Keywords: Montgomery Maryland, Payroll Deduction, Authorization Form, Optional Matters, Employee Description: The Montgomery Maryland Payroll Deduction Authorization Form for Optional Matters — Employee is a crucial document that enables employees in Montgomery County, Maryland, to authorize deductions from their paychecks for various optional matters. This form allows employees to take advantage of different offerings, benefits, and contributions available through their employer. There are several types of Montgomery Maryland Payroll Deduction Authorization Forms for Optional Matters — Employee. These forms are classified based on the specific optional matters that employees can choose to have deductions made for. Some common types include: 1. Health Insurance Deduction Form: This form is used when employees wish to have their health insurance premiums deducted directly from their paychecks. It provides a convenient way for employees to manage their health insurance payments and ensures they have continuous coverage. 2. Retirement Savings Deduction Form: Employees who want to contribute a portion of their salary towards their retirement savings can use this form. By completing this authorization, employees can automate their retirement contributions, making it easier to save for the future. 3. Charitable Giving Deduction Form: This form allows employees to support charitable organizations by opting to have a specific amount deducted from their paychecks and donated to selected charities. It promotes philanthropy and empowers employees to make a positive impact in their community. 4. Flexible Spending Account (FSA) Deduction Form: Employees who wish to participate in a flexible spending account program can complete this form. It enables them to designate a portion of their salary to be deducted pre-tax and deposited into their FSA, which they can then use to pay for eligible medical expenses or dependent care expenses. 5. Loan Repayment Deduction Form: This authorization form is applicable to employees who have taken out employer-provided loans or salary advances. By completing this form, employees instruct their employer to deduct the agreed-upon repayment amount from their paychecks until the loan or advance is fully repaid. These are just a few examples of the different types of Montgomery Maryland Payroll Deduction Authorization Forms for Optional Matters — Employee available. Employers may customize and create additional forms based on their specific optional deductions and benefits offerings. Employees should carefully review and complete the appropriate form(s) based on their desired optional matters, ensuring accurate and complete information. It is recommended to consult with the employer's HR department for any guidance or clarifications regarding the completion and submission of these forms.

Montgomery Maryland Payroll Deduction Authorization Form for Optional Matters - Employee

Description

How to fill out Montgomery Maryland Payroll Deduction Authorization Form For Optional Matters - Employee?

Draftwing paperwork, like Montgomery Payroll Deduction Authorization Form for Optional Matters - Employee, to take care of your legal matters is a challenging and time-consumming task. Many cases require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can acquire your legal issues into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal documents intended for different cases and life situations. We make sure each form is in adherence with the laws of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Montgomery Payroll Deduction Authorization Form for Optional Matters - Employee form. Simply log in to your account, download the template, and customize it to your needs. Have you lost your form? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly straightforward! Here’s what you need to do before getting Montgomery Payroll Deduction Authorization Form for Optional Matters - Employee:

- Ensure that your form is compliant with your state/county since the rules for writing legal paperwork may vary from one state another.

- Discover more information about the form by previewing it or reading a quick intro. If the Montgomery Payroll Deduction Authorization Form for Optional Matters - Employee isn’t something you were hoping to find, then use the header to find another one.

- Log in or register an account to start using our website and get the form.

- Everything looks good on your end? Click the Buy now button and choose the subscription plan.

- Pick the payment gateway and type in your payment information.

- Your template is all set. You can try and download it.

It’s easy to find and purchase the needed document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!

Form popularity

FAQ

What are payroll deductions? Income tax. Social security tax. 401(k) contributions. Wage garnishments.Child support payments.

Automatic enrollment allows an employer to automatically deduct elective deferrals from an employee's wages unless the employee makes an election not to contribute or to contribute a different amount. Any plan that allows elective salary deferrals (such as a 401(k) or SIMPLE IRA plan) can have this feature.

Payroll deductions fall into four different categories pretax, post-tax, voluntary and mandatory with some overlap in between. For instance, health insurance is a voluntary deduction and often offered on a pretax basis.

Employers withhold (or deduct) some of their employees' pay in order to cover payroll taxes and income tax. Money may also be deducted, or subtracted, from a paycheck to pay for retirement or health benefits.

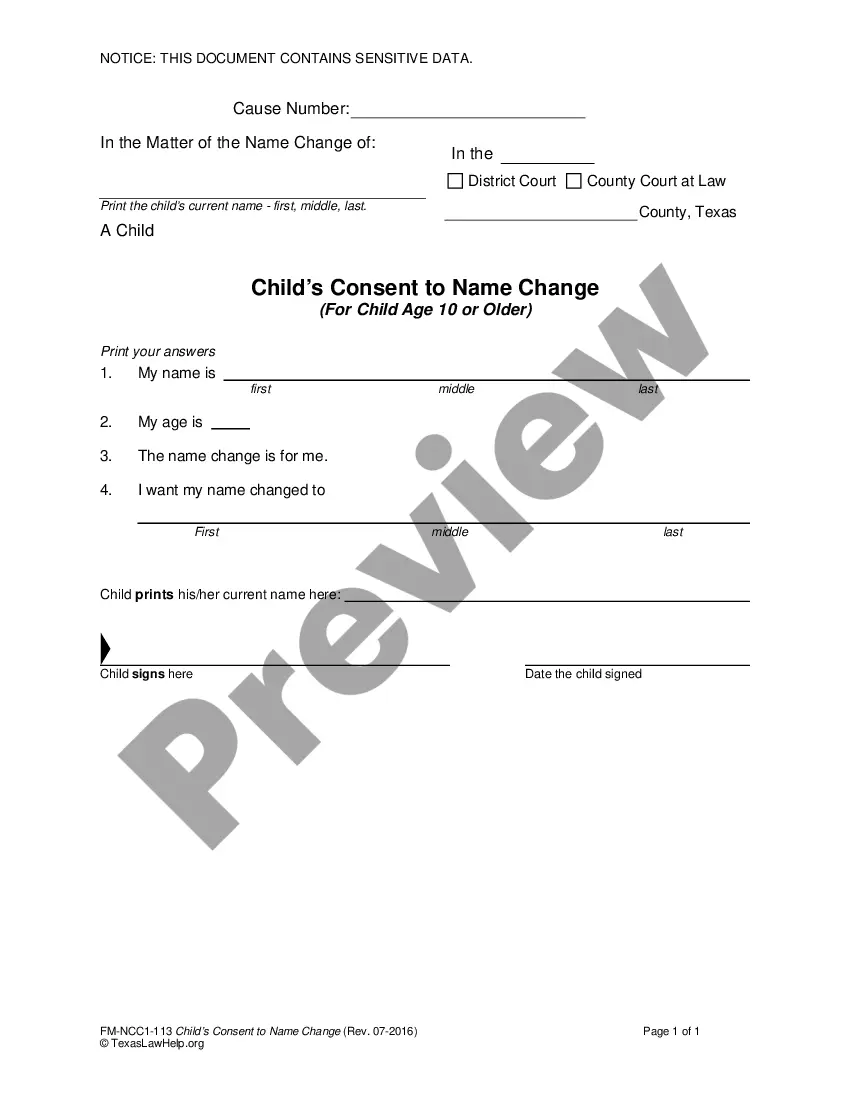

A payroll deduction authorization form is a written agreement an employee must sign if they want certain voluntary deductions taken from their paycheck. These forms should be as clear and specific as possible so employees know how much money voluntary deductions will take out of their paycheck.

A wage deduction authorization agreement is an agreement between an employer and their employee where the employee authorizes the employer to deduct wages from their paycheck.

They include things like 401(k) contributions, health insurance premiums for employer-sponsored health insurance, pre-tax commuter benefits and more. There are both pre- and post-tax payroll tax deductions.

Payroll deductions are wages withheld from an employee's total earnings for the purpose of paying taxes, garnishments and benefits, like health insurance. These withholdings constitute the difference between gross pay and net pay and may include: Income tax. Social security tax. 401(k) contributions.

Taking money out of an employee's pay before it is paid to them is called a deduction. An employer can only deduct money if: the employee agrees in writing and it's principally for their benefit.

A. No, your employer cannot legally make such a deduction from your wages if, by reason of mistake or accident a cash shortage, breakage, or loss of company property/equipment occurs.