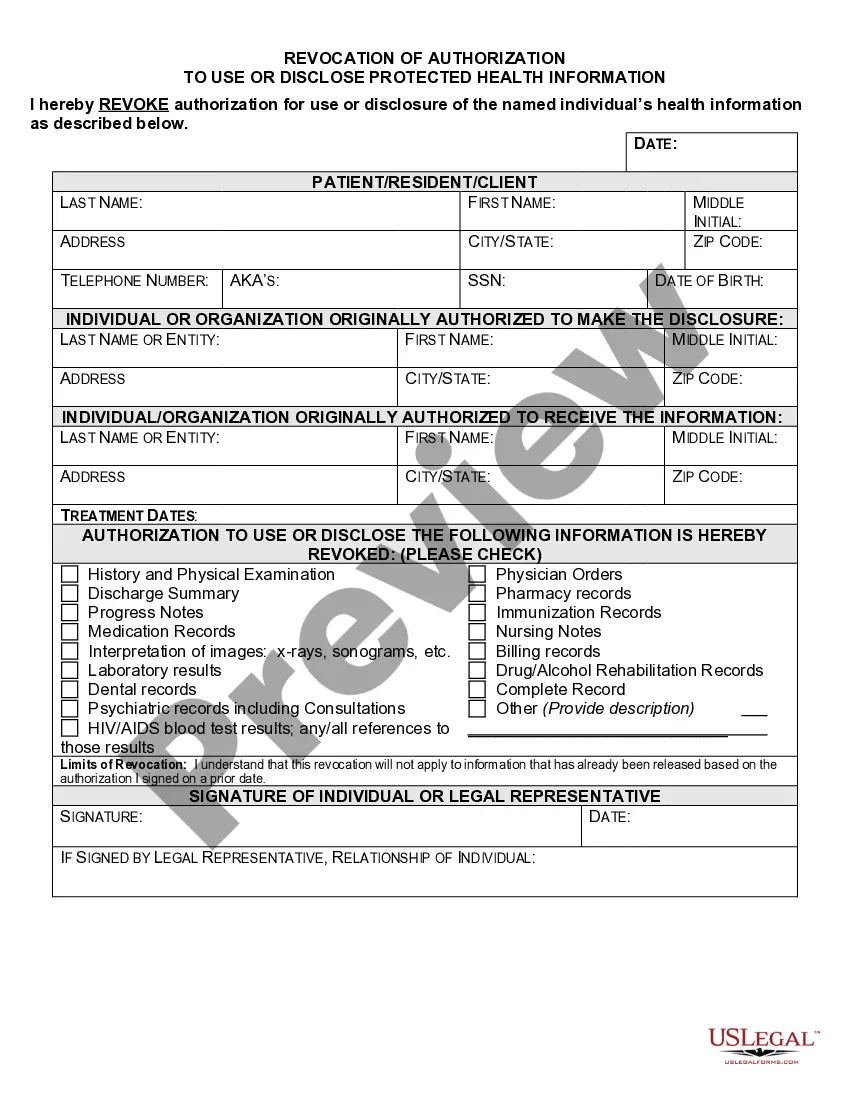

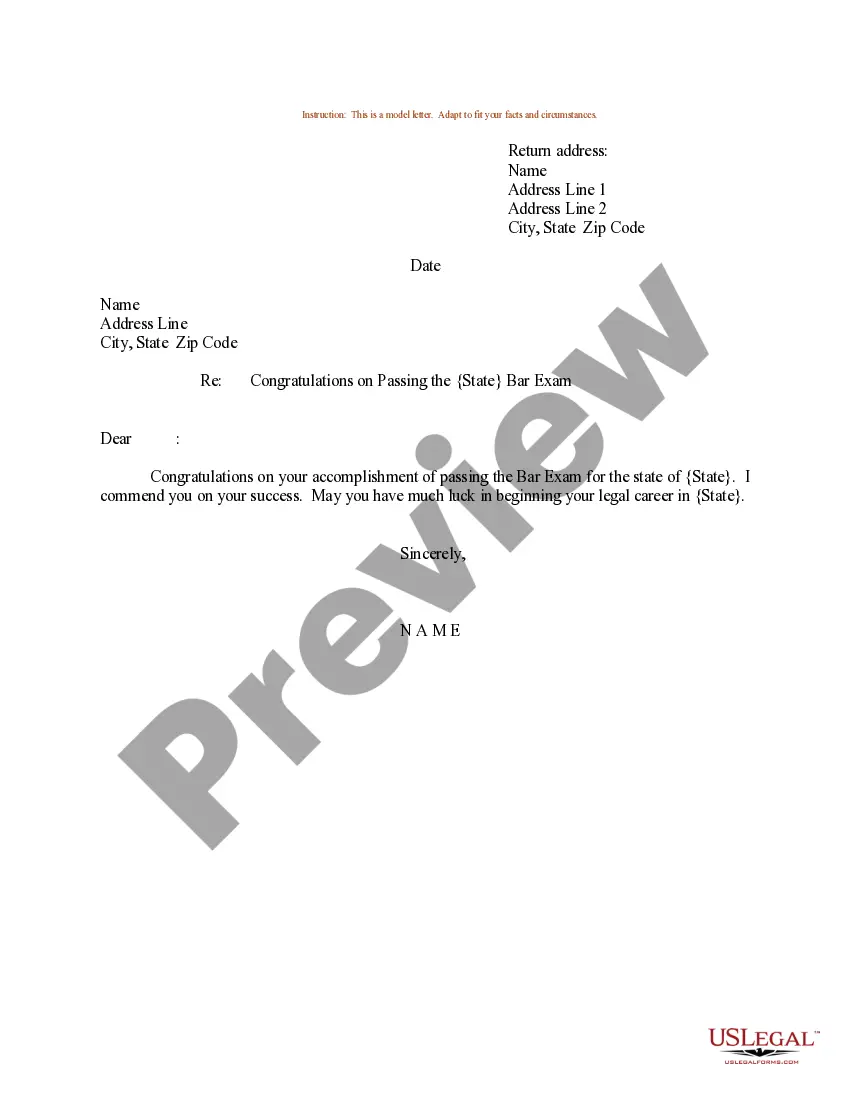

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now when you find the required sample and pick the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the document format for your Houston Payroll Deduction Authorization Form for Optional Matters - Employee and download it.

When done, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!