The Oakland Michigan Payroll Deduction Authorization Form for Optional Matters — Employee is a document that allows employees in Oakland, Michigan, to authorize deductions from their payroll for various optional matters. This form provides a detailed description of the purpose and process involved in such deductions, ensuring clarity and transparency for both employees and employers. Keywords: Oakland Michigan, payroll deduction, authorization form, optional matters, employee Types of Oakland Michigan Payroll Deduction Authorization Forms for Optional Matters — Employee: 1. Health Insurance Deductions: This form allows employees to authorize deductions from their payroll for health insurance premiums. It outlines the terms and conditions of the health insurance coverage provided by the employer. 2. Retirement Plan Contributions: This form enables employees to authorize deductions for contributions towards their retirement plans. It provides information about the retirement plan options available and the contribution limits. 3. Charitable Donations: This form allows employees to authorize deductions from their payroll for charitable donations. It specifies the eligible charitable organizations and provides guidelines on the maximum amount that can be deducted. 4. Flexible Spending Accounts: This form enables employees to authorize deductions for contributions towards flexible spending accounts (FSA's). It provides details about the eligible expenses that can be reimbursed through the FSA. 5. Union Dues: This form allows employees who are part of a union to authorize deductions from their payroll for union dues. It outlines the purpose and terms of the union membership and the associated dues. 6. Loan Repayments: This form enables employees to authorize deductions from their payroll for loan repayments, such as student loans or company-provided loans. It provides information about the loan terms and repayment schedules. 7. Parking/Transportation Expenses: This form allows employees to authorize deductions for parking or transportation expenses related to commuting. It specifies the eligible expenses and provides guidelines on the maximum deduction limit. 8. Employee Purchase Programs: This form enables employees to authorize deductions for purchases made through employee purchase programs offered by the employer. It outlines the terms and conditions of the program and the deduction process. The Oakland Michigan Payroll Deduction Authorization Form for Optional Matters — Employee offers employees a comprehensive and organized way to authorize deductions from their payroll for various optional matters. It ensures compliance with legal requirements and promotes transparency in financial transactions between employees and employers.

Oakland Michigan Payroll Deduction Authorization Form for Optional Matters - Employee

Description

How to fill out Oakland Michigan Payroll Deduction Authorization Form For Optional Matters - Employee?

If you need to get a trustworthy legal document provider to find the Oakland Payroll Deduction Authorization Form for Optional Matters - Employee, look no further than US Legal Forms. No matter if you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate template.

- You can select from over 85,000 forms categorized by state/county and case.

- The self-explanatory interface, variety of learning resources, and dedicated support team make it simple to locate and complete different documents.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

You can simply type to look for or browse Oakland Payroll Deduction Authorization Form for Optional Matters - Employee, either by a keyword or by the state/county the document is created for. After finding the necessary template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to start! Simply find the Oakland Payroll Deduction Authorization Form for Optional Matters - Employee template and check the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Register an account and choose a subscription option. The template will be immediately ready for download as soon as the payment is processed. Now you can complete the form.

Handling your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive variety of legal forms makes this experience less pricey and more reasonably priced. Create your first company, arrange your advance care planning, create a real estate contract, or execute the Oakland Payroll Deduction Authorization Form for Optional Matters - Employee - all from the comfort of your home.

Sign up for US Legal Forms now!

Form popularity

FAQ

A wage deduction authorization agreement is an agreement between an employer and their employee where the employee authorizes the employer to deduct wages from their paycheck.

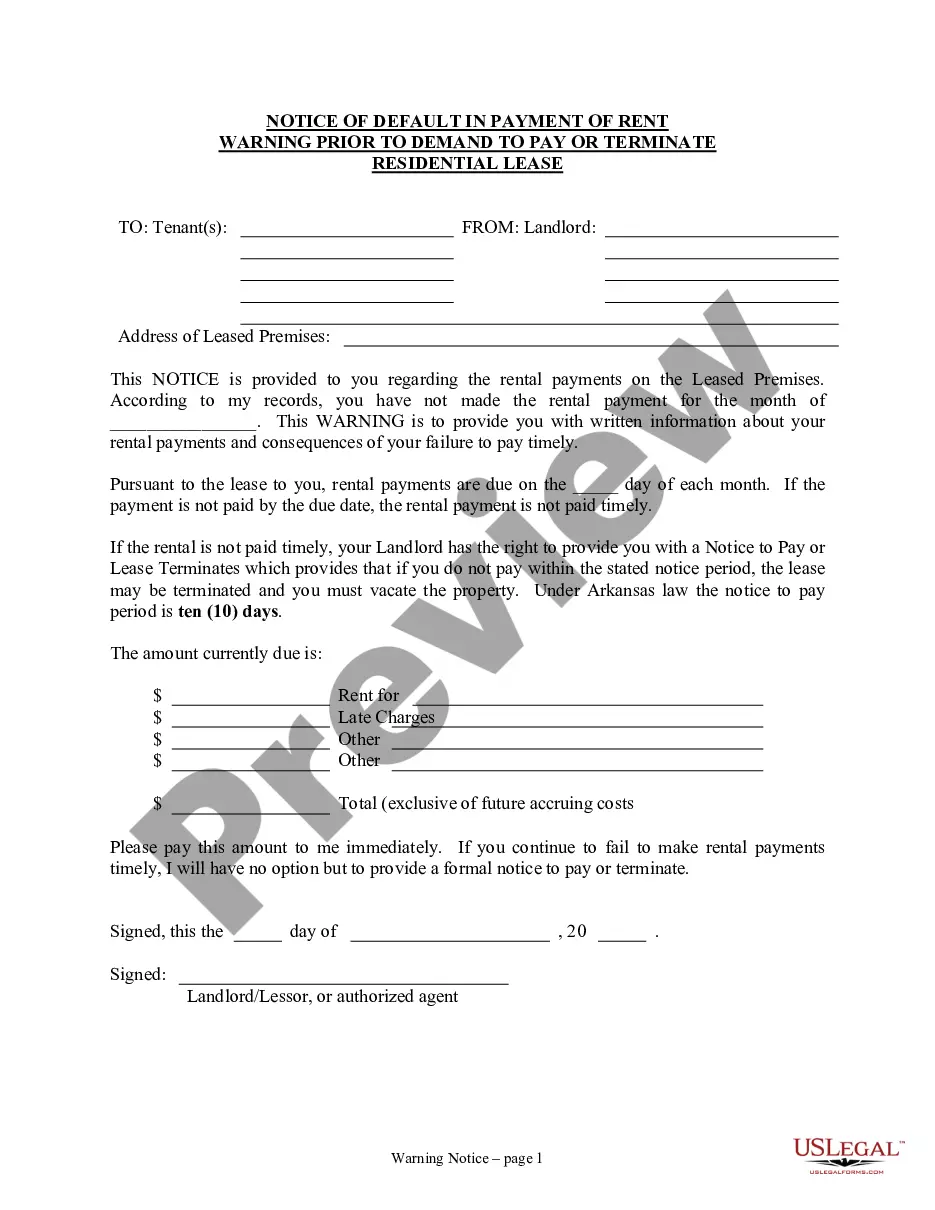

A payroll deduction authorization form is a written agreement an employee must sign if they want certain voluntary deductions taken from their paycheck. These forms should be as clear and specific as possible so employees know how much money voluntary deductions will take out of their paycheck.

Payroll Deduction Authorization Form means the form provided by the Corporation on which an Employee may elect to participate in the Plan and designate the percentage of his or her Compensation to be contributed to his or her Account through payroll deductions.

Payroll deductions are wages withheld from an employee's total earnings for the purpose of paying taxes, garnishments and benefits, like health insurance. These withholdings constitute the difference between gross pay and net pay and may include: Income tax. Social security tax. 401(k) contributions.

Payroll deductions fall into four different categories pretax, post-tax, voluntary and mandatory with some overlap in between. For instance, health insurance is a voluntary deduction and often offered on a pretax basis.

Voluntary Payroll Deductions Retirement or 401(k) plan contributions. Health insurance premiums for medical, dental and vision plans. Life insurance premiums. Contributions to a flexible spending account or pre-tax health savings plan.

Examples of payroll deductions include federal, state, and local taxes, health insurance premiums, and job-related expenses.

Authority to deduct as practiced in employment setting empowers the employer to set off the monetary accountability of employee against his receivable.

The standard payroll deductions are those that are required by law. They include federal income tax, Social Security, Medicare, state income tax, and court-ordered garnishments.

Taking money from wages without consent or contractual provision can result in a claim for unlawful deduction of wages, even if the individual has been employed for less than two years.